It seeks to guarantee that monotributists have access to the benefits of the Tax Relief Law for Small Taxpayers and the Self-Employed enacted yesterday by the Government.

Law 27,676 expanded the maximum billing limits per category of the monotax and thus allows monotaxes to remain at current levels, if applicable, without seeing the values of their monthly obligations increase.

The initiative also established the exemption from the tax component of the monthly obligation for small taxpayers registered in categories A and B, provided that they receive all of their income through the monotax.

That is, they do not have a dependent job or collect a pension and do not receive financial income or rental income.

The increase in the maximum billing limits per category must be taken into account by the monotributistas to evaluate their recategorization.

Exceptionally, the term to make the six-monthly recategorization of the monotax will be enabled between July 11 and 29.

The recategorization consists of the evaluation of the activity of the last 12 months to determine if they should maintain the category in which they find themselves or modify it.

When the different parameters analyzed exceed or are lower than those of the current category, it is necessary to perform the recategorization.

Those monotributistas who maintain the same category should not carry out any action.

Likewise, the AFIP extends until July 27 the period to pay the obligation of the current month.

The extension of the deadlines seeks to facilitate the compliance tasks of the small taxpayers registered in categories A and B who were benefited by the exemption of the tax component.

Taxpayers in the first two categories must make the monthly payment once the exemption from the tax component impacts their profiles, which will be from July 11.

However, throughout the month, the possibility of paying the monthly obligation of the monotax remains enabled for those who, for different reasons, so require.

In those cases, when a difference arises between the amount paid and the corresponding amount after applying the modifications arising from the tax relief law, small taxpayers may reimpose it to cancel other periods.

As of July 11, small taxpayers in categories A and B who have no other source of income will be able to view their new credential through the AFIP website, and if necessary, they will be able to reprint their credential.

This is due to the fact that since they will stop paying the tax component of the monotax, the system will assign them a new Unique Magazine Code (CUR).

This procedure is carried out in monotributo.afip.gob.ar with CUIT and tax code.

AFIP Earnings 1200

Tax relief for monotributistas and self-employed: what are the changes

The project aims to update the amounts of the maximum billing allowed to be in each of the categories of the scale. It will also renew the income ceilings that allow access to the simplified tax system.

The same initiative also provides for news for the self-employed, who pay Earnings from lower income, compared to employees and retirees. The bill will now go to the Senate to become law.

Changes in the monotax: from when will the changes of the new tax relief law be applied

The maximum income amounts will increase by 29.12%, except for those in categories A, B, C and D, which will do so by 60%. This percentage arises from the annual updating mechanism, by which the figures are readjusted each January, taking as a reference the percentage of the increase obtained in the previous year by retirements and pensions from the ANSES general pension system.

If the tax relief law is approved, these changes will apply as of July 1, 2022. Until the 20th of that month, monotributistas must comply with the second recategorization procedure that occurs each year.

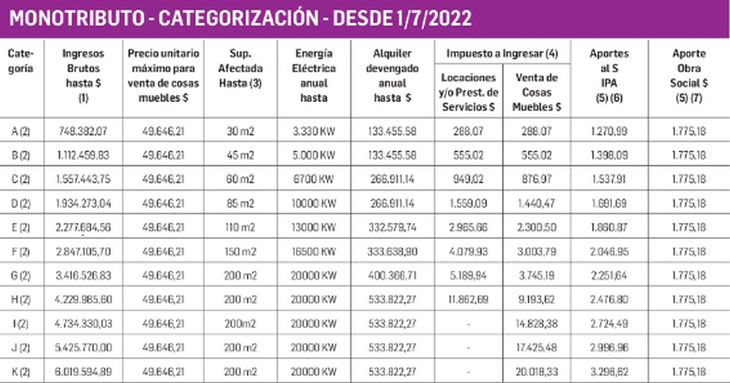

categories monotributo 2022.jpg

How will the scales of the monotax be?

If the new table is approved, they will need to look at their billing for the last twelve months. In this way, the caps by category will be as follows:

- Category A $748,382.07

- Category B $1,112,459.83

- Category C $1,557,443.75

- Category D $1,934,273.04

- Category E $2,277,684.56

- Category F $2,847,105.70

- Category G $3,416,526.83

- Category H $4,229,985.60.

With regard to activities for the sale of personal property, there are three other categories, which will have the following maximum billings admitted:

- Category I: $4,734,330.03

- Category J: $5,425,770.00

- Category K: 6,019,594.89

calculator.jpg

andro4all

What will happen to the income caps for monotributistas?

The highest annual turnover allowed in the case of trade will pass, as planned, from $4,662,015.87 to $6,019,594.89 and that corresponding to those who provide services, from $3,276,011.15 to $4,229,985.60.

In case of exceeding these maximum limits, the taxpayer automatically passes to the next scale. The increase in permitted income with respect to the values in force in January 2021 was 32.05% (trade monotributists) and 39.18% (services).

Changes for the self-employed: how the modifications will impact the new law

In the case of freelancers, the initial project proposed to increase the special deduction by 2 times the non-taxable profit, passing the deduction from $505,129.66 to $757,694.52. In this way, the “gap” of the special deduction between the employee and the self-employed was reduced from $707,181.58 to $454,616.72. In addition, for new professionals it rose from 1.5 times to 2.5 times the non-taxable profit.

In the debate on the premises, it was decided to raise the special deduction for the self-employed from 2 times to 2.5 times and 3 times for new professionals. “This is an additional benefit for 140,000 self-employed taxpayers who pay income tax”they indicated from the ruling party.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.