Special envoy to the 61st IDEA Colloquium.- The economist Esteban Domecqpresident of Invecq Economic Consultingparticipated in the IDEA Colloquium held in Mar del Plata and from there analyzed in detail the advantages and disadvantages that macroeconomics presents today and how this affects the competitiveness of companies. In this regard, he highlighted the fiscal surplus and the low inflation as two important achievements, but described that the logistics cost It is still very high and they are needed key reforms in tax, labor and opening of the economy to the world.

“Since the end of 2023, two years ago, Argentina began to undergo a very complex process of stabilization, of macroeconomic normalization, which implied progress but is unfinished”he revealed at the beginning of his speech at the panel and added that, although this new course has merits, it also has pending issues and challenges. To show the starting point, he displayed a graph that showed that, except for a few years, In the last 60 years “the fiscal deficit was practically a constant.”

For Domecq, the first consequence of the indiscipline is the inflation. In this regard, he said that “this entire process of inflationary acceleration ended with that principle of stabilization, where in April of last year year-on-year inflation was 289%. Yesterday the inflation data for September came out, which for 12 months is 31.8%. There is great merit here, but it is an unfinished process.” In turn, for this economist, the second derivative of fiscal discipline is the default events. Argentina has five in the last six decades.

Besides, the third consequencehe mentioned, are the number of agreements with the International Monetary Fund (IMF) that Argentina has: 22 in total, and 18 since the first cycle of IDEA was carried out. And the fourth variable that Domecq mentioned is recessive cycles. “This is the photo that describes the macro instability of the Argentine economy, which any competitiveness study says: there is the heart of the problem that affects the competitiveness of the local economy.”

Competitiveness: the “stones” that still weigh on the local economy

image

In terms of international trade, Ten places were advanced and Argentina went from 64th to 54th place, when the SIRAS were eliminated and there was a normalization of the payment of importsrevealed the economist, because, as he highlighted, the opening of markets improves access to foreign currency. “The second factor that explains the improvement in investment is fundamentally explained by the RIGI, the large investment incentive regime. And the third factor is public finances”highlighted the improvements in the last two years.

“That is the result of the fiscal surplus, the reduction of monetary financing, compliance with debt commitments, the reduction of country risk, public spending that is reduced,” he expressed, but revealed that in the global ranking we advanced only four places. “So, the question is why we are still down there despite the progress. The answer, according to Domecq, is that there are still factors that are affecting competitiveness.”he continued.

“There are things in which we are relatively well positioned, our virtues such as territorial extension, natural resources, human capital and innovation,” he expressed. “But we have problems in terms of infrastructure, public services and logistics. In addition, we have tax pressure in Argentina, labor legislation and economic integration”, he described as points against.

For this expert, however, “there is a big rock,” which is macro instability, which includes inflation, exchange restrictions and recessionary cycles. “Then there are other very important stones, the tax one, the labor one, and then there are a lot of stones, perhaps smaller, but which in their sum also end up being very heavy,” he indicated.

image

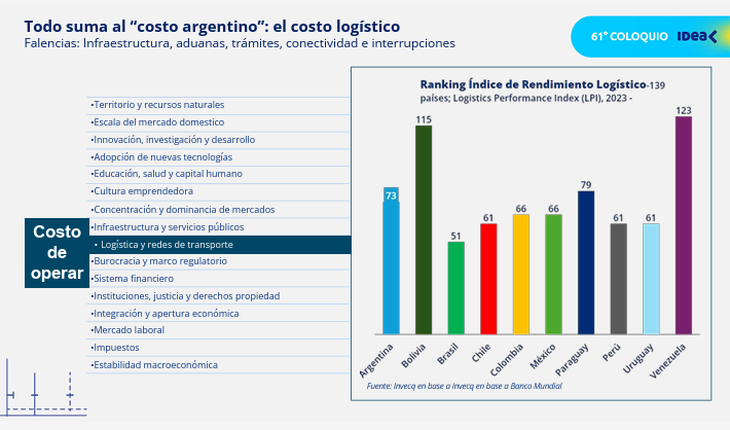

One of the first axes highlighted as problematic is logistics, where Argentina occupies 73rd place among 139 countries, “below the middle of the table and just above Bolivia and Venezuela.” As he explained, The poor performance is due to the poor condition of the routes, poor port infrastructure, slow customs, excessive procedures and frequent interruptions in transportation. “All this translates into one of the heaviest stones: the logistical cost,” he stated.

Citing a study by CIPPEC and the World Bank on value chains in northern Argentina, he warned that the average logistics cost exceeds 15% of the FOB value of the merchandise transported. and, in some cases, it reaches 25% or 30%, “well above the international standard.”

The second obstacle mentioned is the bureaucracywhich includes permits, procedures and regulations. Argentina is ranked 126th out of 190 countries in ease of doing business, “only better than Bolivia and Ecuador, far behind Chile, Colombia, Mexico and Peru.” “The cost of procedures and regulations constitutes another stone: the stone of bureaucracy,” he remarked.

The third critical factor is the financial system, where domestic credit to the private sector is equivalent to 14.4% of GDPcompared to a regional average of 57%. “In Chile it exceeds 100%. It is a landslide against us,” he said ironically. He described the system as “non-existent, shallow and with low inclusion”, with little financing available for SMEs and prohibitive rates.

“Today the rate for current account advances is 83% TNA, with a projected inflation of 22%. That implies a real rate of 50%, when in the region it is between 8 and 14%. And taxes must be added to that”he warned. “That financial cost ends up within the price of the products and services sold in the country.”

After reviewing the external factors that affect competitiveness, the speaker focused on the internal challenges of companies. According to an IDEA survey, Entrepreneurs identify as the most relevant axes the efficient management of costs and productivity, the capacity for innovation, the management of change and digitalization, the competitive vocation and investment in human capital.

Finally, He maintained that Argentine competitiveness starts at a disadvantage, but that “this is a long game.” He proposed imagining a “five-a-side soccer team” with the necessary elements to reverse the situation: macroeconomic stability (“non-negotiable ordering principle”), a correct diagnosis and reforms that decompress the cost of operating, an articulation between the macro and the micro with calibrated rhythms, consensus and long-term policies to end the pendularity and an active role for the business community.

Source: Ambito