Minister Sergio Massa affirmed through social networks that “the result was successful” and He thanked “the trust and support of institutional investors, individuals and public sector organizations, which allows us to alleviate the financial situation for the next quarter, extending maturities to 2023”.

“Clearing maturities enables us to work in a more orderly manner on resources and expenses that we have to manage public accounts, in addition to giving certainty to the domestic economy. I appreciate the enormous work of the Finance team”, indicated the head of the Palacio de Hacienda.

On the other hand, Economy reported that “The conversion operation reached, in cash value, 85% adherence in the eligible instruments”. In the conversion operation, a total of 1,233 deals representing a total of $2 billion in cash value.

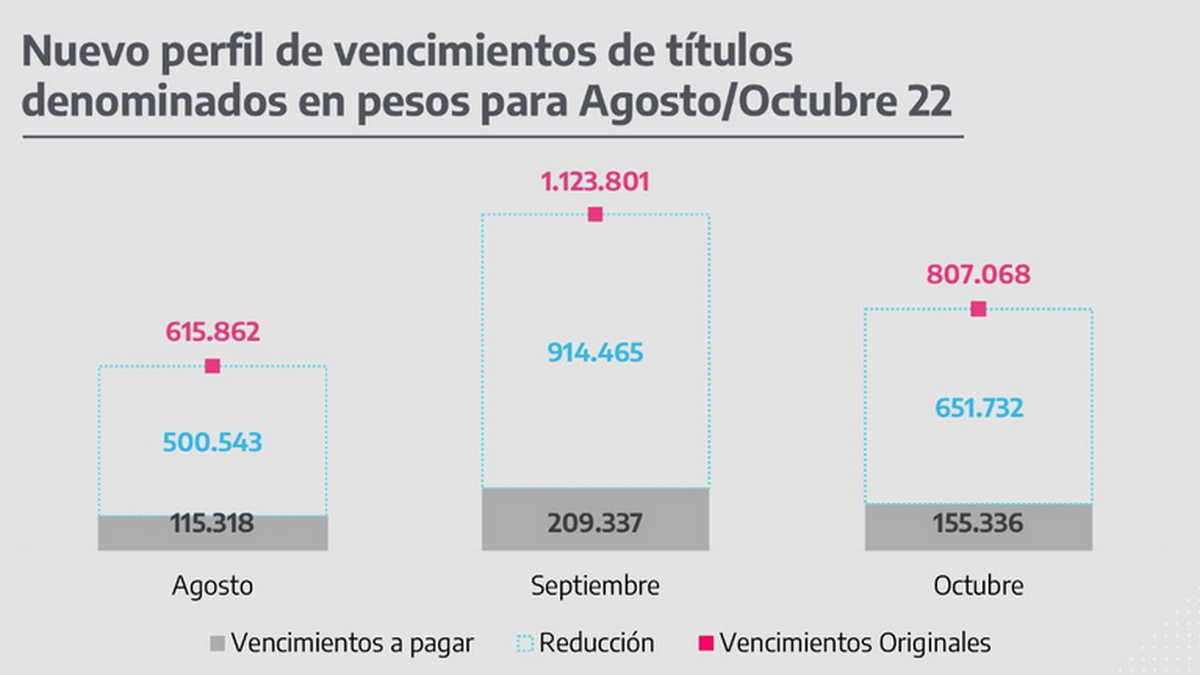

The Treasury Palace highlighted that the National Treasury had to face maturities for $615,862 million in August; $1,123,801 million in September and $807,068 million in October. After the operation, it managed to reduce projected maturities to $115,318 million, $209,337 million and $155,336 million, respectively.

“83% of the maturities for October were placed in the dual instrument maturing in September 2023. In other words, $651,862 million were awarded post PASO 2023”, highlighted the Ministry of Economy. Precisely, one of the problems that was unleashed this year with the debt in pesos was the fear of a reshaping of maturities in the event of a change of political sign in the Casa Rosada. This generated a current of mistrust that was shortening the placement horizon to no more than three months, with June 2023 as the limit. “This government is not going to redefine the debt in pesos,” sources from the Palacio de Hacienda remarked.

The Treasury offered the following options:

- A dual currency bond maturing on June 30, 2023 for holders of LECER X16G2 and LEDE SG162, maturing on August 16, and LEDE S31G2, maturing on August 31, 2022.

- A dual currency bond as of July 31, 2023 for holders of BONCER T2X2 and LEDE S30S2, maturing on September 20 and 30, 2022, respectively.

- A dual currency bond maturing on September 29, 2023 for holders of LECER X2102 and LEDE S31O2, maturing on October 21 and 31, 2022, respectively.

The next important challenge that the Ministry of Finance will have is to obtain pesos to cover the due dates of Advances from the Central Bank that remain until the end of the year. The Treasury owes the monetary entity the equivalent of US$6.9 billion, of which US$2 billion are due in October. In the Palacio de Hacienda they admit that they will need to seek more financing than foreseen in the program with the IMF for that reason and also because of Minister Sergio Massa’s decision not to take more financing from the entity.

From the private sector, the financial analyst Christian Buteler described the operation as “very good” since it allows clearing the maturity profile for this year. Beyond the fact that at least 50% of the titles that were exchanged belonged to State agencies such as the ANSES Sustainability Guarantee Fund, and the BCRA, private participation was very good, said the economist.

The next tender will take place on Thursday, August 11, as previously reported in the preliminary tender schedule for the second half of 2022.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.