He Central Bank of the Argentine Republic (BCRA) today signed a foreign exchange swap agreement with the United States Department of the Treasury for up to US$20,000 million. The objective is to contribute to the macroeconomic stability of Argentina, “with special emphasis on preserving price stability and promoting a “sustainable economic growth”they pointed out from the local monetary authority.

“The objective of this agreement is to contribute to the macroeconomic stability of Argentina, with special emphasis on preserving price stability and promote sustainable economic growth”they pointed out from the local monetary authority.

What is a currency swap and how does it work?

A coin swap or currency swapis a financial agreement between two central banks to exchange a certain amount of one currency for another, with the commitment to reverse the operation in the future. Initially, the swap works to increase gross reserves and does not impact net reserveswhich are the reserves that the BCRA has freely available to use.

swap.jpg

During the term of the agreement, Argentina will be able to use dollars to strengthen internal liquidity.

However, a country can request the activation of the swap that enables you to use a certain amount of currency to carry out operationshow to pay debts. In this case, once the agreement is finalized, the bank that requested activation must return to its peer the amount of money used plus interest. It is worth remembering that this interest begins to be applied only in the activated sections, and not in the total amount that is announced.

How the mechanism develops

- Initial exchange: The central bank delivers its currency and receives the foreign currency.

- Stipulated term: uses the funds to strengthen local liquidity.

- Closing of the operation: returns the foreign currency and recovers its original currency, paying the agreed interest.

Unlike a traditional loan, the swap does not imply a definitive delivery of funds, but rather a reversible exchange. Nor does it always add freely available reserves, since in some cases it can only be used for commercial operations.

The history of the use of the swap in Argentina

He The first currency swap with China was signed in 2009 with Cristina Kirchner. In 2014, a second agreement was signed that was renewed in 2017, with Mauricio Macri and complemented at the end of 2018.

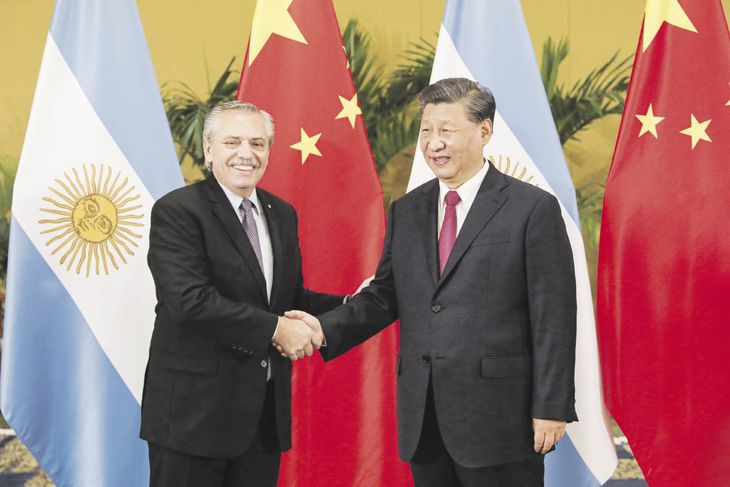

Finally, in 2020, during the management of Alberto Fernandeza new agreement was made official that brought the exchange to $18.5 billion.

P11 – 15-11-2022_el_pr_opt.jpeg

In 2020, during the management of Alberto Fernandeza new agreement was made official that brought the exchange to $18.5 billion.

The use of the swap has the advantage of not only providing more “reinforcement” to the gross reserves of the Central Bank, but also the incorporation of yuan to the economy allowing you to pay for imports of Chinese products without having to use dollars. This is key for two reasons: firstly, due to the increase in imports to China since the trade opening carried out by the Government of Javier Milei (China is Argentina’s second trading partner). Secondly, because in geopolitical terms, China’s presence increases in Latin American countries, a place that had been relegated by the US.

It is important to keep in mind that it will be a agreement between both countrieswhether or not the activated tranche can be used to intervene in the exchange market. These swaps pay interest on the activated tranche, generally referenced to international rates (for example, SHIBOR for yuan or SOFR for dollars). Upon expiration in 2026, the BCRA must repurchase the yuan by delivering pesos (or dollars if agreed), at the exchange rate agreed in the contract.

Source: Ambito