Regarding the non-taxable minimums, they are $252,564.85 for the 2022 period and $451,683.19 for the year 2023.

I want to remind you that the deadline for submitting form 572 for the 2022 fiscal period through the service with a fiscal key “SiRADIG – WORKER” will end on March 31, 2023.

Step by step: how to deduct income tax expenses

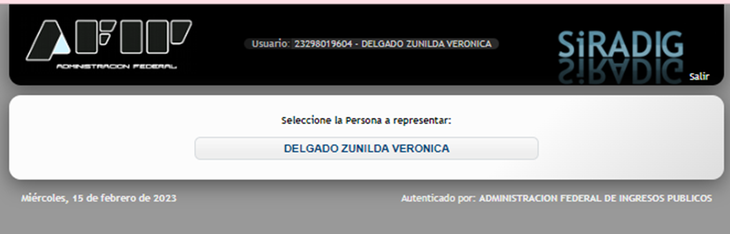

STEP 1: enter the AFIP.gov.ar WEB with your CUIT and tax code and then inside look for the option SIRADIG – WORKER.

image.png

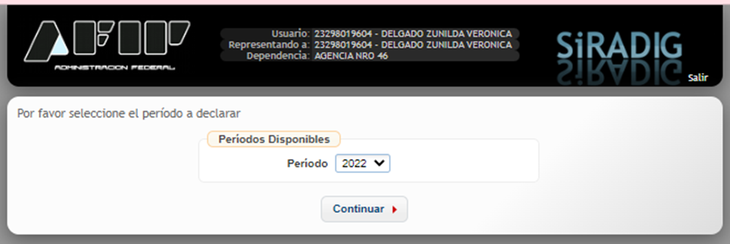

STEP 2: Enter where your name and surname appear and go on to select the year. Period 2022, as indicated by the next two images: Continue!

image.png

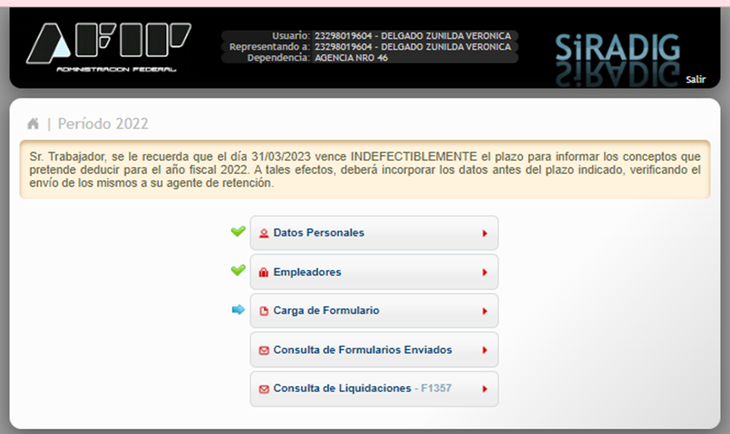

image.png

STEP 3: You must already have your employer’s data loaded. Otherwise, you charge them with the employer’s CUIT, your date of entry and put YES where he says if he is a withholding agent. YOU ACCEPT and it will appear with a blue arrow LOADS FORM.

image.png

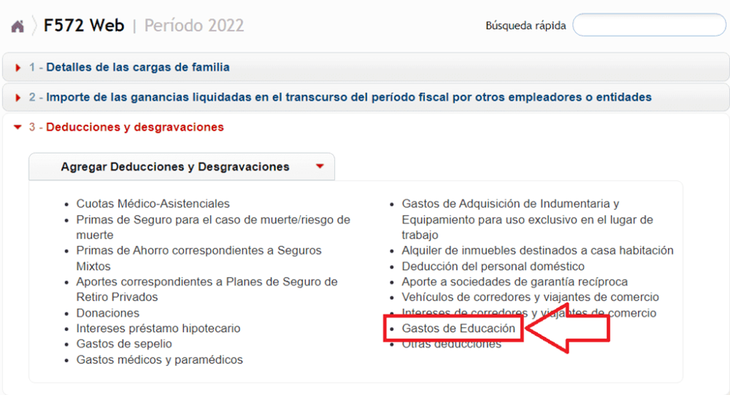

image.png

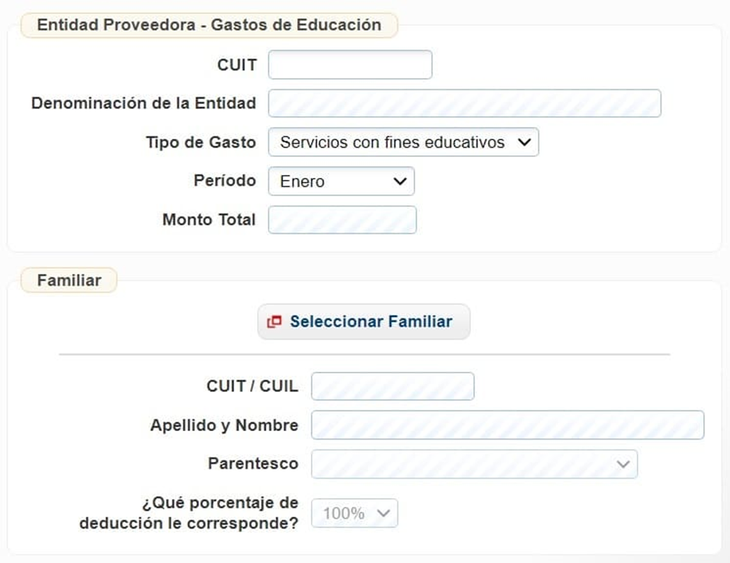

STEP 4: you will see 5 options on the screen and the last one will say settings. You go to option number 3. You open the flap that says ADD DEDUCTIONS AND ALLOWANCES and there, as the following image indicates, you are going to enter “Educational Expenses”

image.png

Then, you must enter the data of the educational entity with its CUIT, which you can obtain from a salary receipt.

STEP 5: After loading the automatic entity that, placing the CUIT appears by default, the expense receipts must be loaded as indicated in the screen below.

image.png

You place the date using the calendar next to the box where it says Date. He invoice typeif it is A, B or C. THE point of sale and proof to find it in the upper right part of your invoice and finally the amount.

At the end of loading the documents of the Educational expenses, You accept and send to the Employer the DDJJ of earnings F572 WEB Siradig Period 2022.

Source: Ambito