The International Monetary Fund (IMF) cut its forecast for the increase in Argentina’s Gross Domestic Product (GDP) for the current year to 4.5% and raised the inflation projection to 28%. This emerges from the latest update of its World Economic Outlook report released this Tuesday in Washington. The document also predicts a slight slowdown in global growth, estimated at 3.2%.

Around the end of July, the IMF anticipated an expansion of the Argentine economy of 5.5%, that is, reduced the forecast by one point. In any case, it is above the average of economists’ estimates, which is 3.9% according to the latest Survey of Market Expectations (REM).

For 2026, the Fund also cut the growth forecast for Argentina, bringing it to 4%, half a point less than the July forecast.

Argentina IMF_2025 projection

IMF projections for Argentina for 2026, according to WEO data.

At the end of that month, the organization’s chief economist, Pierre-Olivier Gourinchas, estimated for Argentina “an inflation that is expected to be around 18%-23% annually at the end of this year.” These figures were corrected upwards since an inflation of 28% is now projected. In this case, the IMF is close to the REM that it anticipates 29.8%.

for the year next the Fund hopes a significant drop in the variation of the price index, estimating 10%.

In accordance with the economic expansion, it is estimated that unemployment will go from 7.5% of the economically active population this year to 6.6% next year.

Regarding external accounts, an imbalance equivalent to 1.2% of GDP is projected in the current account of the balance of payments, which would be reduced to 0.4% in 2026.

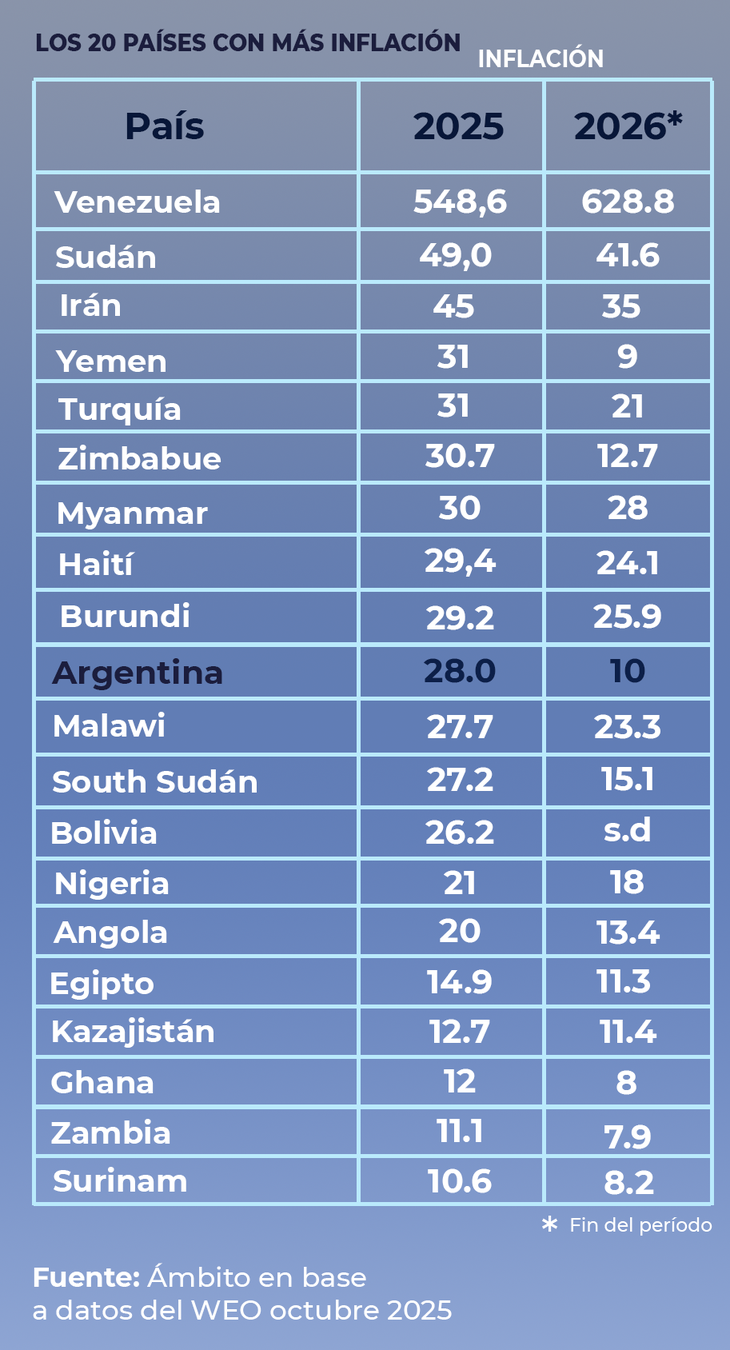

TABLE 01 IMF inflation projections October 2025

The countries with the highest inflation, according to the IMF.

Scope

Volatile

The Fund anticipates that global growth to slow from 3.3% in 2024 to 3.2% in the current year and 3.1% in 2026.

The year 2025 has been fluid and volatile, and much of the dynamic has been driven by a realignment of policy priorities in the United States and the adaptation of policies in other economies to new realities, the report maintains. Trade news has dominated the headlines and along with it, the perceived outlook for the global economy has fluctuated.

“Trade policy uncertainty remains high in the absence of clear, transparent and lasting agreements between trading partners, and when attention begins to divert from the final level of tariffs to their impact on prices, investment and consumption,” the document warns.

However, the evaluation is that “to datethe most protectionist trade measures have had a limited impact on economic activity and prices.”

In Latin America and the Caribbean, growth is projected to remain stable at 2.4% in 2025 and fall slightly to 2.3% in 2026. The region continues to be one of the regions with the lowest growth in the context of emerging market and developing economies. For this set of countries, it is projected that the expansion will moderate from 4.3% in 2024 to 4.2% in 2025 and 4.0% in 2026.

In relation to Argentina’s main trading partners, it is observed a slowdown also in the increase in China’s GDP, with a rise of 4.8% in the current year and 4.2% next year. For Brazil is expected a growth of 2.4% in 2025 and 1.9% in 2026.

It is projected that global inflation will decrease to 4.2% in 2025 and 3.7% in 2026. From the analysis of the report it appears that only 20 countries register double-digit annual rates. He record corresponds to Venezuela with 548.6%.

Also warns drops in raw material prices. For example, cereal prices decreased 11% as a result of the important harvests expected for the main world producers, that is, the United States, Russia, Brazil and Argentina.

For its part, the futures curve suggests that the oil spot price index will average $68.90 a barrel in 2025 and decline to $67.30 in 2030.

Risks

The Fund identifies different factors that could introduce downside risks in the global economy:

- Prolonged trade policy uncertainty and increase in protectionist trade measures.

- Shocks in labor supply due to stricter immigration policies in advanced economies.

- Fiscal vulnerabilities and fragilities of financial markets. In light of the recent rise in long-term sovereign bond yields in major advanced economies, abrupt market reactions to fiscal vulnerabilities could have an amplified impact.

- The Overly optimistic growth expectations on artificial intelligence They could be revised in light of incoming data from early adopters and could trigger a market correction.

- Erosion of good governance and institutional independence. Intensifying political pressure on political institutions safeguarded by a country’s constitution, statutes and jurisprudence (for example, central banks) could erode public trust.

- New increases in raw material prices as a result of climate shocks, regional conflicts or geopolitical tensions.

But it also considers that there could be Circumstances that would favor the world economy:

- Progress in trade negotiations, leading to lower tariffs and greater policy predictability.

- A faster pace in structural reforms.

- The reactivation of productivity growth from artificial intelligence.

Source: Ambito