The Australian Securities and Investments Commission (ASIC) decided this week Cancel financial services license Binance “in response to a cancellation request” from the platform itself, so customers they will not be able to increase derivative positions or open new positions starting next April 14th.

The resolution is given in the midst of a lawsuit from the Commodity Futures Trading Commission (CFTC) for “numerous violations” of the Commodity Exchange Act (CEA) and the regulations of the CFTCamong which is that of operating illegally in USA.

Binance.jpeg

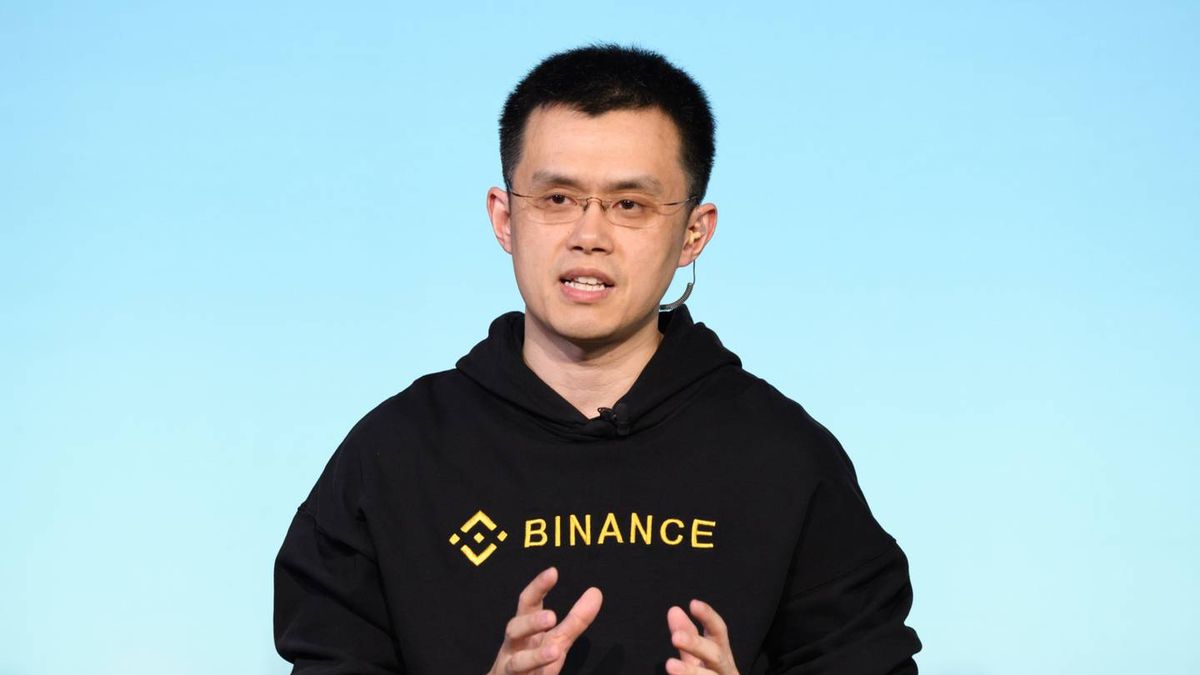

In parallel, began to circulate a rumor about a possible interpol arrest warrant about Changpeng Zhao, CEO and founder of the ‘exchange’.

He exchange will require customers close out any derivative positions existing before April 21, and that same day will close the remaining open positions.

Changpeng Zhao.jpg

Capital Radius

The regulator made this decision after conducting a specific review of the financial services business of Binance in Australiaincluding his classification of retail and wholesale customers.

“It is vitally important that AFS (Australian Financial Services License) licensees classify retail and wholesale customers according to the law. Retail clients who trade crypto derivatives have significant consumer rights and protections under Australia’s financial services laws, including access to external dispute resolution through the Australian Financial Complaints Authority,” said the chairman of the body. regulator, Joe Longo.

binance bnb

The Australian Securities and Investments Commission repeatedly warned users that “cryptocurrencies are risky and complexand the crypto derivatives pose additional risks for consumers through the leveraged operation”.

“SO C supports a regulatory framework for cryptocurrencies with a focus on consumer protection and market integrity. The final decision regarding the regulatory frameworks corresponds to the government,” adds Longo.

ceo binance.jpg

Binance acquired in July 2022 the Australian license for Oztures Trading to issue and create a derivatives market and foreign exchange contractstrading specific financial products on behalf of another person and providing financial product advice on specific financial products to retail clients and wholesale clients.

Group entities Binance were subject to regulatory warnings and actions by various foreign regulatorssuch as the UK Financial Conduct Authority, the Japan Financial Services Agency, the Italian National Stock and Company Commission, the Monetary Authority of Singapore, the Netherlands Central Bank, the Securities and Exchange Commission of Ontario and the Stock Exchange Commission of Thailand.

Source: Ambito