To reach the elections with the dollar between the bands, the Government also appealed to intervention in futures and Dollar linked, as well as the sales of the BCRA and the local Treasury in the MLC.

The US Treasury intervened strongly to contain the rise of the dollar in Argentina, in the run-up to the legislative elections next Sunday. Although there is no official number, private estimates indicate that it may have sold up to $2 billion in the last two weeks.

The content you want to access is exclusive to subscribers.

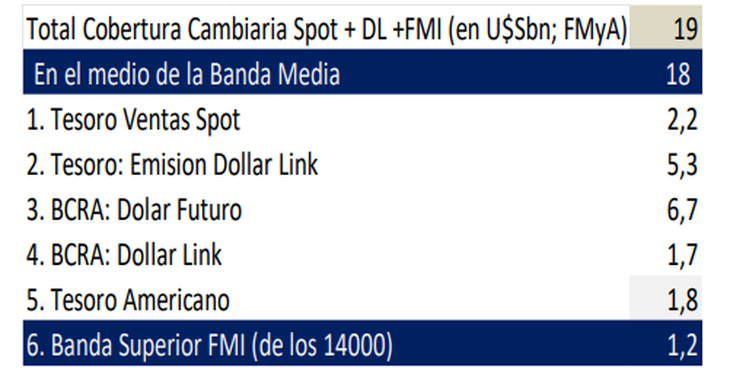

This is how he calculated it Delphos Investment. The entity highlighted in a report that, according to official statements, the demand for coverage in “hard” currency rose in the last three months to an estimated figure between US$23,000-27,000 million. This pressure was covered for the most part by intervention in futures and linked Dollar securities, although sales were also necessary in the spot of the Central Bank (BCRA), the local Treasury and the US Treasury.

“The support of the United States to the Argentine economic program through the purchase of pesos for about US$2,000 million It seems to us to be a preview of the potential help that the Government could receive if our base scenario of a ‘reasonable’ result for the ruling party is confirmed. An agreement of this magnitude could redefine future dynamics and take country risk to levels where re-entry into the markets is once again an option,” Delphos highlighted.

For its part, South American Visionthe think thank led by the former Minister of Economy Martin Guzmanestimated a North American intervention of approximately US$1.9 billion starting on October 9, when Scott Bessent’s portfolio began to actively participate in the domestic Free Exchange Market (MLC).

With the same tone, the economist’s consulting firm Fernando Marull estimated a sale of US$1.8 billion. The market arrives at the elections with a fairly high stock of hedging assets (whether assets in pesos linked to the dollar or directly in dollar bills), of almost US$20 billion. Added to the US stock is a stock of US$14 billion in the hands of futures and linked dollar holders, and US$3.4 billion sold between the BCRA and the portfolio of current minister Luis Caputo.

image

Source: Ambito