It was in the purchase compared to the same month of 2022. At the end of the first quarter of the year, banks, for the first time, are the type of creditor with the highest volume in number of operations within the total pledge market.

Car registrations through financing grew by 12.4% during March in purchase compared to the same month of 2022, while in relation to last February, the expansion was 24.7%according to a report released this Wednesday by the Association of Automotive Dealers (Acara).

The content you want to access is exclusive to subscribers.

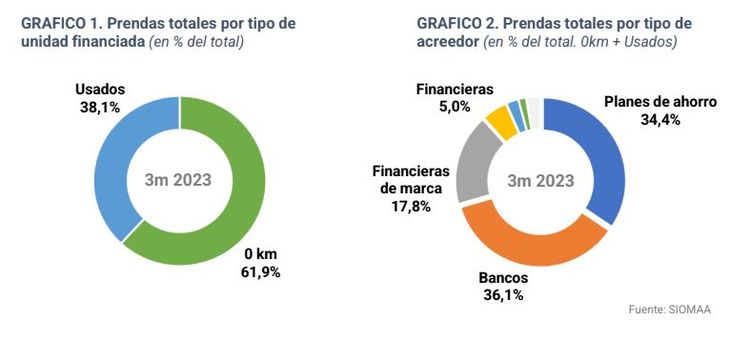

The survey found that 22,647 garments were registered during the third month of the year. 61.9% of these garments (13,113) were issued on 0km vehicles and the remaining 9,534 on used vehicles.

car financing.jpg

Both markets continue to exceed their 2022 figures, mainly used, which achieved a rise of 24.7% compared to the same month in 2022, while 0km maintains a rise of 2.5% for the same period.

At the end of the first quarter of the year, Banks, for the first time, are the type of creditor with the highest volume in number of operations within the total pledge market. The latter obtained a higher growth than that observed in the market compared to last year (+64.5% of banks vs +10.0% of the market).

Cars: 0 km financing

During the month of March, 13,113 registered, some 2,253 more than during the same month last year, which represents a positive variation of 2.5% compared to the same month in 2022.

cars financing 2.jpg

The most relevant type of creditor in this market are the Savings Terminals that accumulate more than half of the garments, while they are followed by banks (with a growth of 29.1% compared to last year) and brand financial companies that contracted 16%.

cars financing 3.jpg

Cars: used financing

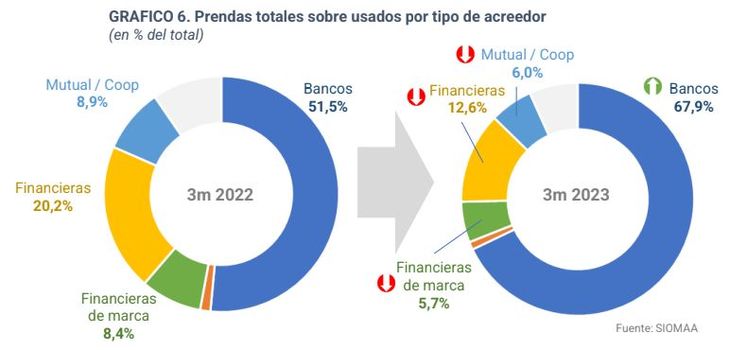

The 9,534 garments registered during March were 29.7% higher than those observed during the same month last year. Growth in the first quarter compared to 2022 reached 24.7%.

cars financing 4.jpg

By the way, it is the performance achieved by the banks that explains this growth so far this year, since they grew almost 68%. The others seem unable to improve on what was done in the first quarter of 2022, since together they contracted 18%.

Source: Ambito