According to the official IMF document, “in the context of an increasingly severe drought, rising inflation and weak reserve coverage, a stronger policy package is needed to safeguard stability.”

“LThe risks of the program are now higher due to the less favorable economic context and the increasing challenges of policy implementation”. In this sense, makes observations on the recent sanction of the pension moratorium, the delay in the segmentation of rates and the repurchase of debt. Submits that the exchange rate is behind and projects rate increases, These are some of the relevant points of the report corresponding to the 111-page staff report released this Monday.

The content you want to access is exclusive to subscribers.

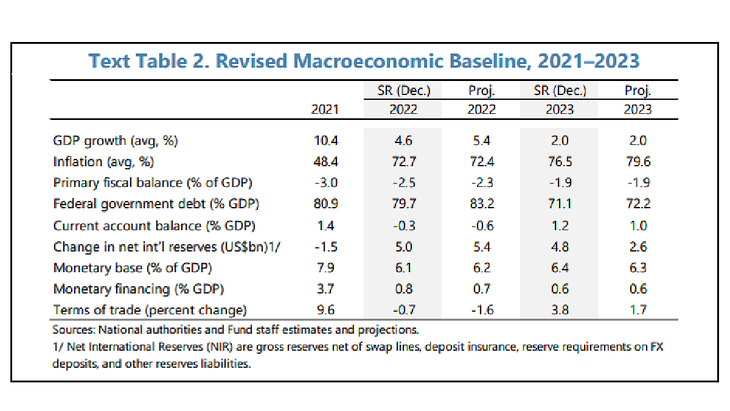

as it was already known reduced the reserve goal by 1.8 billion dollars for the year and it maintained that corresponding to the fiscal deficit at 1.9% of GDP. To meet the fiscal goal, the IMF says that real spending must be reduced by 5%.

Regard To the exchange rate states that it is observed a real overvaluation of between 10 and 25%.

The paper highlights that “the implementation of firmer macroeconomic policies” allowed all the goals for the October-December 2022 period to be met – even with a certain margin. However, it points out that “in the context of an increasingly severe, rising inflation and weak reserve coverage, a stronger policy package is needed to safeguard stability, address setbacks and secure program objectives.”

image.png

The staff report also warns that “While tight macroeconomic policies have largely been maintained, reliance on interventionist policies persists and there have been notable recent policy rollbacks.”

less confidence

- “Since the beginning of 2023, the economic situation has become more challenging, especially in view of the increasingly severe drought. Against the backdrop of large macroeconomic imbalances, the drought is seriously challenging reserve accumulation, adding to inflation and exchange rate pressures.

- Meanwhile, policy implementation it has become less reliable, with recent debt buybacks, energy policy deficits, and congressional approval of a new pension moratorium that undermines reserve accumulation and fiscal consolidation goals.

- A stronger policy package is now needed to address the challenges of the drought, reverse reserve losses and rising inflation, and strengthen the anchoring role of the program. The already high downside risks have increased even further, even given the political cycle.”

Agricultural dollar and import control

- A timetable for its implementation is being drawn up, with initial measures on export promotion coming into force in early April.

- Specifically, the prospective actions will seek: (i) to strengthen the trade balance, through the application of a differential exchange rate for a limited time period (April-June) for:

- a select set of primary exports (including soybeans and other agricultural products), raw materials)

- and imports, especially tourism and transportation services; and

- improve import administration and compliance to limit billing, warehousing, and other irregularities, especially on the services front.

Criticism of the moratorium

- “A new unfunded pension moratorium created additional challenges for consolidation in the medium term. Congressional approval of a new pension moratorium bill in February is likely generate additional pension liabilities of around 0.4 percent of GDP in the medium term, for which additional policy measures will be required to mitigate the impact and maintain the planned fiscal adjustment path. This year’s fiscal costs are much lower and are expected to be absorbed by savings from the social security institute”.

- “Independent estimates put the cost of the moratorium at less than 0.2 percent of GDP in 2023, increasing to around 0.4 percent of GDP in the medium term, assuming the entry of the 800,000 potential beneficiaries into the new scheme.

- Therefore, to address these costs, efforts are being made to issue a decree and implementing regulations (prior action) to guide entry into the moratorium to those with the greatest need.”

- “Measures, which could result in savings of around 0.2 percent of GDP, would seek:

(Yo) ensure strong means verification (based on income and wealth);

(ii) increase deductions from pensions, including through an interest rate structure that increases with the increase in contribution quotas; and

(iii) allow access only to those who have made some contributions to the pension system, are not receiving other social benefits and are giving up access to the official exchange rate”.

rate adjustment

- “In energy, the resolutions to eliminate subsidies for high-income residential users they were delayed to april february.”

