The value of a studio apartment in CABA is US$96,269. On the other hand, a two room apartment with 50 m2 has a value of US$116,307 dollars. While an apartment with three rooms and 70 m2 reaches US$163,740.

sale prices zonaprop.PNG

According to the real estate portal report, In October, 85% of the neighborhoods registered a drop in price, however, the number of purchase and sale operations in the City of Buenos Aires shows a reactivation in the market compared to the previous year. In September of this year, the volume of deeds was 15% higher than the volume of 2021.

Why are property prices falling?

Hernan Perronereal estate broker responsible for RE/MAX told Ambit: “Prices go down because we currently have a record of properties for sale. Never before were there so many properties for sale in the Federal Capital and it continues to accumulate month after month because only 2% of everything for sale in the city is sold and the number of buyers is not increasing”.

In this sense, he affirmed that the one who has the need to sell has to lower the price until the person who is willing to pay the value appears.

“Today the price is set by the buyer, who is the one with the power to negotiate. In addition, the operations are being carried out 99% in cash, without mortgage loans, with which the buyer is the one who has the money to invest and wants to make it count.”, he highlighted.

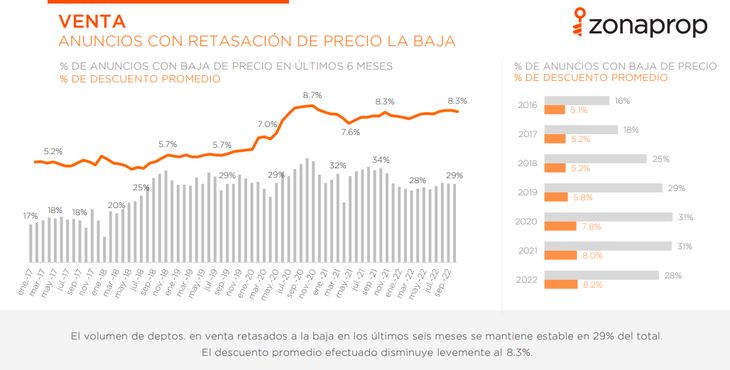

reassessment zonaprop.PNG

Asked if prices can continue to fall, he said: “I think that prices will continue to decline until there is economic stability, where the course of where we are going can be set, if there are going to be credits at some point or not. and it will also depend on inflation. If inflation doesn’t stop, there will be no credits, without credits there are no buyers and, if there are no buyers, prices tend to keep going down”.

“It is true that, in recent months, since September and October, a greater demand has been seen in consultations that are transformed into visits and then these visits in reservations and sales closings. However, it is a seasonal situation, this usually happens in the last quarter of the year. In the case of the current market, cWith a dollar that has been relatively stable for a while, people take it as a reference price to go out and buy”, he assured.

For its part, Jose Rozadosfrom Reporte Inmobiliario, stated: “The reduction in prices arises from the need to adjust an initial overvaluation, which some brokers admit to capture the property”.

Prices by neighborhoods

According to Zonaprop, the ranking of prices by neighborhood is headed by Puerto Madero ($5,594/m2), Palermo ($2,948/m2) and Belgrano ($2,767/m2). While the cheapest neighborhoods in the city are Lugano (1,057 dollars/m2), Nueva Pompeya (1,428 dollars/m2) and La Boca (1,514 dollars/m2).

In this sense, they highlighted that except for Montserrat and Puerto Madero, all the city’s neighborhoods registered year-on-year declines. Mataderos and Parque Avellaneda are the ones with the greatest drop.

How much does it cost to rent in CABA?

According to the survey of the real estate portal, currently, Puerto Madero is positioned as the most expensive neighborhood in the City of Buenos Aires with an average price of 155,803 pesos per month. They are followed by Palermo and Nuñez with 100,859 and 100,219 pesos per monthrespectively.

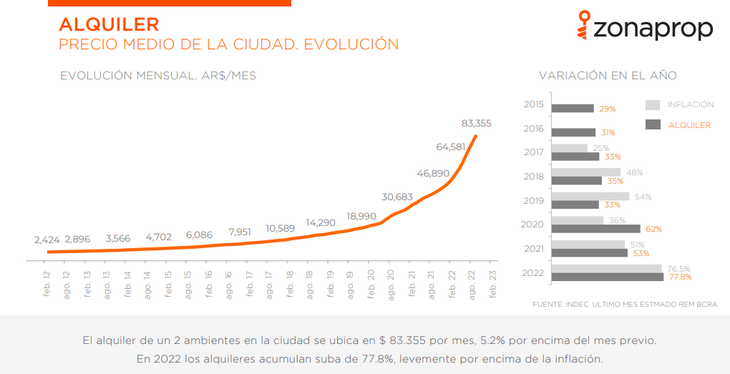

rentals zonaprop.PNG

In the middle zone are Villa Pueyrredón (82,400 pesos per month), Caballito (78,396 pesos per month) and Boedo (76,626 pesos per month). The cheapest neighborhoods to rent are Villa Luro (67,330 pesos per month), Barracas (67,771 pesos per month) and Floresta (67,873 pesos per month).

In the month of October, the increase was 5.2% and in 2022 they accumulate a rise of 77.8%, above inflation (76.5%).

According to the Zonaprop report, the rental value of a studio apartment in CABA is 69,460 pesos per month, a two-room apartment costs 83,355 pesos per month, and a three-room unit with 70 m2 is rented for 112,281 pesos per month.

Real estate profitability rises compared to the previous month

The rent/price ratio increased slightly in October and stood at 4.07% annually. In other words, 24.5 years of rent are needed to recover the initial investment. This value is 25% below what was required a year ago.

La Boca and Villa Miter are the best neighborhoods for investors looking for rent as they have an average return of 5.3% and 5.0% per year, respectively. On the contrary, Puerto Madero and Villa Luro are the ones that generate the lowest profitability (3.1% and 3.6%).

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.