The official maintained that the Fund is willing and works in “close contact” with the Argentine authorities on these issues whose dimension is being evaluated by the Ministry of Economy. In this regard, he stated that the body is “engaged” in helping to carry out the program and although he recognized that it is still premature to talk about specific changes, he reiterated that they are willing to collaborate “in the best way that we can”.

For her part, the director of the organization, Kristalina Georgieva, This Thursday at a press conference in Washington within the framework of the Spring Meetings of the IMF and the World Bank highlighted the efforts of the Argentine economic team to meet the goals of the program, but stressed the need to continue with the implementation of the program agreed with the organism.

“Let me acknowledge that, in the second half of last year, the Argentine authorities have directed efforts to develop prudent management and meet the goals of the program,” Georgieva pointed out, while recalling that “on March 31 our executive board completed the fourth review of the program thanks to what the country has done.”

He also stressed that “Argentina was affected by a severe drought that has undermined the performance of the economy and is significantly harming the country’s population” and? “It has complicated the job of politicians.”

For this reason, Georgieva explained that the body has analyzed the implications of this shock and that “partially accommodated in the modification of the goal of accumulation of net international reserves”. addedthat “we know that we have the government’s commitment to continue refining policies in light of the conditions in which they find themselves,” he added.

Finally, he remarked that the success of the program “It comes down to implementation, and implementation will continue to matter even in these very challenging circumstances.”

In this sense, the Fund remains firm regarding the need to meet the fiscal deficit goal of 1.9% for the year, according to news from Washington. Analysts point out that this is a “very challenging” objective in light of the strong impact of the drought that the Fund itself acknowledges.

According to estimates from the Rosario Stock Exchange, the drought would have an impact of 3 points on GDP and the Treasury will lose collecting the equivalent of 1% of GDP due to lower withholdings. The Fund recognized part of the problem derived from the unfavorable climatic conditions by making the reserve goal that the country must accumulate more flexible, given the loss of some 20,000 million dollars in exports. But so far he has not shown signs of accepting a change in the fiscal goal.

