Although October started without major differences, the drag of increases from the last week of September is still felt on shelves and counters. According to different sectoral surveys, local businesses and wholesalers face average increases of between 4% and 11%with greater increases in oils, farinaceous products, dairy products and cleaning products. At the same time, There is increasing difficulty in financing clientsin a context of still weakened consumption.

In that framework, the inflation of the City of Buenos Aires HE accelerated to 2.2% in Septemberin front of the 1.6% registered in Augustin a month crossed by a greater exchange and financial tension. With this figure, the Buenos Aires consumer price index accumulates an increase of 22.7% so far in 2025 and one interannual variation of 35%.

“Some cold cuts, some oils and derivatives – such as mayonnaise -, some bread products rose, all between 4 and 5%. Danone rose 4%,” he explained. Adrian Moralespresident of the Chamber of Storekeepers of Río Cuarto.

From the same entity but from Santa Fe, they confirmed that “they are beginning to show slight increases in products, alcoholic beverages, oils and dairy products”, with a variation that ranges between 2% and 3.5%. “Some we transfer to the final price and others we prefer to keep them,” they stated.

The head of the Federation of Storekeepers, Fernando Savoreexplained that the strongest increases came at the end of September: “Arcor sent us 8%, an outrage. And Arcor is cookies, jams, noodles, canned goods. Coffee rose 7%, top brand soda 4%. The rest remains the same, but the sale does not accompany”.

Savore further warned that expiration dates are shortened: “Distributors are desperate to sell and you have to look at the dates of the products. A lot of stock was locked up. We are not the exception, but at least we sell more than the hypermarkets.”

In the wholesale sector, the increases were more marked. A Buenos Aires distributor highlighted: “I reduced their purchases by half for the three bakeries I work with. They increased between 6 and 8% and I can’t transfer a single point because people don’t buy”.

“Everything increased for us: rent, fuel, social security contributions, insurance. You are even with luck. This is not going to improve: the main thing is missing, money”he added with resignation.

Along these lines, a grocer from the interior of the country assured that “before we put together combos because people were moved by the offers, but now not even that.” “They can’t really buy it, We noticed that many people who were going to buy with a credit card, now do not buy because they have space, or they could not pay the summary. We have reached that point”, he noted.

posnet credit card payment purchases.jpg

It should be noted that at a time when workers do not have liquidity, they go into greater debt with credit cards to try to maintain their level of consumption. So much so that despite the growing default, Credit card operations grew 1.2% in real terms in September and 39.8% annuallyas reported First Capital Group based on data from Central Bank (BCRA).

“We observed irregular behavior in recent months, alternating increases and decreases in real terms. Although the balances are affected by financial circumstances such as rates, defaults and terms, new commercial offers that are made to mobilize sales by offering interest-free installments or promotional discounts also influence,” explained Guillermo Barbero, partner at First Capital Group.

Regarding delinquency, the latest data for July showed that in families it represented the 5.7% of total financing, the highest figure since the monetary authority began records in 2010.

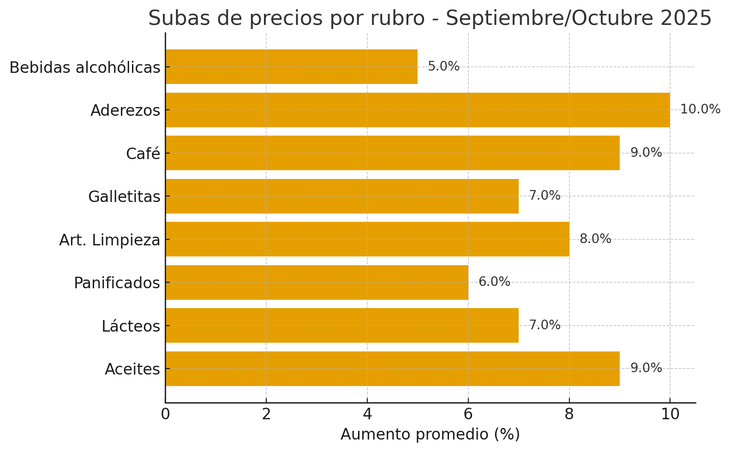

Increases by items

According to the Argentine Chamber of Distributors and Wholesale Self-Services (CADAM)the main companies applied adjustments in the last week of the month.

price increases

According to CADAM, the increases respond to the rise in Work Risk Insurers (ART): “They increased commissions from 1.5% to 2.9% and there was a transfer to prices,” highlighted its vice president Armando Farina.

Although the rise in the dollar and electoral uncertainty also had an influence, especially in oils, flours and coffees, which have commodity prices.

Source: Ambito