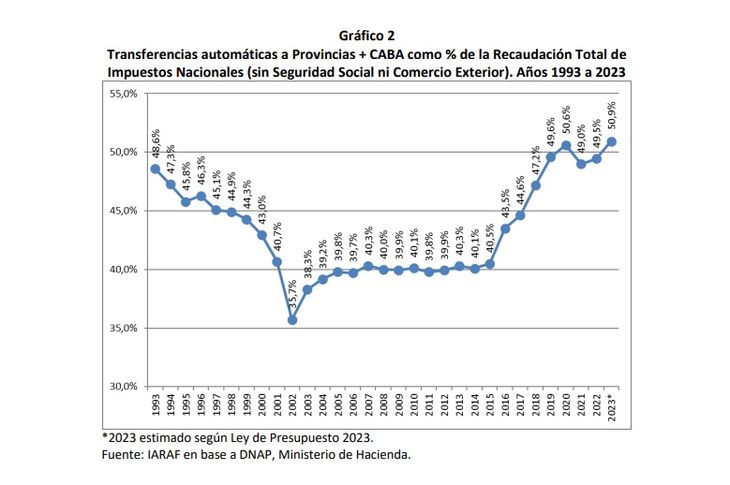

Clarifies that the primary distribution quantifies “What percentage of the national tax collection went to the hands of the 23 provinces and CABA in the last 30 years, considering the recent resolution of the Supreme Court of Justice regarding CABA”.

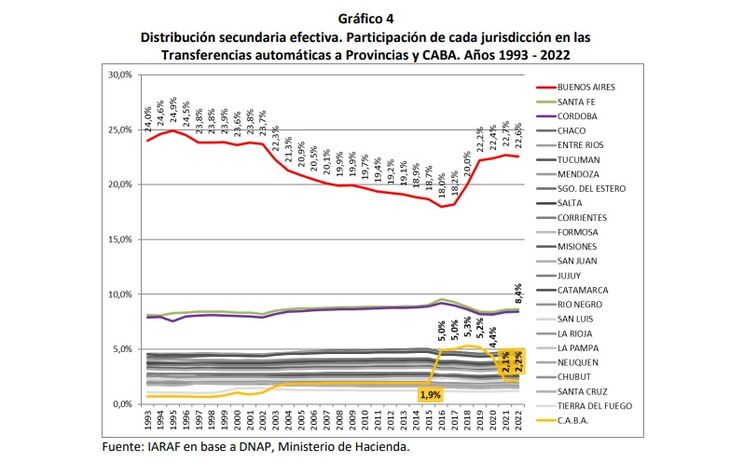

The quantification of the secondary distribution allows to set “the effective percentage of resources that went to each of the jurisdictionss in each of the years of the period analyzed, in relation to the total amount of resources distributed to the Provinces and CABA”.

In this scenario, the report analyzes in different sections the evolution of the distribution of resources since 1993.

Evolution of the effective primary distribution of resources 1993-2022

“Argentina is a politically organized country with a federated structure.he. The tax sharing system currently in force is based on Law 23,548 of the year 1988 with its amending and complementary laws, which are permanently subject to debate as long as they are not based on objective bases to establish the distribution of resources, at the same time that by constitutional mandate of the 1994 reform they should have been replaced in 1996 by a new institutional arrangement”, they point out from the IARAF.

In this framework, he adds, the distribution of resources between the national level and the provinces is called primary distribution, while the distribution of the funds that falls to the provinces among the jurisdictions themselves is called secondary distribution. “In both cases, considered individually, it is about ‘zero sum games’, that is to say that in the primary distribution everything that the provinces gain from participation will be resigned to the federal level (and vice versa), and in the case of the distribution secondary, the increase in the participation of a jurisdiction can only occur if the portion that takes the rest falls”, he detailed.

“A particularity that goes to the heart of the distribution debate is the case of CABAwhich, however, is considered as a member of the group, obtains its co-participation percentage from the legal participation of the National Treasury, so that everything that happens legally with CABA (such as the current increase in its coefficient of 1 .4% to 2.95% established by the Supreme Court as of 2023) affects both the effective primary and secondary distribution”, they explained from the organization.

graphic 1 iaraf.jpg

Initially, Law 23,548 established that the total of co-participating resources is distributed in 42.34% for the Nation, 56.66% for provinces and 1% for a National Treasury Contribution Fund (ATN) whose destiny was to deal with emergency situations and financial imbalances of the provincial governments.