TABLE 1 FRANCO.jpg

Inflation

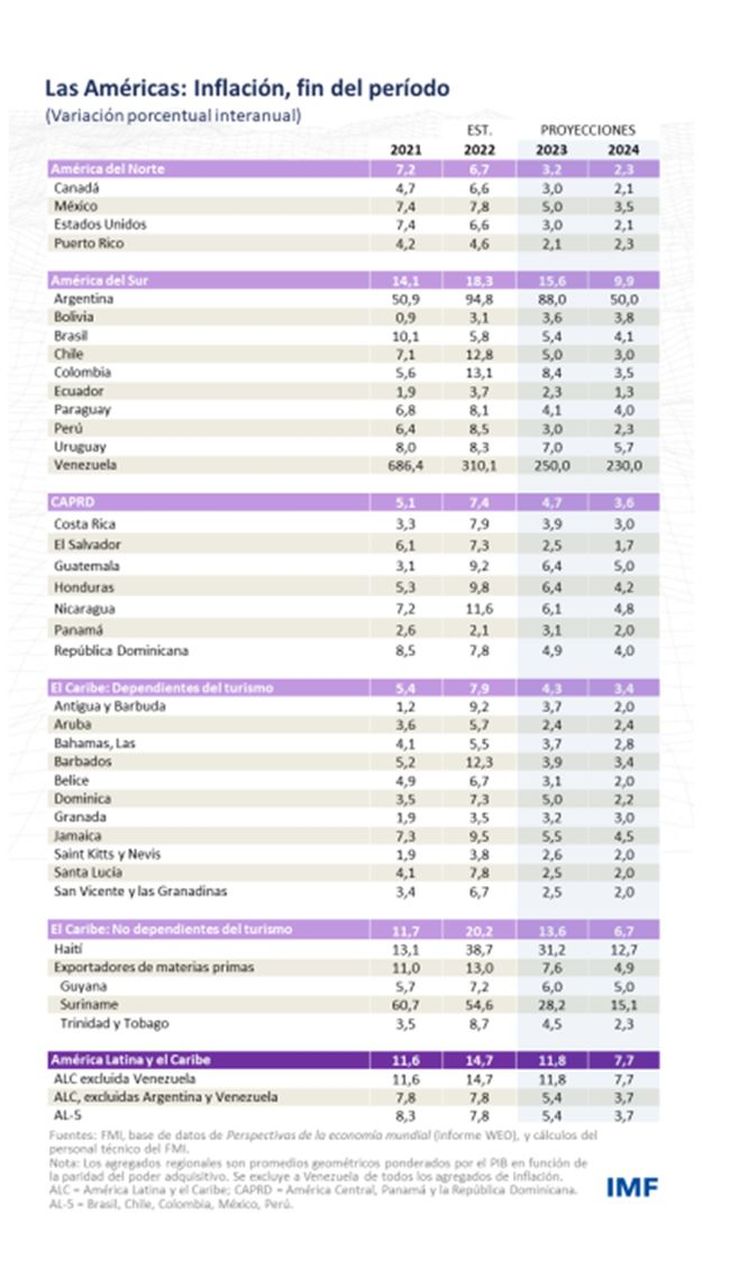

The Fund warned that “growth in Latin America will slow down from a notable 4% in 2022 to 1.6% this year.”” and emphasized the management of public spending by pointing out that “although monetary policy has done its partreducing the fiscal deficit would also help alleviate the cost of living crisis”.

In a document released by Gustave AdlerDivision Chief in the Western Hemisphere Department, and Chalk explained that “the price pressures that accompanied the buoyant economic activity last year they seem to have already reached their maximum level”, but they pointed out that “core inflation remains at persistently high levelsdisproportionately hurting low-income households.”

In this regard, they recommended that “in order to mitigate the risk of entrenchment of inflation, fiscal policy can help monetary policy in reducing demand pressures”.

After peaking at 10% in mid-2022, headline inflation in the main Latin American economies has slowed to 7% in March. But this decline is mainly due to the decline in commodity prices from their peak levels.

Meanwhile, progress in reducing core inflation—which excludes food and energy— “seems to have stalled.” They considered labor demand to be very strong, with employment holding firm above pre-pandemic levels. At the same time, output is at or above its potential level, and near-term inflation expectations are above the target ranges set by central banks.

“Strong domestic demand, rapidly rising wages and widespread price pressures suggest the risk that inflation will remain at unacceptably high levels in the region”as alerted.

After pointing out that restoring price stability is essential to have a healthy economy and protect the most vulnerable groups, they considered that “in the current situation, this means slow down domestic demand”. They added that “the policy objective now should be to slow down demand to bring it in line with potential output. This inevitably requires chill job market”.

Adler and Chalk considered that, given that inflationary pressures are proving to be persistent, central banks will have to hold their ground and “interest rates will probably need to stay high for much of this year, and even next in some cases.” This will help bring inflation back towards the target level by the end of 2024 or early 2025.

TABLE 2 FRANCO.jpg

To help central banks in their fight against inflation, they argued that fiscal policy could take a greater role through a more countercyclical stance this year.

Still, managers acknowledged that “rebalancing the policy set will not be an easy task.” They specified that the demand for social spending is high in the region, and there are serious distribution and social equity issues to be faced.

In this regard, they considered that “part of the solution should consist of enact tax policies that require those who have the most to contribute their fair share”.

But, at the same time, they warned that “the authorities will also have to generate savings, without cutting the main social programs or spending on health, education and public infrastructure.”

They stressed that “there is a lot of room to reduce inefficiencies in public spending, and people will become more inclined to the idea of more prudent public finances if this leads to greater efficiency in state services.”

They concluded by noting that “Good management of public resources could also help repair trust in government, which has been so eroded in many countries in recent years.”

Source: Ambito