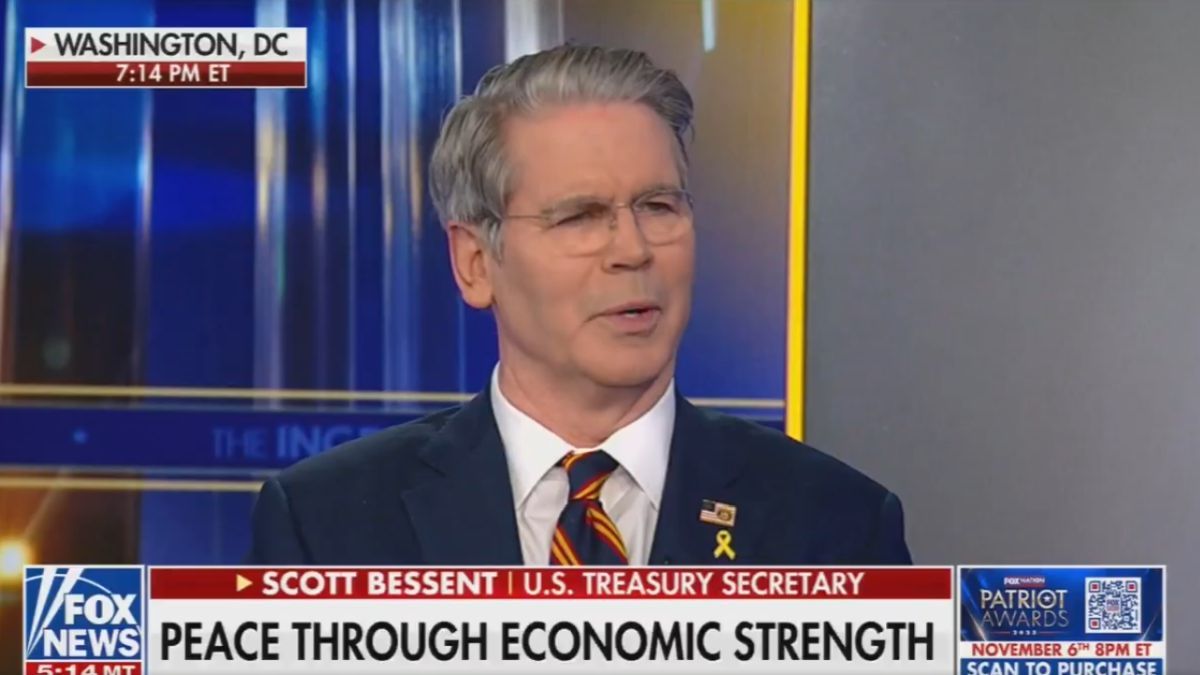

He US Treasury Secretary Scott Bessent spoke tonight about the financial assistance granted to Argentina Xavier Milei which will consist, mainly, of an exchange of coins for US$20,000 million. Given the political noise it generated on American soil, the Donald Trump government official said: “It’s not a bailout at all. It’s buying low and selling high”. In addition, he stated that the peso “is undervalued.”

In an interview with Fox News, Bessent defended Washington’s decision to financially support the libertarian government, shaken by the exchange rate volatility given the market’s doubts about the program sustainability implemented by Luis Caputo’s team.

When asked about the benefits that the United States could obtain, he did not hesitate to affirm that They will get “a lot of benefit from it” and he gave as an example the commercial and economic war with the Chinese government by pointing out that Milei “is committed to removing China from Argentina.”

For Bessent, The White House is not helping Argentina. “It’s not a rescue at all”he said and added: “It is buying low and selling high” since “the Argentine peso is undervalued.”

“Argentina is a benchmark in Latin America,” the Treasury Secretary emphasized as a justification for the aid, and stressed that, in his opinion, President Milei “has done the right thing” since his arrival in the Government. “He is trying to break a hundred years of a negative cycle in Argentina,” he continued.

In addition, he defined him as “a great ally for the United States” and stressed that next Tuesday, in the run-up to the legislative elections, the libertarian will travel to the United States to hold a meeting with Trump in the Oval Office, which, clearly, will be a new political support for the elections. “He will come to the Oval Office next Tuesday and is committed to getting China out of Argentina. The risk is ending up facing more gunboats, as in Venezuela. We do not want a failed state”, he continued.

In that sense, Bessent emphasized that it is not a rescue. “There is no money transferred,” he said and also assured that “the Exchange Stabilization Fund has never lost money and will not lose it here. I have been in the investment business for four decades, especially in foreign currencies. The Argentine peso is undervalued. We consider that Milei will do quite well and that the country is leaving the Peronist path behind.”

The Exchange Stabilization Fund (ESF), to which Bessent alluded, is a tool of the US Treasury that is made up of three types of assets: dollars, foreign currencies and Special Drawing Rights (SDR), an international reserve asset created by the International Monetary Fund (IMF). According to its own statute, it can be used “to buy or sell currencies, hold assets in US currencies and Special Drawing Rights (SDRs), and provide financing to foreign governments.” All of this requires approval from the Treasury.

News in development-.

Source: Ambito