The consultant Equilibra calculated a monthly contraction of 1% in its own Monthly Economic Activity Estimator (EMAE) for September. This was explained by a 1.3% decline in the indicator that excludes the agricultural sector, since the latter had an improvement of 2.4%.

image

In this way, according to the entity, activity in the ninth month of the year was 2% below the level of February. “In the seasonally adjusted measurement, a 0.7% drop in the third quarter compared to the second quarter of the year, being the second consecutive – it fell 0.1% in the second quarter of 2025 -, giving rise to what formally defines a recession,” he stressed in a report published this Thursday.

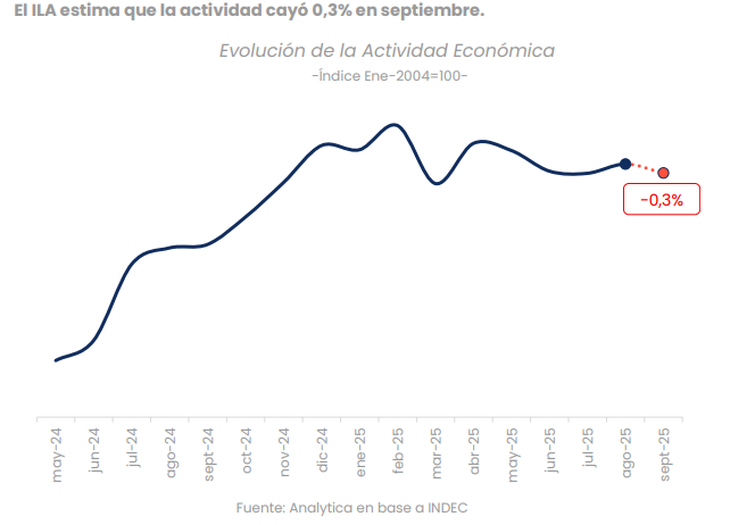

For its part, the consultant Analytics predicted a decline of 0.3% in the September economy. It did so through an index that uses high frequency data (including sectoral, consumption and credit indicators), with high correlation with the EMAE.

image

“Activity retreated in a context marked by the relative price instabilityevidencing disparate behaviors between sectors. The falls predominated in the automotive industry, basic metallurgy and the energy sector, with a decrease in gas production. Declines were also observed in indicators linked to consumptionwhile some industrial segments showed improvements, particularly in the production of flat and cold-rolled steel, as well as in certain durable goods,” the consulting firm detailed.

In parallel, they highlighted that “imports continued to expand strongly, reflecting the persistent heterogeneity of the productive network.”

It is worth remembering that September was crossed by legislative elections in the province of Buenos Aireswhich represented a hard blow for the ruling party and for the financial markets, a combo that led to the active intervention of the US Secretary of the Treasury, Scott Bessent, to calm expectations.

The consulting firms adjusted their growth projections for 2025 downwards

With the same tone, Orlando Ferreres & Associates announced this day that its Industrial Production Index (IPI) sank 3% in September, compared to August. “Industrial activity is heading to close the year in decline with some sectoral exceptions,” they warned.

Adding to the rest of the sectors, Equilibra expects for the remainder of the year a “seasonally adjusted fall as a result of political uncertainty and exchange rate volatility.” “For these reasons, We correct our GDP expansion forecast downwards to 3.5% average in 2025,” he projected.

LCG foresees a cumulative growth of the 3.8% in 2025. “With a longer perspective, we continue to expect erratic growth for the remainder of the year, with months with declines or very modest growth, and concentrated in a few sectors (oil, mining and agriculture) that can hardly drive a recovery in employment and income,” he noted.

Despite the rebound in August, the outlook for economic activity does not improve

It should be noted that This week the INDEC reported that in August the economy rebounded 0.3% versus July, thus breaking a streak of three falls in a row. Even so, the data from the seasonally adjusted series was lower than those observed between December of last year and May of this year (with the exception of March).

LCG reflected that The food industry contributed 0.6 percentage points (pp) to monthly growth. It is worth remembering that this activity had accumulated a collapse of close to 10% between February and July, so it was to be expected that at some point there would be a certain rebound. On the other hand, the seasonally adjusted data reflected that it was financial intermediation the sector that grew the most compared to the previous month.

The doubts about the sustainability of the exchange rate scheme They do not contribute to boosting the economy, since expectations of devaluation delay companies’ investment decisions. Likewise, these are affected by the very high volatility of interest rateswhich are well above expected inflation.

On the demand side, there is no sign of a trend toward a significant recovery in real wages. The latest indicators of mass consumption reflect the low purchasing power of the income of Argentine citizens.

Source: Ambito