The support of the world power to Argentina occurs within the framework of the geopolitical dispute with China. Trump would be seeking to have our country as his main ally in Latin America.

With that objective, the US intends for this to be the platform to facilitate a greater penetration of North American companies in the regionto the detriment of an advance of Chinese capital. In exchange, a reduction in tariffs is expected to the imports that the Republican imposed in the context of the trade war unleashed last April.

Aluminum and food, among the sectors that could most enjoy the trade agreement with the US

Since then, The products that Argentina sells to the north face a minimum surcharge of 10%to which are added specific tariffs, highlighting the 50% tax on aluminum and steel. It is precisely in the production of aluminum where the consulting firm Analytica sees one of the greatest opportunities regarding the eventual trade agreement.

This is derived from the fact that aluminum represents 8.2% of exports to the US. Furthermore, 54% of the aluminum exported is destined for that territory.

“Therefore, a reduction in tariffs would have a far from insignificant impact, especially on Aluar, whose turnover depends on more than 70% of its sales abroad. It should be remembered that recently the Government temporarily reduced to 0% the withholdings on exports of steel and aluminum to countries with tariffs higher than 45%,” Analytica highlighted.

In parallel, the consultant identifies a potential advantage in Argentine products that compete with Brazilian ones when it comes to gaining the North American market, taking into account that the neighboring country is subject to a 50% rate on its exports. He specifically highlighted the case of meatwhich in the case of Brazil began to pay a rate of 76.4% for shipments that exceed the annual quota of 65,000 tons.

“This, in turn, occurs in a context in which the stock of cattle in the United States is at historic lowsputting pressure on the price of meat. An increase in cheaper imports could be functional for US interests,” they elaborated on the matter.

When observing the composition of the basket of exports to the US, Other sectors that would benefit from lower tariffs would be energy, mining and some regional economies. such as those of wine, honey, citrus fruits, prawns, tea and wood, among others. The case of honey and lemon is particularly notable, since most of their foreign sales have the North American country as their main destination.

image

The impact in dollars of the potential trade agreement with the United States

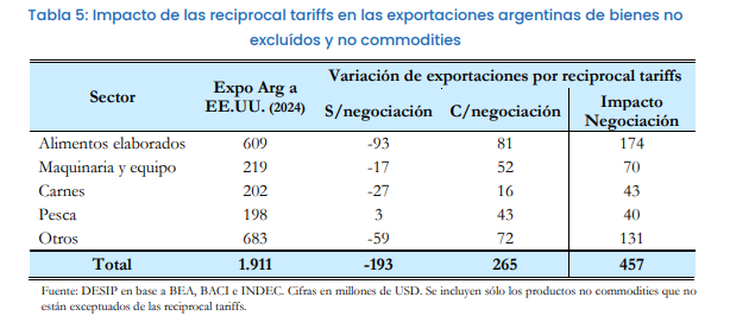

After Trump’s Liberation Day, the Interdisciplinary Institute of Political Economy (IIEP) of the UBA had projected that if Argentina managed to undertake a successful negotiation with the US for an exclusion of tariffs, The gain in exports could represent about US$457 million (7% of total sales to the country in question). Most of these additional dollars would be contributed, according to the estimate (which did not contemplate an agreement for aluminum and steel), from sales of processed foods, machinery and equipment, meat and fish.

image

Promptly, Federico BerniniIIEP economist, imagine that the wine sector can be one of the most benefited for the alleged agreement, since “today we already export quite a few wines to the United States and we are relatively competitive in that production.” In addition, he highlighted the opportunities in foods such as lemons, meats or sugarin addition to other products such as tobacco or wood.

“Beef is a segment where we could export much more, given that now beef from Brazil is going to be much more expensive,” he predicted in dialogue with Ámbito.

Bernini clarified that “this is not going to turn around the trade balance, at least in the short term,” but it would help improve the balance and “It would allow several companies to consolidate as exporters and stop looking only at the internal market.

“A problem that Argentina had in recent years is that it lost markets it had accessed and had a hard time generating new export markets. When you enter a new market, perhaps in the short term you will not export much more because first you have to see the reaction of consumers to your product. Some stick it and grow, and others don’t stick it and fall, but the first are the ones that grow the most in the long term.“, he elaborated on the matter.

Analytica explained that tariff reduction is much more feasible in the short term than a free trade agreement, given that the latter cannot be signed unilaterally while Argentina remains in Mercosur and, even if the country decided to break with the bloc, this would take time since it requires legislative approval.

It is worth remembering that on Tuesday Argentine assets fell sharply, after Trump conditioned the bailout on the electoral result, with the addition of the confusion generated around whether the Republican thought that the elections on October 26 were a presidential election, and not a legislative one. The market’s fear calmed after a new post by the North American Treasury Secretary, Scott Bessent, anticipating that the bailout would reach US$40 billion, of which half would correspond to the swap.

Source: Ambito