The funds come 49% from the Inter-American Development Bank (IDB), 20% from the International Bank for Reconstruction and Development (BIRF), 14% from the Development Bank of Latin America (CAF) and 14% is credit. bilateral.

box.jpg

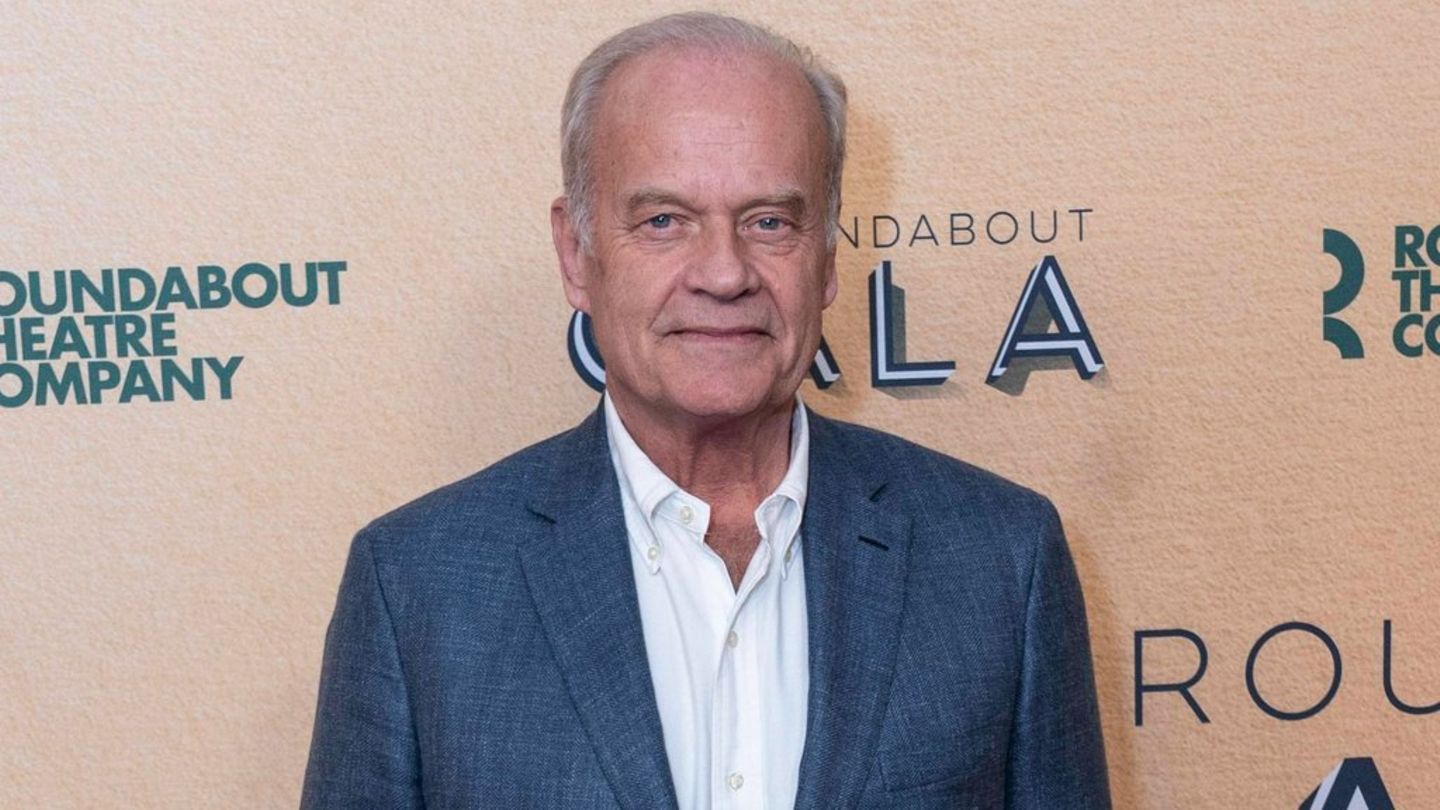

An achievement of the Massa management

They also noted that “there is a acceleration of disbursements as of August of last year”, since 77% (almost US$4,000 million entered between that month and December).

The date coincides with the beginning of the management of Sergio Massa as Minister of Economy. Thus, the official would be fulfilling one of the goals that he announced the day he took office, on August 3 of last year, since that day he had communicated a series of measures aimed at strengthening the Central Bank’s reserves and one of They were the agreement to execute disbursements for US$1.2 billion by international organizations for current programs and others under study, and the announcement of a new program with the Development Bank of Latin America, CAF, with a disbursement for an additional US$750 million.

It should be remembered that the reserve target agreed with the International Monetary Fund (IMF) includes income from international organizations, many of which were delayed and the new minister proposed to expedite them.

The REPO: the pending issue

Massa traveled abroad several times and met with different authorities from credit agencies and he dedicated a large part of his work to expediting the arrival of those funds. It seems that he achieved his goal at this point. Now, Massa has to move forward with the negotiation of a REPO with international financial institutions to strengthen reserves and repurchase sovereign debt. That was another of his commitments upon assuming management.

It is worth mentioning that a REPO It is an operation in which one of the parties buys securities from the other and the seller agrees to repurchase them within a specified period for an agreed price called the premium. He is in line with the debt repurchase announcement made by the minister recently and he himself had anticipated the day he took office that he was negotiating four contracts of this type, which would be a strong relief for the Treasury and, therefore, , for the BCRA.

Source: Ambito