Faced with uncertainty and financial volatility, investors are betting on liquidity and coverage in “hard currency.”

Given the financial volatility and political uncertainty typical of a previous election, In September, a migration of demand deposits towards short-term interest-bearing deposits and a significant dollarization of portfolios was observed.. In the market, the dynamic is expected to be sustained in October.

The content you want to access is exclusive to subscribers.

The monetary report of the Central Bank (BCRA), published this Tuesday, reflected that demand deposits fell 4.6% real, compared to August. “The disarmament of demand deposits is the opposite side of exchange tensions that were seen in the month,” said the consultant LCG in an analysis of the aforementioned report.

This exchange rate tension was reflected in a official exchange rate reaching the ceiling of the band in the middle of the month in question, although later the price decreased at the pace of the official intervention, which implied a significant loss of foreign currency, and the help of statements from the US.

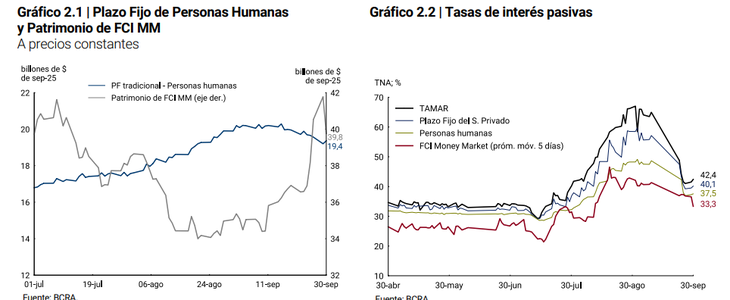

In that framework, the fixed deadlines They grew 6.3% monthly, if monthly averages are taken. Nevertheless, If the balances at the end of each month are taken into account, the data showed a drop. “This lower dynamism contrasted with the strong increase in the assets of the Money Market Common Investment Funds (FCI)which registered a real growth of 13.9% between balances at the end of the month. In this way, families would have opted for more liquid assets in a context of financial volatility,” the BCRA explained in this regard.

image

Regarding deposits in dollars, an increase of US$1,540 million was verified. “The increase occurred quite in parallel with the extraordinary liquidation of agriculture encouraged by 0% withholdings, so we assume that This is a part of the exporters buying their own liquidations (the rest demanded coverage via futures or linked dollar securities)”, LCG said in this regard.

Liquidity and coverage in dollars: bets in a framework of volatility and uncertainty

Going forward, it is expected that, given the proximity of the legislative elections of October 26, the bets on investments that guarantee liquidity or coverage in “hard” currency. LCG noted that, “in the face of more modest yields in pesos and with depreciation expectations that remain high and widely changing, term loans are likely to moderate the pace of growth that was seen in September”.

In addition, he described as “key” “the form that the transition takes towards a new exchange rate scheme”, since “to the extent that it is delayed in time and the dollar and the bands continue to be perceived as backward, positions in pesos will suffer.”

Source: Ambito