- “It is expected that energy subsidies decrease to 1.5% of GDP in 2023, from 1.9% in 2022, while average cost recovery is estimated to improve, reflecting a combination of lower production costs and higher actual rates.”

- “Average wholesale prices for electricityafter remaining constant in 2022, increase between 25 and 35% in real terms during 2023, and high-income residential and subsidized commercial users will see a real increase of 55 to 70%while other subsidized users will see a real decrease of 15-25%.”

- “Average wholesale prices are projected to natural gas (where historical data is sparse) change by an average of [-3-6] percent in real terms, with high-income residential and subsidized commercial users seeing a 40-55% increase, offsetting a 20-25% actual decline for other subsidized users.

- However, average actual rates and cost recovery remain low by historical standards.”

- “It is expected that the supply of domestically produced gas increase by 11 million cubic meters per day once the first phase (of the Néstor Kirchner pipeline) is completed in June, doubling in September once new compressors are installed.

- Greater distribution of domestic gas will reduce dependence on more expensive Bolivian gas and LNG imports, reducing imports by 2,500 million cubic meters in 2023 (US$2,000 million, according to current prices) and by 10,000 million cubic meters (US$6,900 million) in 2024.”

overvalued exchange rate

- The increase in the crawl rate since mid-2022 has reversed some of the previous real appreciation of the exchange rate, although staff assess that the external position remains weaker than medium-term fundamentals and desirable policies imply with an overvaluation of the real exchange rate of between 10 and 25%.

Reserve Goal

- “The net international reserve targets for 2023 are being revised downwards in US$1.8 billion and most revisions will take place in the first half of 2023 to reflect the impact of the drought, estimated at more than US$5 billion after considering lower energy import prices.”

Compliance in the first quarter

- While the quarterly fiscal and monetary financing targets will remain unchanged, more fiscal effort will be needed to offset the impact of lower export taxes.

- Preliminary information suggests first quarter 2023 fiscal targets will be met due to renewed spending controls. “Uncertainties remain, as the most recent data suggests that the severity of the drought could be even greater.”

inflation and growth

- “Addressing rising inflation will be especially difficult given the headwinds of high inflation inertia, the weak central balance sheet (reflecting past liquidity injections), the need for relative price adjustments, and the external challenges posed by the drought.

- As such, Inflation is projected to decline only gradually (from over 6% per month in the first quarter of 2023 to around 4% by mid-2023), although particularly large upside risks remain.”

- The average inflation of 2023 was corrected from 76.5% to 79.6%, while annual inflation is located in a range of 55% to 65%.

- “Higher inflation and much lower growth could fuel the social discontent and undermine support for the program, particularly given the electoral cycle.”

- Regarding growth, the IMF maintains the target of 2%, despite the fact that private consultants are already talking about a retraction of GDP.

spending cut

- Under the original schedule, the primary fiscal deficit is expected to narrow to 1.9% of GDP in 2023 from 2.3% of GDP in 2022.

- Consolidation relies heavily on better targeting of energy subsidies and social assistance, with estimated real spending contracting by 5%, to offset lower export earnings.

Internal financing

- “The recent exchange of bonds successfully extended a significant portion of second quarter maturities beyond the electionparticularly for debt held by banks, while avoiding greater reliance on dollar-linked paper.”

Against BCRA interventions

- “Interventions in the parallel exchange market were renewed with negative implications for reserve coverage. In response to pressures in the foreign exchange market, the Treasury intervened in the parallel market, buying around US$550 million in securities through a debt repurchase operation in January-February.

- These operations have since ceased and short-term external borrowing is no longer considered for these purposes.

positive rates

- “Based on the recent increase, policy interest rates should remain firmly in positive real territoryguided by the improved monetary policy framework, based on real core inflation and forward-looking measures, as well as broader market dynamics and reserves.

price controls

- “Well-designed price and wage coordination, including its recent extension through June and expansion to a broader set of products, could play a complementary role in the disinflation processalthough Unilateral and involuntary price controls must continue to be avoided.”

Waivers

- “The IMF Board approved default waivers associated with the introduction of policy measures that gave rise to new exchange restrictions and multi-currency practices.”.

external financing

- “International lending organizations have provided firm financing commitments for the next 12 months and there are good financing prospects for the rest of the program.

- Multilateral development banks, including the World Bank, the Inter-American Development Bank (IDB) and the Andean Development Corporation (CAF), commit to provide net financing of about $1.5 billion in 2023including budget support and project loans.

- Paris Club creditors agreed to restructure Argentina’s legacy debt with payment by September 2028, while other bilateral creditors pledged to provide net financing of around US$400 million per year”.

Source: Ambito