If the geographical distribution is observed, 50% of the transactions were carried out in the main urban centers of the country: the Province of Buenos Aires concentrates 30% both in number of operations carried out and in volume, followed by Córdoba (9%) , Santa Fe (6%), CABA (5%), Salta and Tucumán (both with 5%).

About, Martin BellocqChief Marketing Officer of Ualá, pointed out: “The digitization of cash is very positive because it allows more people to permanently enter the formal financial system.”

“It is the door to financial inclusion and the first step to increase the use of financial services such as cards, investments and credits”, I consider.

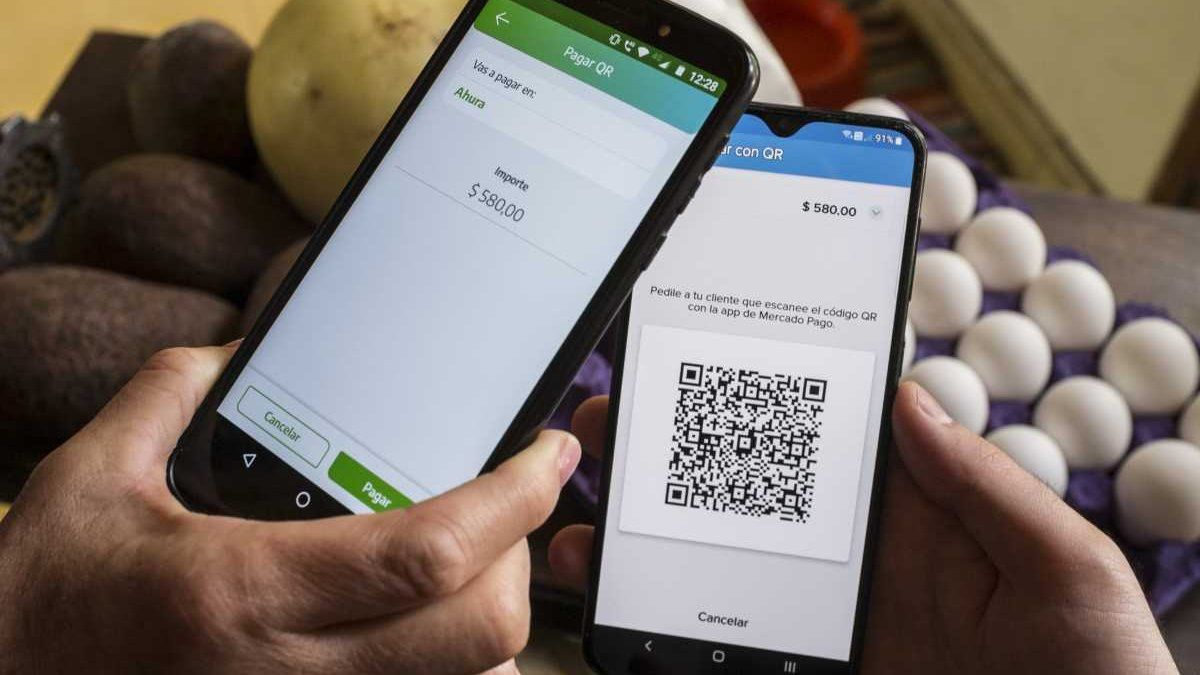

The Transfer Payment system by reading the QR code of businesses through the application of a bank or virtual wallet came into force on November 29, 2021.

Since then, operations under this modality have shown significant growth month after month.

In March, for example, payments with QR codes broke the barrier of 63,000 daily operations on average and already involve a monthly movement of about $1,500 million, with an average ticket of around $2,000 per operation.

Currently there are more than 60 companies that make up the system: three administrators (Coelsa, Prisma and Red Link), 15 acceptors and 16 payment applications, although there are almost 40 that have begun efforts to join both as payment acceptors and as wallets.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.