If compared to the same month last year, electronic money transfers grew 77.8% in amounts and 31.9% in real amounts, so it is estimated that these operations represented an amount equivalent to 46.3% of GDP (+13.9 percentage points than in the same month of the previous year) when considering annualized amounts of the last three months, according to data from the Central Bank (BCRA).

“Year-on-year performance was driven both by transactions between accounts opened in financial entities via CBU (53.1% year-on-year (yoy) in amounts and +24.2% yoy in real amounts) as well as operations involving accounts in suppliers of “PSP” payment services from and/or to CVU (+111% yoy in amounts and +75.3% yoy in real amounts)”pointed out the monetary authority in its May Bank Report.

growth factors

One of the factors that strongly boosted transfers were those made through Mobile Banking (+139.5% yoy in amounts and +73.9% yoy in real amounts), particularly those made through digital wallets linked to public banking.

Specifically, the operations through BNA+ -Banco Nación’s wallet- grew 486.8% in amounts and 372.3% in real amounts between April 2021 and April 2022, while ID account -Banco Provincia’s wallet- grew 215.8% in amounts and 145.3% in real amounts in the same period.

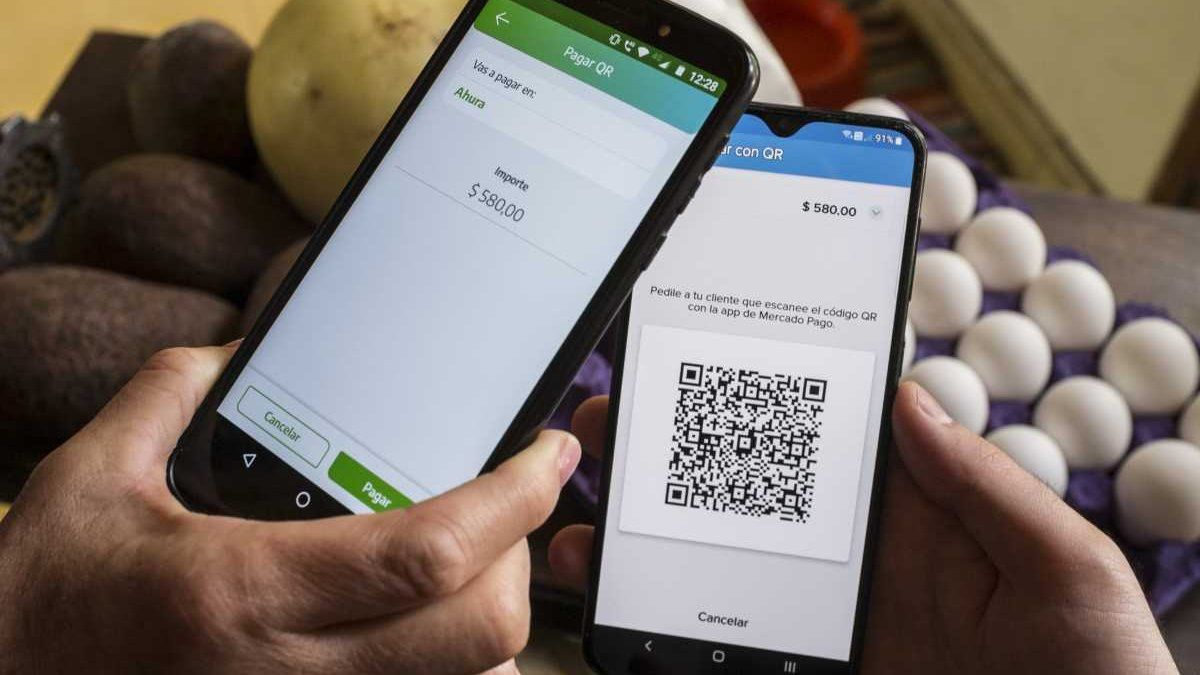

payment in business with DNI Account.JPG

“Considering the different channels, in May the average amount of each transaction reached almost $370,343 in business electronic banking, $40,706 in internet banking, $33,187 in ATMs, $11,211 in mobile banking and $8,786 in CVU”detailed the BCRA.

On the other hand, transfer payments initiated through interoperable QR codes increased significantly between April and May: 20.3% in amounts and 21.3% in real amounts.

“Since the beginning of the full QR interoperability scheme (end of November 2021), the accumulated amount of operations under this modality as of May reached 12.5 million, equivalent to $25,408 million at May 2022 prices (resulting in an average of $2,023 per transaction),” detailed the Central.

Cash reduction is one of the main objectives of the transfer payment system, which allows any virtual wallet or banking application to read all payment QRs, regardless of the issuing company, to make payments immediately.

With this system, merchants irrevocably receive the money in their accounts in less than 15 seconds -an improvement of 10 seconds compared to the time of its launch- and with the lowest commission in the market (from 0.6 to 0.8%), which simplifies operations and allows it to compete against cash, which is the form of payment used in about 8 out of 10 transactions.

In addition, it means a resounding improvement over other electronic payment methods such as those made with a debit card, which are credited within 24 hours, or with a credit card, which are credited within 8 to 18 business days. , depending on the size of the company that receives the money (if it is micro or small it will be in 8 days, if it is medium in 10 and if it is large 18 business days).

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.