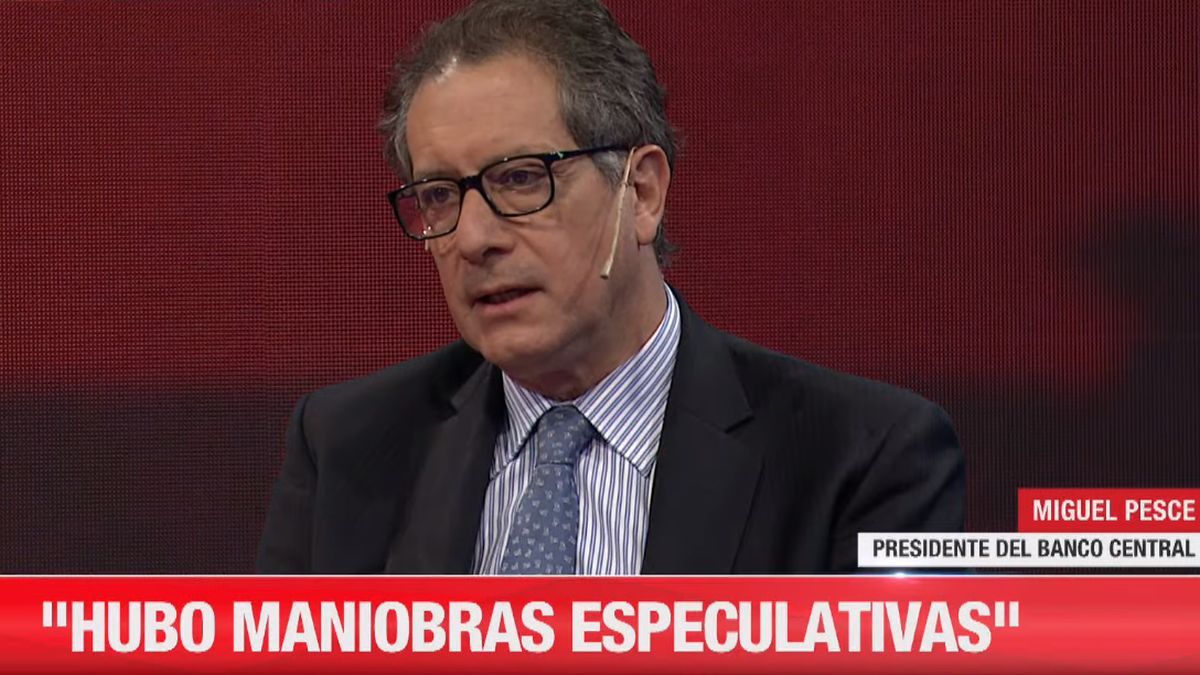

Pesce, in statements to the cable channel C5N, He maintained that “like all central banks when these maneuvers occur that depress the prices of securities, the BCRA went out to bank it and we have managed to normalize the yield curve both in the nominal rate and in the rate with CER.”

The official indicated that “the government securities market is central to the development of the capital market. One of the defects that our country has is that it does not have a deep capital market and that is the role of the bond market, to give it liquidity and depth to that capital market”.

Fish added that “We have decided to increase the interest rate so that savers in pesos can beat inflation. After the pandemic we have begun to recompose the interest rate.”

Later, the president of the BCRA pointed out that “today the entity has had less intervention in the foreign exchange market and we hope that next week a normal path will begin where the intervention of the BCRA is not necessary.”

In reference to reserves, Pesce pointed out that “we are in a very complex international situation, where the Federal Reserve increased its reference rate because inflation is high there, there is volatility in the price of commodities and this is generating difficulties in our trade It is true that the primary sector is liquidating foreign currency at a higher level than last year, but there are delays in the liquidation of the soybean harvest, which is very important and which would be around between 2,200 and 2,500 million dollars that they will surely settle it later. It was also expected that there would be net disbursements by multilateral organizations of the order of 700 million dollars and that has not yet arrived, which is why at the moment, we have these imbalances in the exchange market, but the BCRA came out to defend the exchange rate and that is what the reserves are for”.

Pesce declined to adopt additional measures to the stocks and stated that “The BCRA is going to apply foreign currency to growth and investment and job creation, but we are in a situation of foreign currency scarcity,” while also ruling out a split in the foreign exchange market.

The official admitted that he is concerned about the gap between the value of the dollar in cash with liquidation and the official exchange rate because “that feeds people’s expectations, but it does not have as much weight on those who need foreign currency to import.”

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.