In any case, the report highlights how the provinces were losing primary participation during the 1990s. “This is due to the introduction of a large number of laws and decrees of the national government that directly or indirectly modified what was established by the regime basic”, they explain.

“From 2003 to 2015 there is a stabilization of the participation of the Provinces and CABA on the taxes collected at the national level in around 40%, a situation that changes in 2016. First, the national government decided to gradually restore the pre-participation to the provinces (Santa Fe, San Luis and Córdoba stopped making the deduction at the end of 2015), in an amount of 20% per year, reaching the return full of the 15 points in 2020”, maintains the study.

“Second, through Decree 195/2016 se CABA’s coefficient was increased from the 1.4% established in 2003 to 3.75%, which after the Fiscal Consensus was reduced to 3.5% in 2018. Since 2018, and also as a result of the fiscal consensus signed between the Nation and the provinces, the gross co-participating mass was increased, by incorporating, on the one hand, the funds from the suspension of specific deductions from profits for ANSES and for Funds (Conurbano and NBI), on the other hand, the result of the establishment of a compensation system to prevent the provinces (except Buenos Aires) from seeing their situation change compared to 2017”, it was highlighted.

This led to in 2020 the participation of the Consolidated Provinces plus CABA in national tax collection is the highest in the last 29 years. Finally, at the end of 2020, the Autonomous City of Buenos Aires had a change in the primary coefficient of distribution of national resources, which, in effect, was a drop from 3.5% to 1.4%.

Evolution of the effective primary distribution of resources: 1993-2023

At the end of 2022, the Supreme Court of Justice issued a precautionary measure ordering CABA to deliver 2.95% of the mass of co-participating funds and logically withdraw the funds it obtained through the Treasury Obligations account to finance the expenditure of the security force.

graph 2 iaraf.jpg

“CABA receives its co-participation of funds from the National Government, so this increase in its distribution coefficient is an increase in funds for all the Provinces and CABA. It is for this reason that in 2023 it is expected that the effective participation of automatic transfers to Provinces and CABA as a percentage of total national collection (without social security and foreign trade) will increase by 1.4 percentage points compared to that of 2022. and reach the maximum of the last 30 years, since it slightly exceeds the participation of the year 2020, ”explained the study.

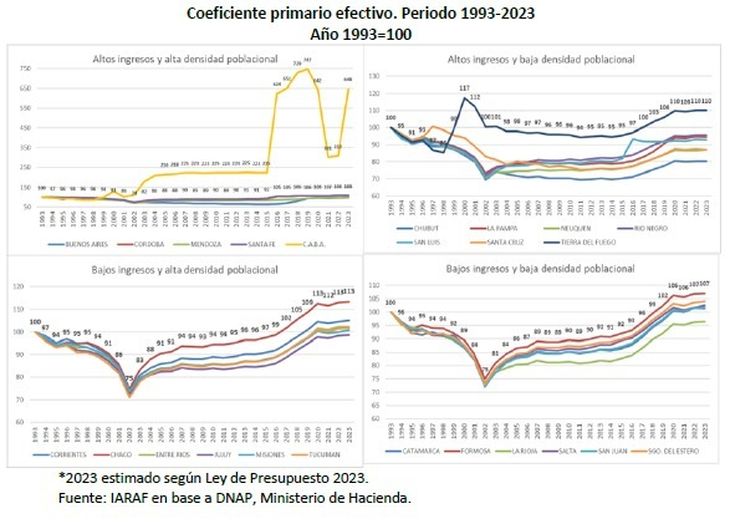

In order to observe how the effective primary coefficient of each jurisdiction evolved with respect to the base year (1993), the study groups the 24 national jurisdictions based on average income and population density, obtaining four homogeneous groups:

- High income and high population density (AIAD): made up of Buenos Aires, the Autonomous City of Buenos Aires, Córdoba, Mendoza and Santa Fe.

