Personal loans showed a virtual stagnation. In this segment, the annual nominal rate closed the month about 80%.

The credit in pesos maintained its stagnation in September, in a context of growing delinquency and interest rates still at very high levels. Particularly highlighted the poor dynamics of commercial and personal loans.

The content you want to access is exclusive to subscribers.

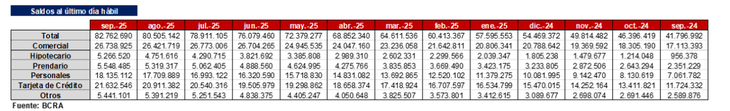

According to a survey of First Capital Groupbased on data from the Central Bank (BCRA)the balance of credits in local currency as of September 30 was $ 82.8 billion. This meant a real monthly improvement of just 0.6%, the second worst data since March 2024, only surpassed by August of this year.

Image

Among commercial loans, credit card financing and personal loans explained more than 80% of the total. In the commercial segment the third consecutive real setback was verified. “This portfolio segment has experienced the most important rise in the active ratein relative terms, therefore the makers reacted very cautiously, canceling commitments and not renewing operations within their possibilities. In addition, the offer of new financing was largely restricted to the uncertainty that was generated on the level of rates and liquidity in the coming months, ”he explained in this regard Guillermo BarberoFirst Capital partner.

In addition, In the personal segment a real positive variation of just 0.2%was observed, thus transforming into the worst data since March of last year. “This month we observed a sharp brake on the placations in real terms, which is even more remarkable because this item is one of the most grew more for the last 18 months,” he said on this barber line, after highlighting the effect of the rates rise and the caution on the offer for the highest levels of delinquency.

In contrary to the general trend, mortgage loans held their growth

A countermean of the general tendency, Cards financing grew 1.2% versus August. In this segment an irregularity is perceived in the dynamics of recent months; From First Capital they stressed the positive influence that “new commercial offers that are made to mobilize sales offering fees without interest or promotional discounts” may have had.

Greater were the increases in mortgage and pledgee (8.5% and 2.1%, respectively)although it should be clarified that its relative weight on the total loans is limited. On the mortgages, it is worth noting that they are the ones that grew the most in the last year in percentage terms.

The rates remained very positive in real terms

According to the data that the BCRA updates every day, The annual nominal rate (TNA) of personal loans closed September at 76.4%practically at the same level as August. In this way, the cost of indebtedness looks extremely excessive, taking into account that the estimated inflation for the next 12 months is around 25%.

Regarding delinquency, the last data of Julio showed that in families he represented 5.7% of the total financing, the highest figure since the monetary authority began the records, in 2010.

Source: Ambito