For this reason, in Economy they celebrated the operation this Tuesday: “The result was positive for this tender and also for the month. In both cases with positive net financing, that is to say that more was obtained than what was sought”.

Specifically, the Ministry of Finance (led by Rafael Brigo and Ramiro Tosi) placed $248,078 million yesterday in a package of instruments that reflected a reduction in the terms of issuance and a new concentration of demand in indexed titles. 85% corresponded to instruments maturing in 2022 and the remaining 15% to a dollar linked bond that expires in 2023. In fact, a dollar bond linked to 2024 had been offered, which received offers from investors for US$55 million. , but that Finance declared void so as not to validate very high rates. Likewise, 51% of the awarded amount went to CER-adjustable instruments (inflation), 34% to fixed rate (Ledes) and 15% to dollar linked.

In addition, Finance had to validate a significant rise in the interest rate of its instruments to get private investors to enter the placement. In the case of LEDs, rates reached nominal yields of up to 60% and effective rates close to 72%, almost 6 percentage points above the Central Bank’s monetary policy rate. In the case of Lecer, real rates were between 2.5% and 3.3% per year. While the dollar linked to 2023 paid 4.26% above the depreciation rate.

With this result, during June the Treasury accumulated a positive net indebtedness of $16,220 million, which implies a refinancing rate of 106%. Although there is still the second round of the bidding, which will take place this Wednesday with the participation of banks and brokerage firms that act as market makers. There, Finance will be able to place up to 20% of the amount placed in the first round in the Ledes and the Lecer.

All in all, in the first semester the Government accumulated a net financing of $663,246 million, which is equivalent to a rollover of 121%. According to private estimates, this refinancing rate is insufficient to meet the objective of obtaining at least 1.7% of GDP in net funding during 2022 to reduce the monetary issue to 1% of GDP. Analysts point out that it should reach 130%, so it will need to put the financial panorama on track in the remainder of the year.

Therefore, for Economy it was key to pass this test. The debt in pesos is the key tool to sustain investment and public spending, facing a second semester in which the IMF asks for a real contraction of 7.8% in State outlays. It also needed to give a signal to prevent the tensions in the parallel dollars, which are experiencing strong devaluation pressure, from heating up even more.

Within this framework, and just as it did since the bullfight began, the BCRA intervened with purchases in the peso debt market to put prices and rates on track. On this occasion, it added a new tool: an immediate liquidity window for mutual funds (FCI), which in recent weeks had led to significant disarming of positions. This liquidity line was open from 15:30 to 16:30 at a TNA of 57.3%. This mechanism to encourage investors to finance the Treasury had been discussed on Monday at the meeting that Miguel Pesce held with the authorities of the Argentine Chamber of FCI.

Source: Ambito

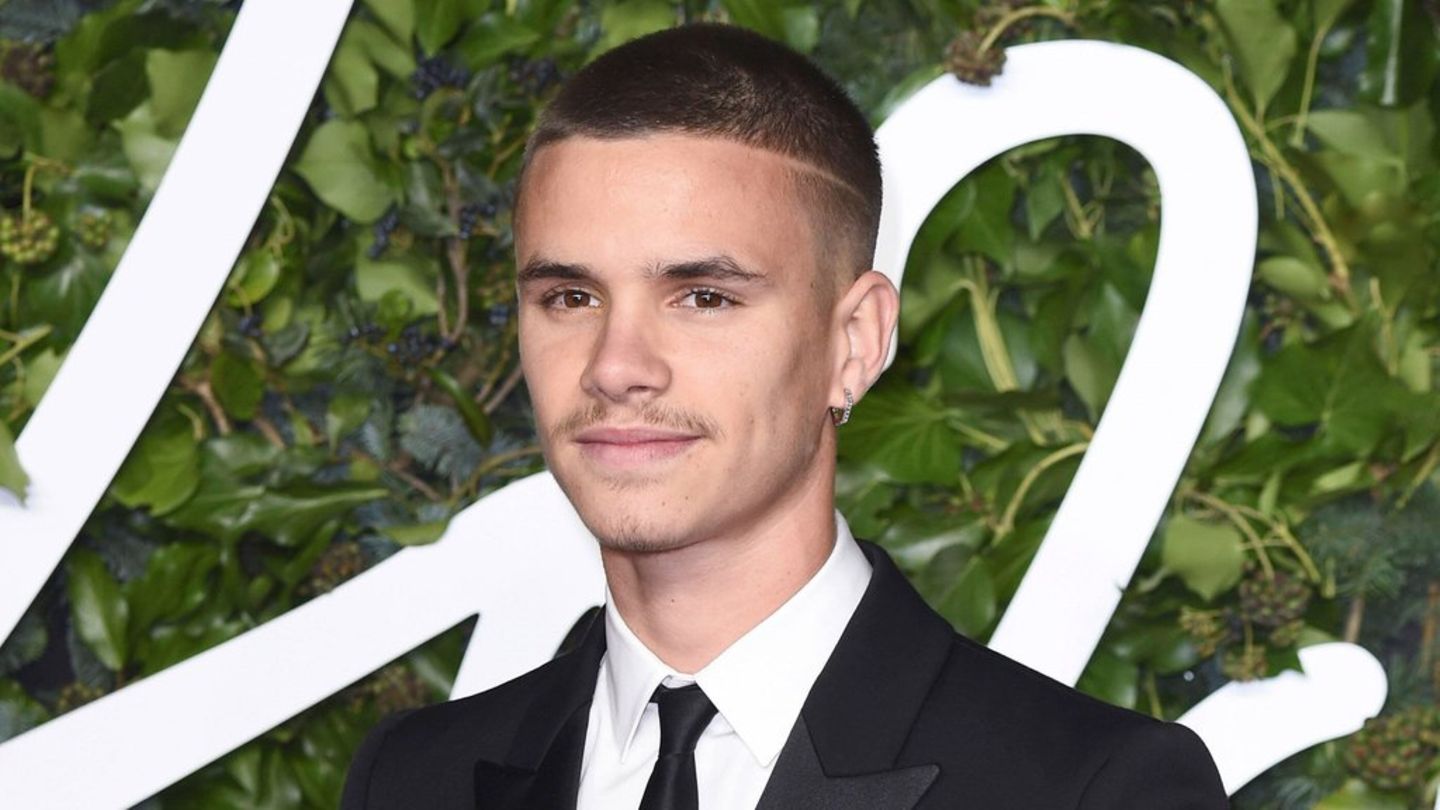

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.