The Government published the DNU with the new measures to contain the dollar

He Government made official on Wednesday Decree of Necessity and Urgency (DNU) that obliges public bodies to dispose of their holdings of bonds in dollars to contain the pressures on financial currencies and absorb pesos.

The document bears the signatures of the president Alberto Fernandez and of the ministers Agustín Rossi (Head of Cabinet); Eduardo de Pedro Interior); Santiago Cafiero (Foreign Ministry); Jorge Taiana (Defense); Sergio Massa (Economy); Diego Giuliano (Transportation); Gabriel Katopodis (Public Works); Martín Soria (Justice) and Aníbal Fernández (Security).

Also the signatures of the ministers Carla Vizzotti (Health); Victoria Tolosa Paz (Social Development); Ayelén Mazzina (Women and Gender); Jaime Perczyk (Education); Tristán Bauer (Culture); Daniel Filmus (Science and Technology); Raquel Kismer (Work); Matías Lammens (Tourism and Sports); Santiago Alejandro Maggiotti (Development and Habitat).

With this decision, the State seeks to take pressure off the currency in the midst of a new escalation of the blue dollar. In this way, yese orders public bodies to redeem their dollar bonds under foreign law (global or GD) for instruments in pesos under local legislation.

The total amountit encompasses some US$4,000 million. Besides, proceed with the incorporation of dollar bonds under local law (bonares or AL) in the CCL dollar operation.

One by one, what are the measures decreed by the Government

This Wednesday, Ámbito anticipated the draft of the final document that was finally published on Thursday March 23 in the BO. This battery of announcements was communicated in the morning by the Minister of Economy, Sergio Massato representatives of financial institutions and banks during a working breakfast at the Palacio de Hacienda.

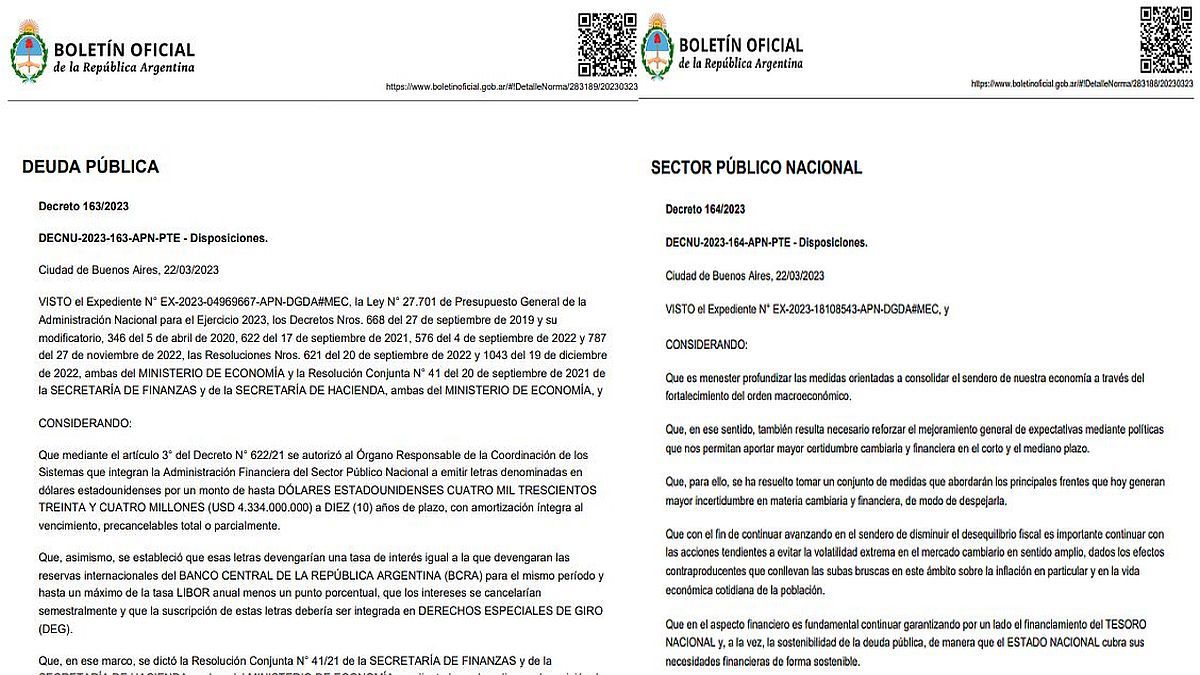

decree 163/2023 mecon bonds

The decree provides:

- Order public bodies to enter the exchange with their bonds in dollars under foreign legislation (global or GD)

- Incorporate dollar bonds under local law (bonares or AL) in the CCL dollar operation to generate depth in the market

- The Ministry of Economy, in coordination with the BCRA, will concentrate the management of the rest of the ALs that were not placed on the market

- Withdraw GD bonds from the market

What is expected to be achieved

According to the fine print of the DNU, the objective is to absorb the excess pesos in the market and contain the pressure on the exchange gap of the dollar. This, they remark from the Ministry of Economy, will allow to contain the inflationthe great problem facing the Government in these months.

What is expected to be achieved

- Allows for the absorption of surplus pesos that otherwise put pressure on inflation

- Manages to reduce debt in dollars with foreign legislation

- Generates instruments to act in the financial dollar market WITHOUT affecting reserves

- The management of these instruments (today disseminated in different Public Sector agencies) is concentrated in the Mecon, in coordination with the BCRA

- Lift some exchange restrictions, as a first step towards a principle of normalization

- It helps to reduce the volatility of the financial dollar market in particular, and of the capital market in general, thus avoiding its impact, among others, on inflation.

- Equates bonds with local legislation (AL) as a benchmark for the financial dollar market

- It continues to consolidate the treasury’s financial program, and

- In this way, we continue on the path of stabilization to overcome the crisis of June 2022.

decree 164/2023 mecon annex 1

decree 164/2023 mecon annex 2

decree 164/2023 mecon annex 3

Source: Ambito