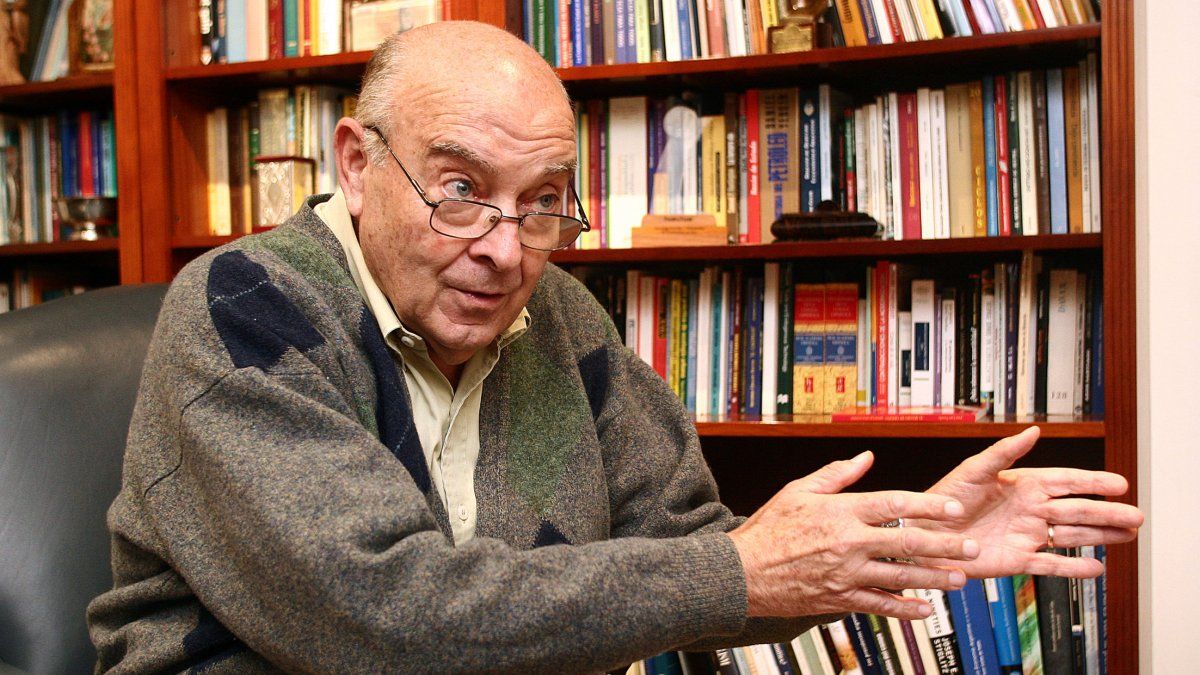

Serge Massa

NA

With some recipes Sunday Horse wrote on his blog that according to his point of view, Serge Massa should address two main lines of action. On the one hand, unfold the exchange rate. On the other hand, make use of the fiscal adjustment in public spending and sell the shares of the Sustainability Guarantee Fund (FGS), as a basis to balance the central bank reserves.

Public spending and fiscal adjustment

For the former Minister of Economy, yes Serge Massa begins by acknowledging that it will be necessary to make a fiscal adjustment due to the reduction of public spending, “even greater than that committed in the negotiation with the IMF”, he stated on his blog, “it is possible that he will be able to limit inflation in the remainder of the presidential term to 6 % monthly or 100% annually without a violent fall in the level of economic activity”.

To do this, explain horse, it is necessary for the new minister to take monetary policy towards the objective of closing the exchange rate gap, in order to accumulate reserves. Given the circumstances, “it’s the best result he could get,” he noted in his detailed analysis.

He also detailed that Massa must ensure that “all other items of expenditure, including salaries, pensions, social benefits, capital expenditures and transfers to the provinces, do not increase by more than 5.5% per month, in such a way that inflation of 6% per month reduces them by real terms at a rate of 0.5% per month”.

Dollar and reserve accumulation

This is exactly what it points to Sunday Philip Cavalloin his “advice” to Serge Massa. For a long time, he has argued that if the exchange market unfolds, not so many dollars will be sold. He insists on selling the FGS shares, which could give the government some $5 billion for reserves.

Dollar.jpg

“In my opinion, the vertiginous increase in the exchange gap throughout the month of July was due to the loss of reserves that strongly installed the expectation of a devaluation jump in the official exchange market,” said the former minister in his Blog. And he added: “The reaction of the Central Bank and the Ministry of Economy in the face of this problem exacerbated that expectation.”

on his blog, Sunday Horse warned that initially the increase in the gap was attributed to the difficulties encountered by the Government to continue placing debt securities in pesos. “This led the Central Bank to increase the intervention interest rate from 4% to 5% per month, but that decision did not have a significant effect, at least until the appointment of Serge Massa as Minister of Economy,” he said.

In this sense, according to the gaze of the former Alliance super minister in 2001could have tried to stop the loss of reserves “by introducing an intelligent unfolding of the foreign exchange market”, which would allow all foreign exchange transactions related to the hoarding of dollars, travel and tourism expenses and financial transfers unrelated to a free market. with deferred payment of imports.

In parallel, this opening of the foreign exchange market will allow the entry of capital and external financing for the private sector in the country. Along these lines, he warned that “import restrictions and attacks on the agricultural sector” were seen by the markets as “absurd.”

Therefore, he held horse In this Sunday’s post “If Sergio Massa does not manage to reverse this expectation, it will be impossible for him to achieve even the unambitious goal of 6% monthly inflation”he replied.

Sale of FGS shares

A separate paragraph in the analysis of Cavallo is the item related to the sale of shares of private companies that make up the Sustainability Guarantee Fund (FGS). This would give air to the Central Bank’s dollar reserves.

If these shares were sold, the Government could acquire more than US$5,000 million, which is what this set of FGS shares is worth, which in December 2017 was worth US$12,905 million.

“It is likely that if the FGS decided to offer those shares to the shareholders that have control of those companies, it could obtain income closer to double the current market valuation than the US $ 5,688 million that, according to the market, are currently worth,” he clarified. And he added: “This is likely because those who have share control of the companies will get rid of the State as a shareholder in this way.”

Energy, another key point

In his analysis, horse established a series of guidelines, with spending control as the key. In this sense, it proposes the financing of the deficit: “It required a strong monetary expansion and, in parallel, a large placement of debt in pesos, to the point that the internal capital market collapsed in mid-June, raising an additional question about the sustainability of the internal debt,” he said.

In this way, for the former Minister of Economy, “Massa will have to achieve a significant reduction in the amount of economic subsidies, which means implementing an adjustment of electricity and gas rates much higher than the one that Martín Guzmán intended to achieve and that Kirchnerism prevented him from the Secretary of Energy”, he added.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.