In terms of sectors, the study highlighted that the construction had an increase of 3% per year, still below the peak of 2017.” “Similarly, the Durable Production Equipment (EDP), presented an increase of 18.7% and is also at levels close to the 2017 peak,” the report added.

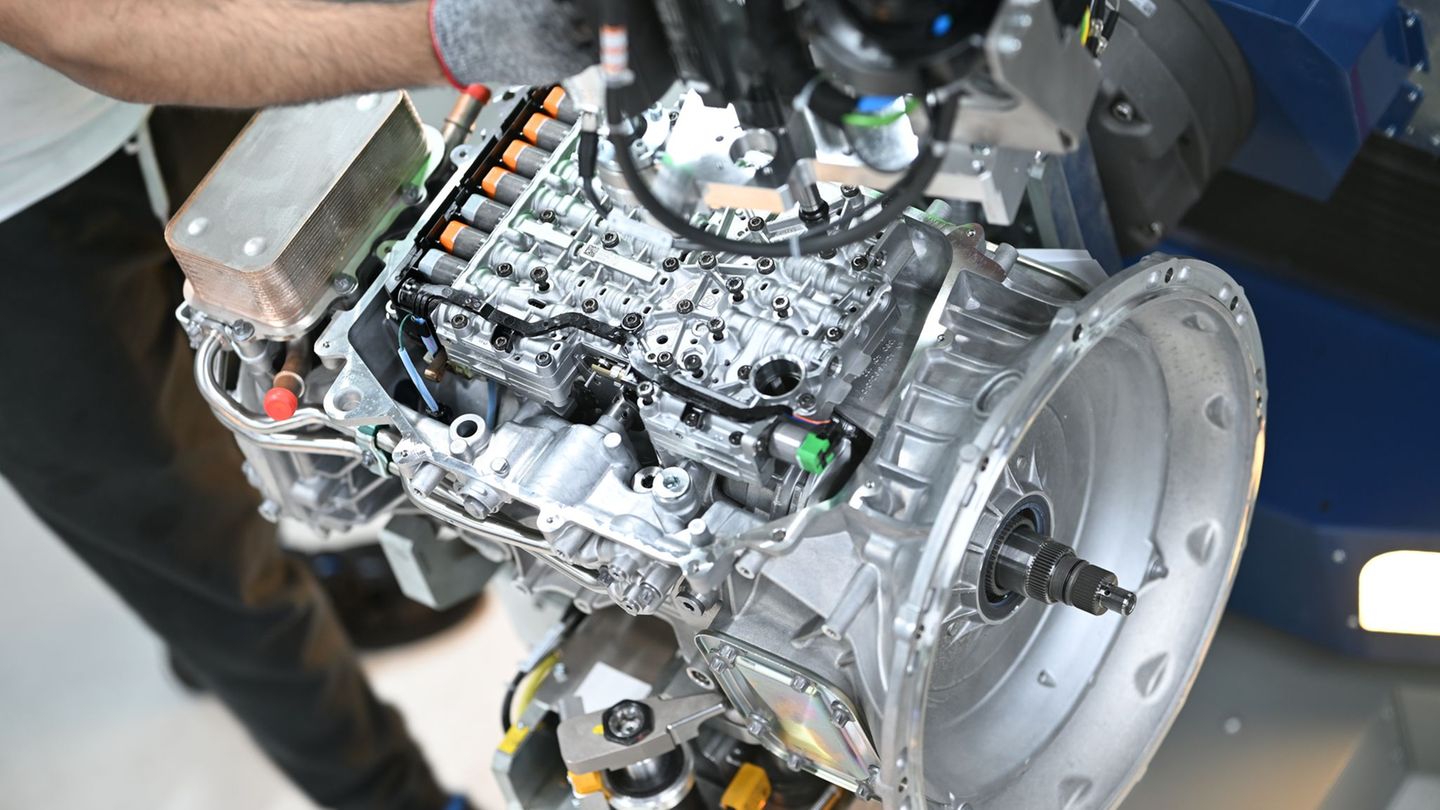

“The investment in National Production Durable Equipment (EDPN) exhibited a 3.7% annual drop, closing a first quarter without increases. However, this sector is at levels close to 2017,” said the study, which remarked: “For its part, the Durable Imported Production Equipment (EDPI) had an increase of 37.8% per year. This sector continues to be the one that contributes the most to investment growth, which is linked to the dynamics of the exchange rate, which has been appreciating in real terms since January 2021.”

In this context, facing what may happen in the coming months, the director of the ITE, Juan Manuel Telechea, analyzed in dialogue with Ambit: “Depending on the significant improvement shown so far in economic activity and, in particular, in investment, it is difficult for a brake to be seen in the short termmore than anything for the inertia that drags For the months to come, it will be necessary to see if the activity can sustain this dynamicwhich a priori is difficult since it demands a lot of foreign currency and that conflicts with the accumulation goal set in the framework of the agreement with the IMF”.

What drives investment

There are different factors that promoted the growth in investment during the first months of the year. “On the one hand, the lack of value protection options, the high exchange rate gap, and a construction cost in dollars that remains low in historical perspective, generate incentives to pour liquidity into the activity, in a context in which the relocation of homes, consumption centers and offices have promoted new real estate developments”, he told Ambit Santiago Manoukian, Ecolatina economist, who added: “On the other hand, the import of machinery accompanies the recovery in demand, but it also remains attractive as a strategy to take cover against the acceleration of inflation and certain uncertainty about greater controls on foreign purchases compared to the foreign exchange shortage. Also, the production of domestic transportation equipment is driven by higher exports. On the flip side of this is the less importation of vehicles in a context of greater limitations”.

Looking ahead, Manoukian argued that “in the short term, The main limitation that the continuity of this process will face lies in the goal of accumulation of reserves, which puts a ceiling on the level of imports that can be paid with the current level of foreign currency supply, especially when discounting that energy purchases will grow strongly, added to the jump in global inflation, the increase in freight costs and overheating of the tourist deficit”. “Furthermore, and beyond the availability of foreign exchange, it remains to be seen whether the energy supply will be sufficient to avoid gas cuts in the winterbeing able to affect the industrial fabric”, he concluded.

The government’s gaze

Days ago, the Minister of Productive Development Matias Kulfas stressed that the country is “living a major investment scene”. “The private investment in Argentina grew about 30% in real terms since the Alberto Fernández government began and there have been more than 200 investment projects, some already executed or in execution,” the official said.

Kulfas further remarked that “investment in energy is flying, in miningPatagonia is seen as a very important space for investment”, as it is also doing well “in the food sector”.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.