Where events do not stop, neither because of the pandemic nor because of the war, it is on the neighboring shore of Punta del Este, where the LATAM ConsultUS “Kick Off” took place, leaving some data and news. The Spanish manager Protein Capital Management, which manages an investment fund in crypto assets, is looking for distributors in the region – with a focus on Uruguay (indirectly Argentina), Chile and Mexico – because it sees greater interest than in Europe for this type of investment.

The Protein Capital Fund is a Luxembourg-domiciled investment fund that invests in the top 20 cryptocurrencies. It is the only fund that uses financial options on bitcoin to generate income (they take 10% of the bitcoin they have invested to the options, but not as a hedge but to generate income). For its part, it was learned that the investment fund manager Valores Afisa, the subsidiary in Uruguay of the main trustee of Argentina Banco de Valores, will launch its first fund in the country, whose asset management will be in charge of the local stockbroker Gletir. Who will be the fund managers? A team led by Nora Trotta and Walter Stoeppelwerth. Another Creole group that is advancing is Balanz Capital, which would enter into an agreement with the local firm Bursátil X Inversiones. Despite the boom on the neighboring shore, some decide to leave, like the Swiss group Edmond de Rothschild, which seems to be closing its wealth management business in Uruguay aimed at offshore clients that it started in 1995.

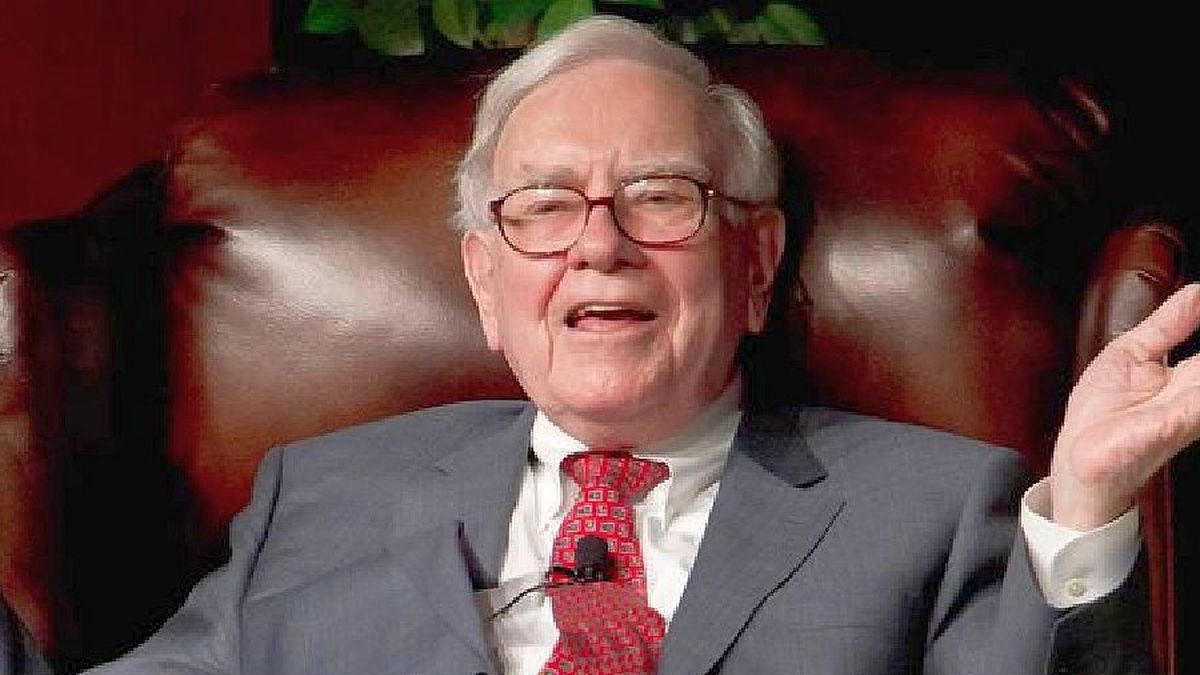

Is there something Warren Buffett knows that we don’t?they wonder on Wall Street. It’s that while hedge funds are liquidating oil positions at a near-record pace amid extreme volatility and fund managers remain cautious when it comes to energy stocks (the only major industry in the S&P 500 with a positive return as far as year-to-date and arguably the best-performing sector today), the Oracle of Omaha Warren Buffett revealed that he increased his stake in Occidental Petroleum to 14.6% by buying an additional 18.1 million shares this week. In this regard, a fact: according to the US oil company, it cannot significantly expand production in the short term to fill the gap caused by the sanctions on Russia due to labor shortages and challenges in the supply chain.

I mean, oil prices will stay higher, leading to windfall profits for drillers and E&P giants. S&P 500 energy stocks are up 28% for the year, the only 2022 gain to date among the index’s 11 major industries. Unlike long-term investors like Buffett, these high gains may have pushed some investors to take them short and may be scaring off new buyers from taking larger long-term positions, experts speculate.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.