“The trend has been going down systematically for years. The drop (in the capacity to save) is explained by the fall of the middle sectors that saw their situation aggravated by the inflationary processes,” he explains. Augustine Sagedirector of the ODSA.

Since 2010, the country’s savings capacity has plummeted. In that year it registered 13.9% and began to fall, except for a peak of 15.9% in 2011. Since then it could not recover and reached its lowest level with 8.3% in 2020 during the peak of the pandemic from Covid-19.

UCA1.jpg

ODSA UCA

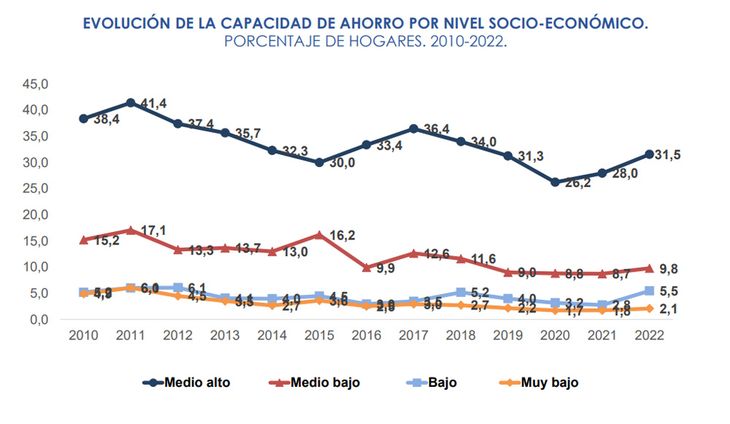

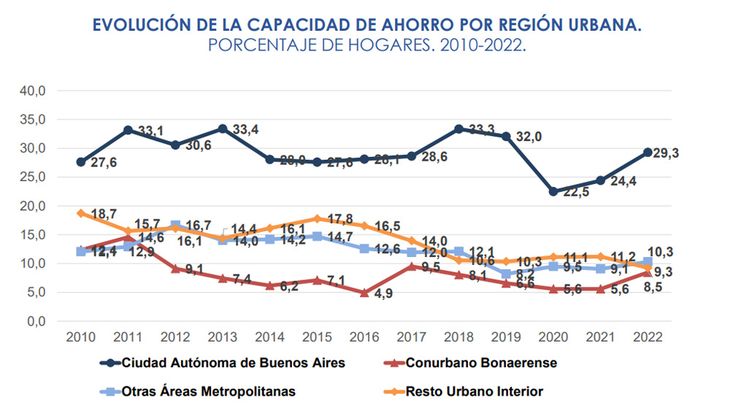

“Decreases in the capacity to save are observed, end to end of the period, in the different sectors of the social structure,” the report clarifies. It is that among households of low or marginal stratum, the declared saving capacity is significantly lower, the same as those in the low and very low socio-economic levels and in the Buenos Aires suburbs.

The inequalities are maintained throughout the period and are complementary to the macro data disseminated by the UCA: poverty reached 43.1% of the population in the third quarter and indigence at 8.1%. The data also shows that poverty hits more in Greater Buenos Aires.

Has the ability to save improved?

UCA2.jpg

ODSA UCA

The increase in the saving capacity in the last year is due to a certain improvement in the sectors with greater purchasing power. In the lower sectors, savings are almost nil and it is a structural fact. “The differences in the saving capacity are maintained, which is higher in the highest sectors”, complete Salvia.

The study indicates that the recovery of the saving capacity is concentrated in the highest strata: medium-high socioeconomic level, professional and non-professional medium strata, and in households located in the City of Buenos Aires.

“Except for the post-pandemic, the trend tends to rise, but mainly due to the professional middle classes that had an increase in the context of high inflation”complete.

UCA3.jpg

ODSA UCA

According to the UCA sociologist, in this segment of the population the income capacity is guaranteed and therefore they were able to cover part of their needs and managed to have the rest. “There was an increase in savings so that there was no degradation of their monetary assets. The syndrome of either consume it or save it is well known”.

Although the study did not ask about the savings made by those surveyed, Salvia recalls the increase in fixed terms in this period and the always desire for Argentine dollars.

X-ray of savings

UCA4.jpg

ODSA UCA

In the upper middle sectors in 2022 the saving capacity reached 31.5% and marked a jump from 28% the previous year. The highest mark was in 2011 when it was located at 41.4%.

The lower-middle class had a much more moderate rise, going from 8.7% to 9.8% in one year. The low sectors grew strongly as a result of the social plans and the very low sectors remained almost unchanged.

As Salvia pointed out, the professional middle class rose to 41.6% from 39% and the non-professional middle class went from 13% to 15.4%. The other sectors had more marginal increases.

Regarding the geographical location, the largest volume of savings was concentrated in the City of Buenos Aires and in the other pole was the Buenos Aires suburbs

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.