The organization announced a relaxation of conditions to enter the payment plan launched in April. Debts until August are included. Tax experts warn that there are taxpayers who could not pay their taxes.

With a sharp drop in activity and consumption as a background, the Customs Collection and Control Agency (ARCA) came out to throw a lifeline to SMEs: improved the conditions of access to the payment plan announced last April, valid until December 30.

The content you want to access is exclusive to subscribers.

This is indicated by ARCA General Resolution 5777, published in the Official Gazette this Wednesday. Although the measure does not clearly specify it, When there is a drop in activity, the first expense that companies usually postpone is taxes.

Faced with this, the new provisions make it easier for taxpayers to stay up to date with the treasury and, thus, prevent the Risk Profile System score from being lowered. The improvements consist of include debts until August 2025 (previously they were until April) and reduce the initial amount to pay to enter the plan.

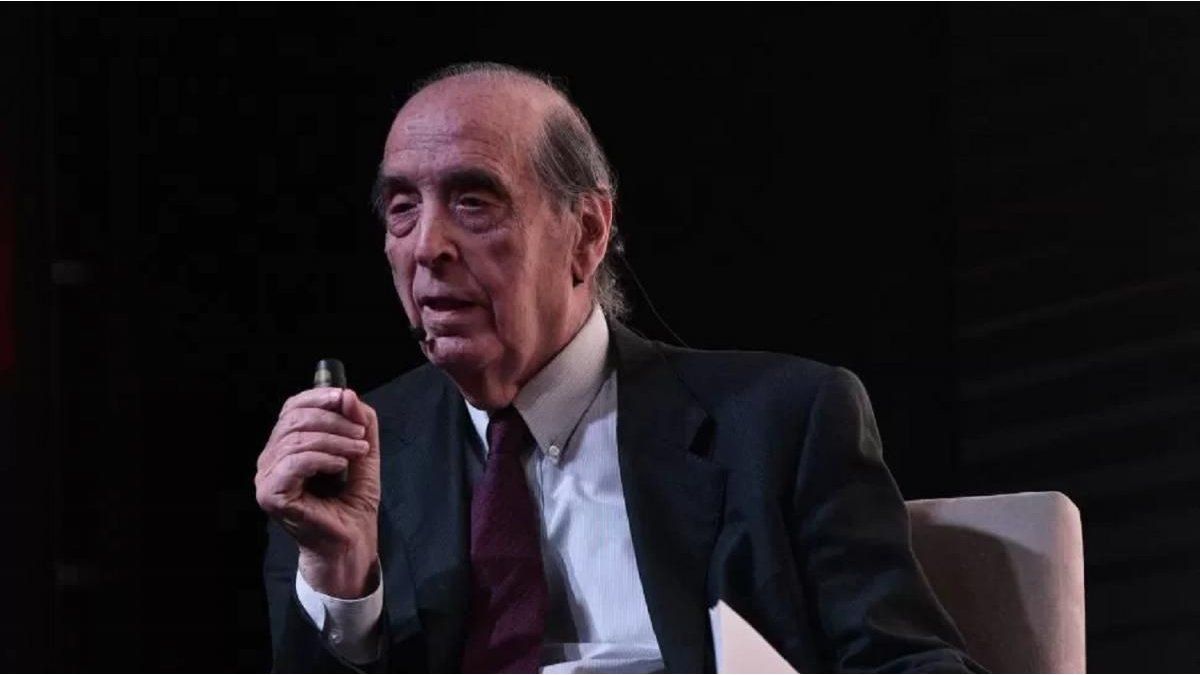

The CEO of SDC Asesores Tributarios, Sebastian Dominguez, He noted that the changes occur “in a complex economic context and with expectations placed on the electoral result next Sunday.”

Regarding the inclusion of debts until August, Domínguez pointed out that “It is positive, since numerous taxpayers have not been able to comply with their obligations in recent months as a result of the drop in sales, the effect of the increase in the interest rate, the dollarization process, among other issues.”

In relation to the decrease in percentage of payment on account He explained that “it also facilitates the possibility of regularizing debts in the plan, by requiring a lower percentage of money that must be available to pay at the time of joining.” “Even, elimination could have been evaluated in the case of human persons, undivided estates, Micro and Small Businesses, non-profit entities and the health sector in order to further encourage accessions,” the tax expert proposed.

He also indicated that “since “The modifications made by RG 5777 take effect as of November 3, for taxpayers it is advisable to wait until that date to join.”

“He risk is that, until the changes come into effect, ARCA can initiate tax execution trials. Consequently, It would be advisable to issue a General Resolution providing for the suspension of trials of tax execution, especially for MSMEs, between today and November 3, 2025,” Domínguez proposed.

The percentages of payment on account are reduced as follows

- Human persons, undivided estates, Micro and Small Businesses, non-profit entities and the health sector: from 10% to 5%

- Medium Enterprises Sections 1 and 2 -except individuals and estates; from 15% to 10%

- Rest of taxpayers from 20 to 15%

What are the debts that can be regularized?

- Tax obligations and social security resources, including its accessories.

- Tax withholdings and perceptions.

- Customs obligations for import or export taxes and settlements of the aforementioned taxes included in the procedure for violations, according to the Customs Code.

What is excluded

- Withholdings and pension payments for any reason (except the personal contributions of workers in a dependency relationship).

- Advances and/or payments on account.

- VAT corresponding to the importation of services carried out abroad and provision of digital services carried out abroad and provision of services carried out in the country by subjects located abroad.

- Contributions and contributions destined for the National Regime of Social Works (except those corresponding to members of the Monotributo).

- Fees allocated to ART.

- Contributions and contributions destined for the Special Social Security Regime for domestic service employees and the Special Employment Contract Regime for staff in private homes.

- Fixed contributions corresponding to workers in a dependency relationship with Monotributo affiliated subjects accrued until June 2004.

- Monthly contributions/contributions destined to RENATRE and RENATEA.

- The internal tax – cigarettes – and the additional emergency tax on the final sales price of cigarettes created by Law 24,625.

- The installments of current payment facility plans.

- Taxes and/or fines that arise as a consequence of violations of Art. 488 of the Baggage Regime of the Customs Code.

- Also, interest, fines and other accessories of the excluded obligations (except interest on the capital canceled from advances, payments on account, withholdings, perceptions and VAT on imports of services).

Source: Ambito