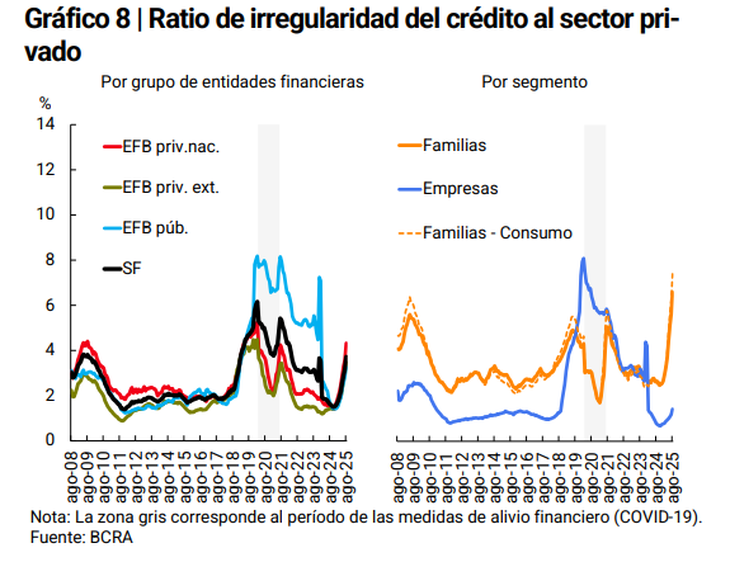

The increase occurred in a context of high interest rates and little dynamism in real wages, which affected normal compliance with the payment of loans.

Delinquencies in families rose for the tenth consecutive month in August and reached 6.6% on total credits, which represented a new record in at least 15 years. The high interest rates and the lack of dynamism of real wages impacted the payment capacity.

The content you want to access is exclusive to subscribers.

This was reported by the Central Bank (BCRA) through its Report on banks. It indicated that the irregularity ratio of family loans advanced by 0.9 percentage points (pp) compared to July and reached its maximum since the monetary authority began records, in 2010.

image

The monetary authority has not yet updated the annex with information on the dynamics of each line of credit. The trend of the previous months had been showing that The main increases in delinquencies were being seen in personal loans and credit card financing.

In the case of the companiesthe irregularity was 1.4%, which implied a monthly increase of 0.2 pp. In this case it was the highest figure since the beginning of 2024. Adding families with companies, the percentage was 3.7%, 0.5 pp above the July figure.

It is worth remembering that, during the eighth month of the year, The annual nominal rate (TNA) of personal loans showed an average of 74%a figure well above the expected inflation for the next 12 months. This situation did not change in the following months, given that in September, and so far in October, the performance was mostly above 80%, reaching a daily peak of 87%.

Source: Ambito