- High income and low density (AIBD): Chubut, La Pampa, Neuquén, Río Negro, San Luis, Santa Cruz and Tierra del Fuego.

- Low income and high density (BIAD): Chaco, Corrientes, Entre Ríos, Jujuy, Misiones and Tucumán.

- Low income and low density (BIBD): Catamarca, Formosa, La Rioja, Salta, San Juan and Santiago del Estero.

graph 3 iaraf.jpg

From the analysis of the index of effective primary coefficients, It is concluded that only ten of the twenty-four jurisdictions have increased their effective primary coefficient in recent years with respect to the base year.

CABA was the one that presented the highest growth (548% compared to the base year), followed in the ranking by the provinces of Chaco (13%), Tierra del Fuego (10%), Santa Fe (8%) and Córdoba (8% ). It is also observed that Catamarca and Misiones are in a situation similar to that of the base year.

On the other hand, the provinces that saw their effective primary coefficient decrease compared to 1993 were: Chubut (20%), Neuquén (13%), Santa Cruz (13%), San Luis (7%), La Pampa (5% ), Rio Negro (4%), La Rioja (4%), Buenos Aires (2%), Mendoza (2%) and Jujuy (1%).

Evolution of effective secondary distribution during (1993-2022)

Having defined the evolution of the automatic resources sent by the national government to all the Provinces and CABA, it is possible to deepen the analysis of the distribution between provinces and CABA, that is, in the secondary distribution.

graph 4 iaraf.jpg

In this analysis, the participation of the province of Buenos Aires stands out due to its variable evolution. “In the three years after the implementation of the Buenos Aires Conurbano Fund in 1992, its effective secondary coefficient (that is, the participation actually received of the total automatically sent to provinces and CABA) was close to 25%.. With the cap of $650 million set for such a fund in 1996, participation stabilized at just under 24% until 2002,” the study detailed.

“The failure to update this cap in an inflationary economy such as that of the following years led the secondary participation of the province to fall year after year until reaching the historical minimum in 2016 (18%),” he added.

“A jurisdiction that drastically increased its secondary participation in 2016 was CABA, which saw its percentage of effective secondary distribution increase by more than 3 percentage points (from 1.9% to 5%), due to the modification through Decree 194/2016 of its primary coefficient, which went from 1.4% to 3.75% and, after the Fiscal Consensus, in 2018 it was established at 3.5% of co-participating funds. In the year 2021, CABA registered a reduction of 2.3 percentage points of its secondary participation, due to the fact that its primary coefficient decreased to 1.4%”, it was highlighted.

“From this perspective, It can be concluded that Buenos Aires and CABA were the jurisdictions that had the most changes in secondary effective participation in the last 29 years. Buenos Aires obtained in 2022 an automatic effective participation of 22.6%, that is, 2.3 percentage points less than the maximum participation reached in 1995. CABA, for its part, obtained in 2022 an effective secondary participation of 2.2 %, that is, 3.1 percentage points less than the maximum reached in 2018”, he concluded.

Evolution of effective secondary distribution (1993-2023)

By including the estimates of the funds sent automatically by the Nation for the year 2023, CABA, as a consequence of the precautionary measure ordered by the Supreme Court at the end of 2022, in the year 2023 would once again increase its secondary coefficient to levels prior to 2021.

“At this point it can be concluded that Buenos Aires and CABA were the big winners of the distribution during the last eight years. This recovery obviously led to a decrease in the secondary participation of the other jurisdictions. While 22 jurisdictions would have a percentage participation reduction, CABA and Buenos Aires would increase it,” the study detailed.

“CABA would see its effective percentage increase by 128.8% between 2015 and 2023, since it would go from 1.9% in 2015 to 4.4% this year, 2023. Buenos Aires would register an increase in its effective percentage of 19, 7%, since it would go from 18.7% in 2015 to 22.4% this year, 2023. More proportional money for Buenos Aires and CABA allowed these jurisdictions to increase their participation in the pie that means the funds sent to the Provinces and CABA, the percentage participation of the rest falling. Of the 22 remaining jurisdictions, all with a drop in their percentage participation, Santa Cruz, Chubut, Neuquén and San Luis stand out, with a drop of between 9% and 10%,” the report concluded.

Source: Ambito