And he added that in the eight accumulated months of the year, 286,489 units were patented, 4.1% more than in the same period of 2021, in which 275,303 vehicles had been registered.

car dealership 2022.webp

However, a dilemma that arises for the consumer who does not have all the money in cash to make the good has to do with how to finance himself and in that sense, the most common options are two: collateral loans or savings plans. But, which is more convenient today in the inflationary framework that exists in Argentina?

In this sense, analysts consulted by Ambit They gave an account of the pros and cons of each.

“It depends on the evolution of relative prices that one expects in a context of very high uncertainty in which it is very difficult to make forecasts. If you expect the price of 0 kilometer cars to grow at a rate higher than the rate of inflation given by a pledge loan, you should go for that option. Today the uncertainty is very high, but there are many seasonings to expect that the prices of 0 kilometer cars will grow well above a general level that outlines above 100% in a short time. It depends on the rates, the bank promotions and the price at which they are charging you for the car given the different forms of financing”, he analyzed Federico MollEcolatina economist.

And he added: “It is very complex to make decisions in an inflationary context. But all this must be taken into account when making a decision. The risks are highly centralized in the possibility of a savings plan as it is tied to the price of new cars”.

In his turn, the director of the consultancy firm Focus Market, Damian DiPace, told this medium: “The pledge loan generally has a term of up to 60 months and finances up to 80% of the value of the vehicle. It has fixed rates and a French amortization system. The conditions of these loans is that the income share ratio is 40%. The rates are in the order of 70% with an annual effective rate of 95% and a total financial cost above 100%. They are above future inflation in the order of 26%. It would seem that if someone has income of that value, it does not seem to be that much.”.

Meanwhile, he considered: “On the other hand, the big problem with the savings plan is the lack of units. As the savings plans adjust for the list value of the unit, given the scarcity of vehicles, it will be worth more and more. Between one and the other, I would say that the pledge loan could be more convenient than the savings plan”.

It should be noted that the savings plan generally enables paying a car in installments for 84 months in groups with another 100 or more consumers who receive their vehicles a couple per month, either by lottery or by tender. Later, when a buyer receives the good, he is pledged.

With regard to fees, these are variable and are recalculated every month by dividing by 84 the updated price of the zero kilometer car. The pace of the increases will depend on the automaker’s increases in the updated value of the vehicle.

In contrast, pledge loans, which are granted primarily for the purchase of 0 km or used vehicles, work as follows: the asset acquired from the financing, in this case a car, is “pledged” in favor of the entity that grants the credit as a guarantee, until its total cancellation. During this period, the borrower is prevented from selling the vehicle until all the installments are paid.

Boom in collateral loans

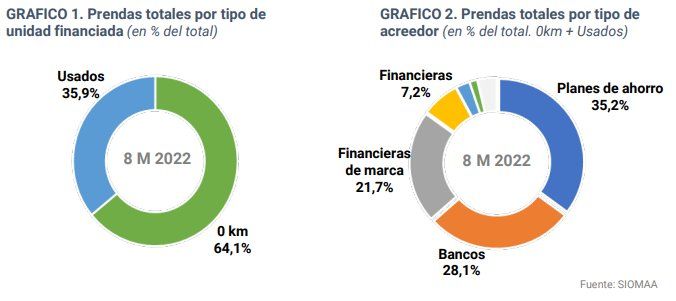

In August, 22,570 garments were registered whose asset is a vehicle. Almost two thirds of that amount corresponds to garments over 0 km and 35% was channeled through Savings Plansaccording to the latest ACARA report.

financing Acara pledges.PNG

In this sense, the figure for August is very similar to that of last July, although last month the operations with used had an improvement and those associated with 0 km vehicles were less than those of a month ago.

Even so, the figures reached this year are higher (in units) than those of the same period in 2021. Garments over new and used grow in the year-on-year comparison (August vs. August) and also in the accumulated.

Last month, more than 12% of all purchase transactions in the automotive market were made with some type of financing instrument, according to ACARA.

pawns acara 2.PNG

“Garments over 0 km units remain in the order of 36.5% of patents, a figure slightly lower than the average for the year and very close to the 2021 average, which in itself is good news considering the context of rates high and prices adjusting almost to the rate of inflation (which has a direct impact on savings plan fees)”, highlighted the entity.

Meanwhile, according to data from First Capital Group, the pledge credit line presents a portfolio balance at the end of August 2022 of $398,697 million, which shows a growth of 128.6% versus the portfolio at the end of the same. month of 2021, of $174,379 million, widely exceeding year-on-year inflation, ranking first in growth among loan lines.

“The variation with respect to the balance of the previous month marked a rise of 6.2%, accumulating two years of consecutive monthly increases”, they highlighted.

How to buy a car with pledge credit and what each bank offers

Santander Bank:

The pledge business has a financing offer to assist 3 large groups by destination of the goods: Light (Cars + Motorcycles); Utilities, Trucks and Other Goods and Agricultural Machinery.

Cars and Motorcycles:

-Maximum credit amount: $6 million.

-Antiquity: Cars, up to 13 years. Motorcycles, up to 5 years.

-Traditional Rate: 73% – 78% (according to term) and UVA Rate: 12.50%

-Term: 12 to 60 months (FIXED) and 12 to 48 months (UVA)

-Requirements: Declarative income and DNI.

-Commission for early cancellation: 5% + VAT.

HSBC Bank:

-Types of vehicles that can be financed: Units 0 km and Used up to 10 years for vehicles with Auto and Pick Ups segmentation. For light trucks up to 6tn for units 0km and used up to 5 years.

-Maximum credit amount: Without proof of income up to $7,000,000 and with proof of income up to $10,000,000.

-Rate: Currently the rate for 0km vehicles in 60 months is 58% and for Used vehicles 64%.

-Term: Financing from 12 months to 60 months, both for 0km and Used units up to 10 years old

-Requirements: DNI, Service in the name of the Holder, do not register unfavorable records in BCRA – Veraz – Internal control bases

-Commission for early cancellation: 5% on the Capital Balance before completing ¼ of the original term, rest of the term without charge for advance commission.

Credicoop Bank:

At Banco Credicoop, companies have different service channels to be able to find out about and process their credit with collateral, both on our website through agreements with suppliers of capital goods, as well as in our network of subsidiaries distributed throughout the country. the country.

“Within the framework of the productive investment line, renewed by the BCRA for the October 2022-March 2023 semester, surely loans with collateral intended to finance mainly machinery and vehicles of national origin will have an important participation. These lines collaborate in the development of SMEs, generating improvements in their competitiveness through the incorporation of capital goods and technological solutions.“, said to Area Alejandro SchachterCorporate Banking Manager at Credicoop.

And he added that, in terms of the characteristics of the loans, they have a wide credit offer that adapts to the destination and type of good to be acquired, “counting for this with lines of credit of up to 60 months, fixed, variable or mixed rates. and with different attributes depending on the needs and characteristics of the companies”.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.