Between January and August of this year, it accumulated a primary surplus of 1.3% of GDP. It has to reach the target of 1.7% in the remaining four months. In September there was a sharp drop in income.

The Government will have to adjust current spending in the remainder of the year to be able to achieve the primary surplus target of 1.5% of GDP which appears in the 2026 Budget project. This is because it has to face a drop in revenue combined with an increase in spending on retirements and salaries.

The content you want to access is exclusive to subscribers.

It could be said that at this time of the year the Palacio de Hacienda has almost everything accomplished. In principle, between January and August managed to accumulate a favorable primary result equivalent to 1.3% of GDP.

The financial fiscal surplus, for its part, without counting capitalized interest, would be equivalent to 0.4% of GDP. The interest paid recorded on the line was equivalent to 0.9% of GDP.

He Next Thursday the Treasury Palace will announce the result of the Non-Financial Public Sector (SPNF). It is worth remembering that September tax collection fell close to 9% in real terms, So to maintain the surplus the Government should compensate with more cuts. Meanwhile, total revenues fell 4.6%. Just as a reference, it is observed that the accrued expenditure of the National Public Administration (APN) fell only 1.8%.

In order to reach 1.5% of the primary surplus, at least, must achieve a favorable balance of 0.05 average point per month until December.

iaraf

Javier Milei must deepen the adjustment to achieve fiscal goal

Although hethe goal is achievable, It must be taken into account that the government is registering a drop in income this year, something more significant than expected, starting with the end of the COUNTRY Tax that contributed 1% of GDP.

But in addition, the Government has granted tax reductions this year that impacted revenue, such as the temporary reduction of withholdings and the reduction of tariffs on imports.

This, in turn, would be compensated with an increase in the collection of the tax on Fuel Transfer and the emission of Carbon Dioxide, as a product of the update of the tax that was frozen in recent years.

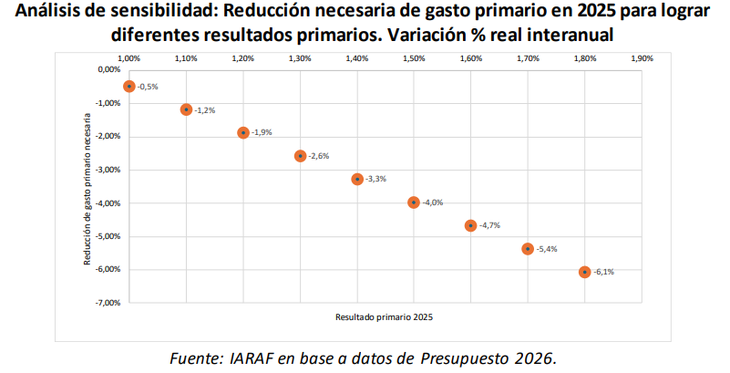

As a result, the Argentine Institute of Fiscal Analysis (IARAF) maintains that this year to achieve a surplus of 1.5% it would be necessary that reducing primary spending in real terms should fall 4% compared to 2024.

“A very relevant aspect within the primary spending is the fact that a good part of it is indexed according to inflation, Therefore, it cannot be reduced and has its own dynamics,” indicates the IARAF.

The report warns that “according to what happened in the first eight months of the year and projections for the remaining months, indexed primary spending would have an increase of 0.5 points of GDP between 2024 and 2025.” “Therefore, non-indexed primary spending should compensate for this increase and at the same time finance the fall in income, to keep the 2024 primary surplus constant,” says the IARAF work.

Source: Ambito