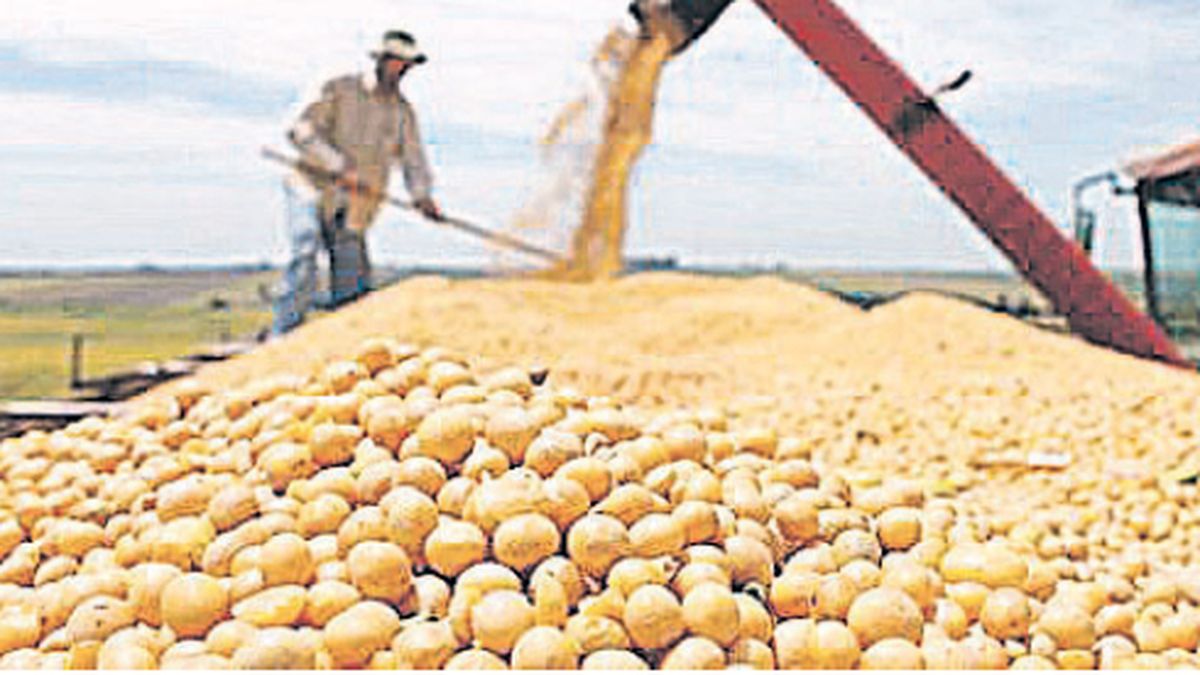

In this framework, soybeans closed the wheel with a rise of almost 1.3% to US$590.38 per ton. The grain price was underpinned by the rise in oil prices (July added US$53.13 and was left with an adjustment of US$1,839.72)which is a reflection of the crisis in the global market for vegetable oils, without the offer from Ukraine –sunflower oil– and without the offer from Indonesia –palm oil–.

In this context, the brokerage firm and agricultural consultant Granar analyze: “The minimum drop in the year-on-year inflation rate in the United States, from 8.5 to 8.3%, a figure that keeps it at its highest in almost forty years, support to purchases from the speculative sector that, apparently, will need more rate hikes to give up the refuge that grains have been able to give them so far from the inflationary outbreak. Looking ahead to the USDA’s monthly report tomorrow (for today), the market is expecting to see a cut in 2021/2022 US ending stocks. The little or no activity of the Chinese demand and the fall of the flour (July subtracted US$3.97 and was left with an adjustment of US$438.61) limited the increases of the bean and supports the position of those who consider that the USDA you can readjust your expectations about the level of imports from China in your monthly report.”

Along the same lines, corn closed higher in Chicago as a result of the delay in US planting, which could affect the realization of the initial planting plan and the potential yield of the crops.. In addition, the continuation of the war in Ukraine and the damage caused by the Russian bombing of the Odessa port complex, key for trade in general and for grains in particular, added to the upward trend because they accentuated the uncertainty about how and when Ukrainian trade may be restored.

“The chance that the USDA adjusts its forecast on US ending stocks 2021/2022 also contributed to the upward trend in prices and added to the lack of moisture in the center-west of Brazil, which affects the second harvest of corn from that country”, advances Granar.

In this way, the cereal gained 1.5% to finish the wheel at US$310.42 per ton. The best value of the last 15 days.

Finally, wheat followed the trend and rose 1.8% to US$408.96 per ton. That is to say, in just one day he recovered more than US$8 dollars, precisely at the moment when the local product is making its sowing decisions for the 2022/23 campaign. Projections indicate that this year Argentina would be sown 8% less than the previous campaign and the harvest would reach 19 million tons, after last year’s record of almost 22 million tons.

“Among the fundamentals that supported the firmness of this market, the poor state of winter wheat in the United States and the continuation of the war in Ukraine continued to stand out, with Russian attacks on strategic objectives such as the port of Odessa, key to trade ukrainian In addition, the heat wave in India was added, which continues to affect crops and would reduce the volume of the harvest, in a campaign in which the Indian authorities hoped to be able to increase their exports from 8.5 to -at least- 12 million tons, to take advantage of the drop in foreign sales from Ukraine. As happened last week, the versions about possible restrictions on wheat exports from India are being heard again in the market”, explains the closure of markets in Granar.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.