In addition, during July the increases in cigarettes stood out, in the Alcoholic beverages and tobacco division (6.4%); of water and electricity services in some regions of the country, which had an impact on Housing, water, electricity, gas and other fuels (4.6%); of the share of prepaid medicine in the Health division (6.8%); of telephone and internet connection services, in Communication (5.5%); and of educational services at all levels, in Education (6.1%).

inflation indec scope July.PNG

The increase in Food and non-alcoholic beverages (6%) was the one with the highest incidence in all regions. Within the division, the increase in Sugar, sweets, chocolate, sweets; Oils, fats and lard; Fruits; Vegetables, tubers and legumes; and Milk, milk products and eggs.

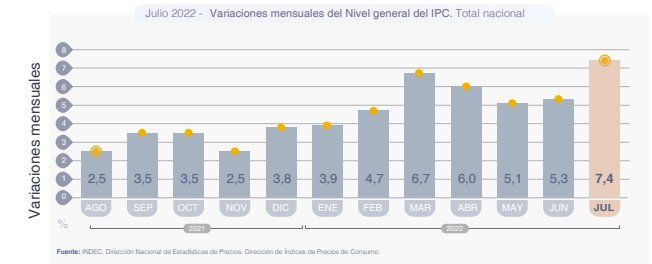

At the category level, it led the seasonal monthly increase (11.3%) -explained mainly by the behavior of Fruits and Vegetables, tubers and legumes and the aforementioned increases in tourism services-, followed by the Core CPI (7.3 %) and Regulated (4.9%).

inflation indec scope July 2.PNG

“The most worrying thing is that the monthly variation was strongly influenced by the core component, which measures the background trend: it was 7.3%. Therefore, all items had significant increases in the month“, he told ambito.com Camilo Tiscorniadirector of C&T Advisors.

Likewise, he remarked that the C&T price survey data available for August “suggest that inflation for the month would exceed 6% monthly and year-on-year would be around 77%“.

While, Claudio Capraruloan economist at the consulting firm Analytica, analyzed: “To see similar increases we have to go to months where there were strong devaluations like September 2018 or international shocks like last March”.

“This peak reflects the jump in the exchange rate gap and coordination problems in economic policy that operated strongly above expectations. We have spent five months with core inflation, almost 70% of the prices of the economy, increasing above 6% per month, ”he told this medium.

The survey of Market Expectations (REM) that the Central Bank had carried out last month showed that the rise in prices averaged 7.4%. The consultants calculated that last month’s Consumer Price Index climbed between 6.8% and 8.4%, the highest percentages so far this year.

“Prices in the domestic market begin to position themselves by looking at the gap in the official exchange rate, especially in those inputs that may have problems replenishing stocks. For this reason, it is essential to move towards calm in the foreign exchange market”, evaluated the director of Focus Market, Damián Di Pace.

The manager also considered it fundamental to strengthen the reserves of the Central Bank and generate incentives to obtain foreign currency from the exporting sectors.

It should be remembered that the index for the City of Buenos Aires was known on Monday: it was 7.7%. In this way, in seven months the accumulated rise in prices in the Argentine capital was 44.1% and the year-on-year rate rose to 69.2%, according to the Buenos Aires General Directorate of Statistics and Census.

Meanwhile, at the end of July 2022, market analysts projected that retail inflation for the current year will be 90.2% year-on-year, that is, 14.2 percentage points -pp- higher than the forecast of the previous survey .

The BCRA raised the rate to control inflation

The Central Bank (BCRA) raised its benchmark interest rate on Thursday by 950 basis points to 69.50% per year to keep up with market returns and before the July inflation figure was released.

The monetary entity raised yields in an attempt to control inflation and stabilize the foreign exchange market, the entity said.

The benchmark ‘Leliq’ rate for the 28-day term was set at 69.5% from a previous annual 60%, compared to inflation expected by analysts that could exceed 90% this year.

“The BCRA considers it necessary to once again increase the monetary policy rate and thus speed up the normalization process of the structure of active and passive interest rates in the economy to bring them closer to positive ground in real terms, in accordance with the Objectives and Plans for 2022 set in December 2021“, said the monetary entity in a statement.

And he affirmed that “the rise in the policy rate will contribute to reducing inflation expectations in the remainder of the year and to consolidating the financial and exchange rate stability achieved after the disruptive events of the last two months that motivated the intervention of the BCRA in the secondary market for public securities.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.