“The summary of the survey shows that 2022 had a good level of sales and acceptable profitability, and one of the highest points in the series in terms of installed capacity, but 2023 will be more difficult, a greater impact is seen on expectations of profitability and a decrease in investmentsaid Pablo de Gregorio, from EY, before an audience of more than 100 executives at the Alejandro I hotel in the capital of Salta.

One of the factors that will affect investments is the sources of financing. “The companies use the parent companies, suppliers or reinvestment of profits and little from third parties for the long term, so there will be a decrease in investments in 2023,” added De Gregorio. In fact, 26% of companies finance their projects with banks, the lowest value in the last 5 years, only behind 2020. In 2018, that number was 40%. While currently 31% of financing sources arise from self-financing and 17% from suppliers.

In the opening speech, Marcelo Fell, president of the IAEF, was critical of the last governments: “We have been worrying about the same thing for decades, inflation, deficits, lack of currency, unemployment, and due to the lack of clear rules, which are not permanently modified in accordance with the short-term needs of the authorities on duty”. He stated that it is this “uncertainty” that functions as “determining factor for all those potential investors, local and foreign, large corporations and SMEs”. Finally, he added: “You cannot live in a context in which the change of rules is a habitual fact.”

investments.png

Sales, profitability and investments

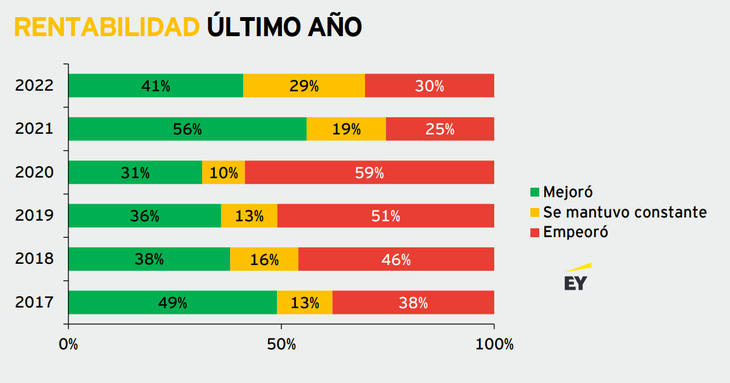

The number of companies that had a growth in sales was 71% in the last year. The highest previous data had been 2015 (75%). Profitability increased for 41% of companies, and remained constant for another 29%. For 1 out of 3 companies, profitability worsened, being the second lowest value in the last 6 years. Regarding investments, in 43% of the companies they increased compared to the previous year. The investment plan was focused in 59% of the cases on fixed assets and the incorporation of technology, the lowest figure since 2018.

However, expectations worsen for 2023. When it comes to sales, 63% of companies believe they will increase. The year of greatest optimism had been 2018, when 89% projected that sales would grow. As for next year’s profitability, the projections are even more pessimistic: only 1 in 3 companies expect to improve profitsthe highest number had been in 2017 (73%).

profitability.png

Regarding investments, 41% of firms plan to grow next year, and 50% believe they will remain constant. In 2017, the year before the devaluation began, 81% of companies planned growth in their investments, a figure that was reduced by almost half in the following years. Asked what State policy could improve competitiveness and facilitate the investment plan, more than half (51%) opted for tax simplification, and 23% in Government-union-company agreements. As for what specific measures could favor confidence to invest, they lead a clear economic plan (30%) and a stable exchange rate policy (26%).

country project

The executives voted that they believe that the sectors that have the greatest potential for the coming years are agriculture and energy, while others, such as infrastructure, believe that they will fall. When asked where the investment should be focused to achieve a “successful country”, more than half (51%) voted to be a supplier of food to the world, and to be a leader in the export of unconventional gas. Fell, the president of the IAEF, called on executives to get involved in order to get out of the “long vicious circle to definitively enter a virtuous one.”

Asked about the global trends that most affect them, the main answer in 30% of the cases was: the advance of populism or extreme nationalism. Then followed the rise in commodities and global inflation.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.