Initially, the investment will be $10 billionbut will reach a total of $40 billion for the entire project that includes the LNG plant that will be located in the Buenos Aires town of Bahía Blanca.

Also the construction of a gas pipeline with characteristics similar to the Néstor Kirchner that will link the Vaca Muerta field in Neuquén with the town of Saliqueló in Buenos Aires, YPF sources told Télam.

Once the project is completed, it is expected to export the equivalent of 460 regasification ships per year in the next decadewhich would generate an income of $50 billion annually to the country. The investment will run in equal parts by the two oil companies, but YPF will be the majority shareholder, with 51%.

Petronas is a specialist in LNGof which it is the third global producer: it generates some 36 million tons per year and has 40 years of experience, a presence in 17 countries and more than 4,000 employees throughout the integrated LNG value chain.

The Malaysian firm also has as one of its big businesses in the country the production of lubricants. In recent years, it installed a state-of-the-art plant in Ezeiza with an investment of US$22 million and with a production capacity of 30 million liters per year and regional operations.

It was also one of the first YPF partners in Vaca Muerta and both are currently developing the La Amarga Chica Block, with an initial investment of $550 million.

“What we are going to announce in the afternoon is the possibility of turning Argentina into a player in the global gas market, taking into account the country’s potential in terms of energy resources,” González pointed out this morning during a talk on energy at the Museum of Latin American Art in Buenos Aires (Malba).

Industry sources say that YPF increased its large market share due to the lack of supply from stations without a flag.

Industry sources say that YPF increased its large market share due to the lack of supply from stations without a flag.

He stressed that “Petronas is one of the most important companies in the world in terms of hydrocarbons, it is the third largest producer of LNG globally, it is active in 50 countries and in 17 with LNG and there is a partnership with YPF since 2014.”

“If we are here, with these developments, it is because in 2012 the YPF Recovery Law and the framework for the development of hydrocarbon investments were sanctioned,” said González, who remarked: “We have been working on this project for two years. almost US$ 10,000 million in a first stage that involves extraction, transportation and production. It should be a State policy.”

Furthermore, he underlined that “Petronas, a great actor at the international energy level, today is trusting in Argentina”, and pointed out that “he has known YPF and the country for eight years and today he is investing again.”

A report on the potential of LNG in Argentina by FundAr revealed that this type of resource is expected to dominate international exchanges by 2030 and predicted that 77% of the growth in global natural gas exchange until 2040 will be carried out via LNG. .

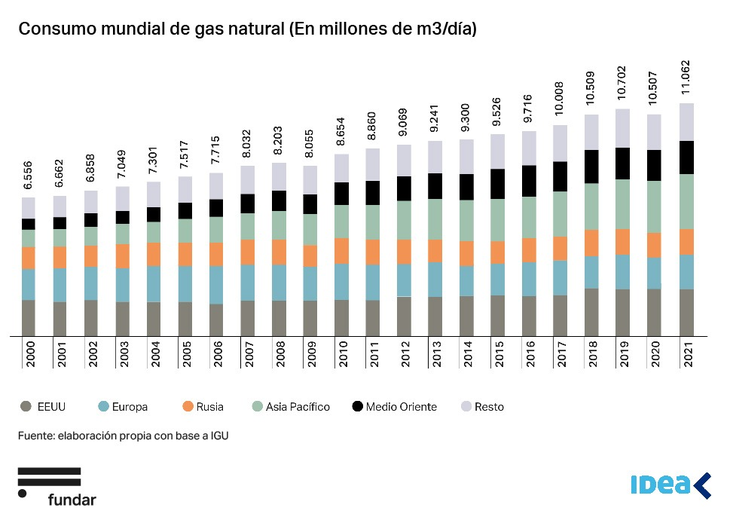

Likewise, the study accessed by Ámbito indicated that the international demand for natural gas has increased greatly over the last decades and it is estimated that it will grow even more due to the role of this resource in the energy transition. Between 2001 and 2021, the annual growth of gas consumption was 2.6% on average, and that of its international marketing, 4.1%.

image.png

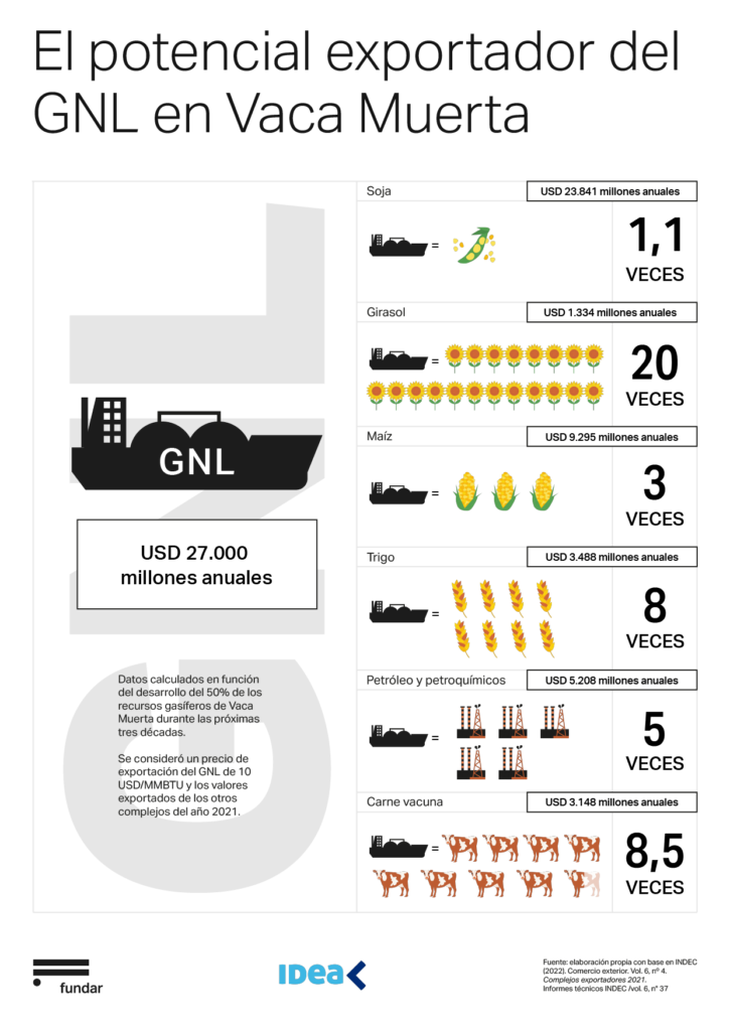

This context presents a unique opportunity for the high level of gas resources in our country to be used to supply world demand, but action must be taken now, before the demand for fossil fuels decreases significantly due to the energy transition. . The opportunity became more acute over the last year as a result of the war between Russia and Ukraine, which more than doubled the price of LNG.

Daniel González, the executive director of IDEA, and researchers from FundAr Nicolas Arceo and Guido Zack assured that LNG is “a unique opportunity for the high level of gas resources in our country to be used to supply world demand”, but they recommend acting now, before the demand for fossil fuels decreases significantly due to the energy transition. “The opportunity has become more acute over the last year as a result of the war between Russia and Ukraine that more than doubled the price of LNG,” they underlined.

image.png

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.