This has led to several upward revisions to growth this year. For Latin America and the Caribbean, the Fund now projects a growth of 3.5%, half a point more than the previous forecast, corresponding to last July.

But economists warn that “Financing is increasingly scarce and expensive as major central banks raise interest rates to tame inflation.”

Capital inflows to emerging markets are slowing and borrowing costs are rising. In turn, domestic interest rates in emerging markets are also rising as their central banks raise rates to combat inflation and in response to lower investor appetite for risky assets.

These factors, they predict, will result in “a slowdown in activity” in Latin America as higher financial costs will weigh on domestic credit, private consumption and investment.

It is also recalled that the highest interest rates in the international market are putting downward pressure on commodity pricesconsequently affecting exporting countries.

It is pointed out that the uncertainty about the future of interest rates and about whether it will be possible to control inflation in a “soft” way (soft landing) supposes the possibility of increases in market volatility and greater risk aversion of investors. . In other words, the document warns that “The transition to a scenario of higher global interest rates may be bumpy.”

Given this change in external conditions, it is expected that the region is expected to slow its growth to 1.7% next year. In this way, the exporting countries of South America, Mexico and some of the Caribbean would see their expansion reduced to the half. This is the case of Argentina, since the Fund expects growth to be 2% next year, against 4% this year.

Inflation

Despite the slowdown in growth, economists at the IMF believe that “stubborn inflation” will continue for some time. It is considered that the rise in interest rates arranged by the central banks of the region will help contain the indices, but this will take time until it has an impact on containing domestic demand and causing downward pressure on prices.

The cases of countries such as Brazil, Chile, Colombia, Mexico and Peru where inflation recently reached highest levels in two decadesof 10% per year.

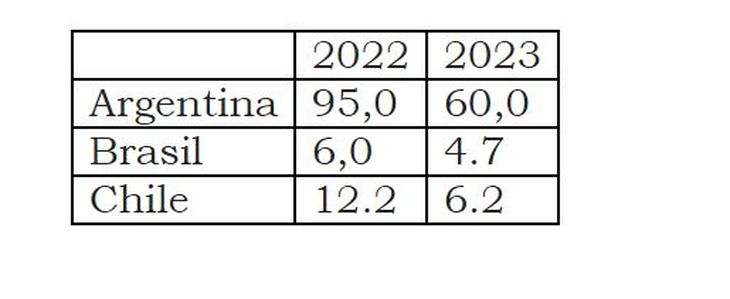

The IMF estimates that By the end of the year, inflation in these five countries will reach around 7.8% and will be around 4.9% by the end of 2023.. For Argentina, the projections coincide with those included in the budget proposal: 95% for this year and 60% for the next.

In general, the banks of the region show a situation “healthy” that mitigates the risks of financial stress, but some vulnerable aspects are observed. For example, it is evaluated that corporate debt “has grown considerably in the last decade, especially outside the banking system”from where monitoring these vulnerabilities is considered key to identify possible sources of tension and take preventive actions.

The document concludes that political priorities must go through “reestablishing price stability and maintaining fiscal sustainability while protecting the most vulnerable sectors.”

growth forecasts

Capture.JPG

inflation forecasts

Capture3.JPG

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.