As Ámbito anticipated weeks ago, the exchange of coins will increase due to the equivalent in yuan to u$s3,000 million, bringing the exchange to $23.5 billion in total. But in this case, the expansion of uses will be more relevant than the amounts. The Government suggests that part of these funds can be used to pay for imports and infrastructure loans, such as the one that Argentina could acquire if the fourth nuclear power plant project, Atucha III, advances, or as those in force for the Néstor dams Kirchner and Jorge Cepernic.

“We have a significant industrial deficit with China and this could be a good instrument to finance it, while we increase exports,” they explained from the monetary entity. According to a report by the Argentine Chamber of Commerce (CAC), based on official data, the bilateral trade deficit with the Asian giant reached US$7.365 million last year. The intention is that part of that deficit can be covered with yuans and thus avoid the exit of a greater amount of dollars from the Central Bank. Specifically, the official expectation is to cover 50% of that red with the Chinese currency.

Strictly speaking, the mechanism to pay for imports with yuan is currently legal. Some transactions, such as the purchase of Sinopharm’s vaccines, were made in that currency. But in practice the operation is complex. That is why it is sought to speed up this process. “The idea is to simplify the administrative part so that private parties can use it. We aim for the operation to be done through the ICBC bank”, they explained from the Argentine monetary entity.

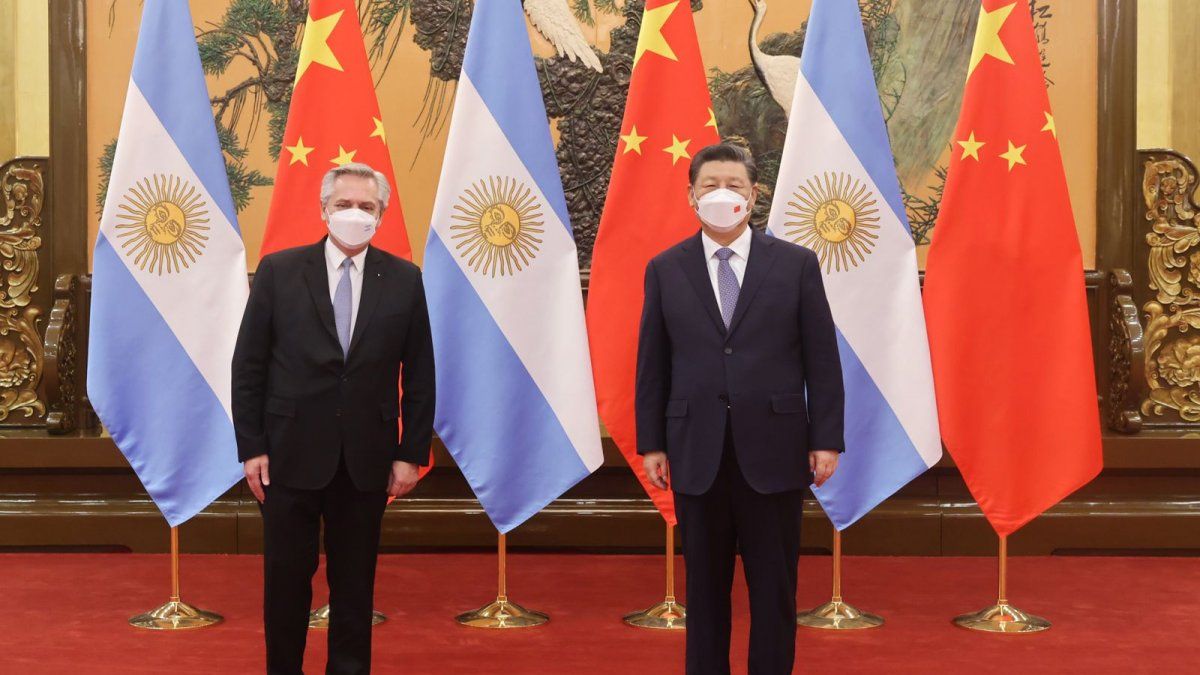

The swap funds are not part of the net reserves, so there would be no immediate effect on that point. But the expectation is that, by reducing the outflow of dollars via commercial exchange, these currencies will be released to swell the coffers of the BCRA. “Soon we will have the corresponding technical authorization. With this we will also strengthen exchange rate stability,” said Alberto Fernández this Tuesday in Congress.

The last renewal of the coin exchange took place in August 2020 and marked an extension for a term of three years. At that time, another point was agreed that becomes relevant in this context, the swap does not depend nor will it depend on the situation that Argentina goes through with the International Monetary Fund.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.