This Sunday, the portal El Cohete a la Luna published a confidential document called “Stabilization Program Proposal” attributed to Rubinstein, dated July 26, two days before it was confirmed that Massa would replace Silvina Batakis. That paper talks about a 50% devaluation of the exchange rate as of September 1st.

Rubinstein denied the information: “I am 100% sure that there is not going to be a devaluation, at least not this Thursday”, he says in an audio that he sent by WhatsApp to a group of economists. “You can imagine that I am in favor of the fiscal surplus, zero deficit, exchange rate unification, at some point for this or the next government, but that has nothing to do with making an imminent devaluation, do not get caught up in the wave of rumors ”.

Companies that adjust to the MEP

Despite the fact that the Government resists the devaluation and maintains the dollar to import at $145, more and more companies adjust their prices to the financial one, today in $282according to the report “Perspectivas PyME II Semestre”, from the Fundación Observatorio Pyme: “The prices of SME manufactures evolved halfway between the official dollar and the parallel dollar until the first quarter of the year, but they accelerated in the second , approaching the MEP”.

In dialogue with Ámbito, Vicente Donato, director of the foundation, clarified that the study is based on a representative survey of 400 SMEs with up to 250 employees in the manufacturing sector. Even in a context of strong restrictions on imports, the foreign trade exchange rate continues to be the official one. The explanation of why the importer and the rest of the chain sets prices to the financier is due to two reasons.

“The problem is the replacement of that good, you import it to the official, but the question is what the replacement value of the input will be, it is a dollar of coverage”Donato explained. In addition, he added: “There is a toned demand, and companies have more and more difficulties to supply, the offer is rigid and the price system is rationing”. According to the work, the stock of raw materials fell in the second quarter, with 72% of SMEs using imported intermediate goods. In the survey, 48% assured that production plans will decrease in the second semester due to exchange regulationswith an average drop of 13%.

observatory pyme.png

Faced with this scenario, Ambit asked what would happen to prices in the event of a devaluation: “In this scenario, the impact on prices would be less because there are companies that are already adjusted. But at the same time, expectations should improve and the gap should be closed”, anticipated Donato.

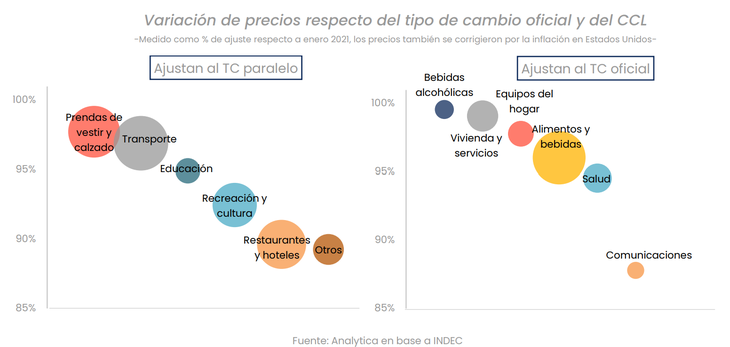

In any case, according to a report by the consulting firm Analytica, companies and businesses are already incorporating the stock dollar into their cost structures, anticipating devaluation, “but not yet massively”. They noted that 57% of the goods and services in the CPI have as their “main determinant international inflation expressed in domestic currency and the official exchange rate.” Meanwhile, sectors such as clothing, textiles, footwear, automotive and fuel “follow the variations of financial dollars.”

For this reason, Claudio Caprarulo, an economist at Analytica, told Ámbito that a strong devaluation would have a significant impact on inflation. “The main component of inflation in Argentina is the exchange rate”he stated, adding that inflation data such as 7.4% per month in July were observed at times of devaluation such as in September 2018.

In Analytica they project an inflation of 93% by 2022, with a crawling peg of 5%, so a strong devaluation would give a much higher percentage. At the moment, Caprarulo considered that the expectation of devaluation continues to be high in companies. In any case, from Analytica they still do not observe a generalized phenomenon of price adjustment based on financial dollars as if it happened in 2015, when “they grew 30% above the official exchange rate, given the condition of the end of the cycle of Christianity in the power”. These dynamics could occur again “if the perception of a change in political sign grows by the end of 2023, which increases the chances of an exchange rate unification (with devaluation included)”.

anayltica.png

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.