This week, the financial dollars are in an upward trend and climb $4 the Cash With Settlement (CCL) and almost $7 the MEP this Wednesday, as is the blue, which rises for the third consecutive day and is offered at $422, a new record price . If goods a worrying sign of the economic evolution for Argentina Because it is a country in which bimonetarism predominates, it is also necessary to analyze what reasons drive them and, there, they come into play speculative movements.

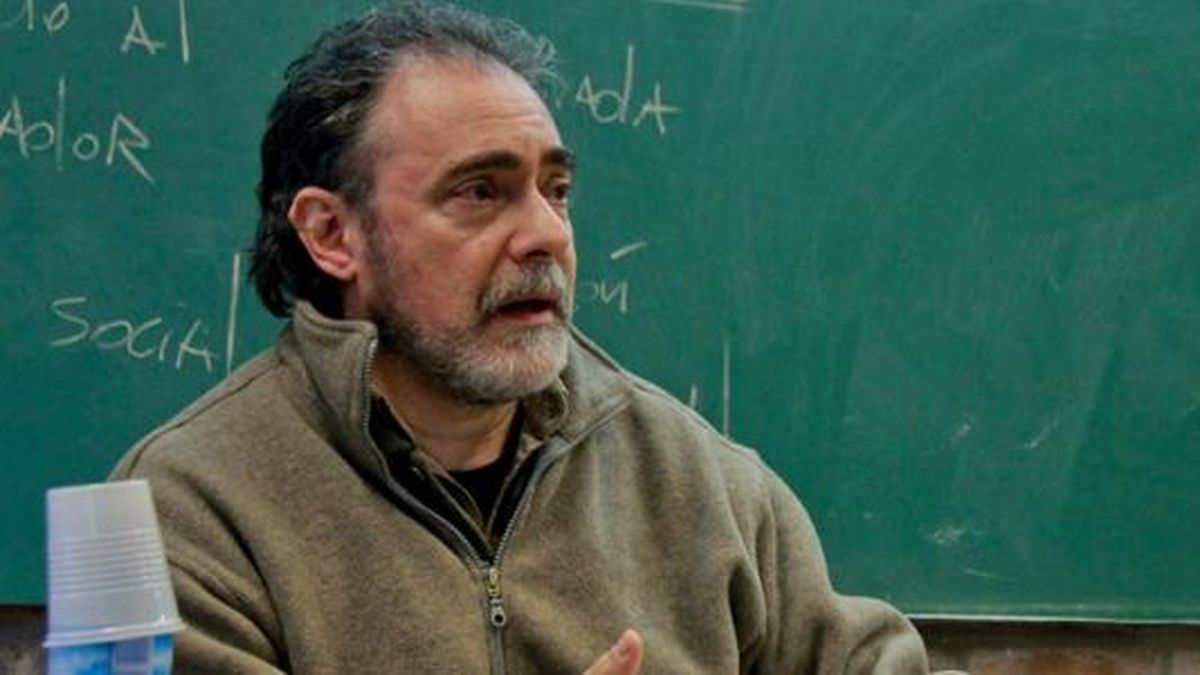

This is what he points out, in dialogue with Ambitthe economist, researcher and professor at the University of Buenos Aires (UBA), Ricardo Aronskindwhen he maintains that “movements in the illegal dollar are speculative and also political”.

Many analysts in the City argue that the electoral climate is making itself felt in the parallel currency markets and Aronskind agrees that the political is pressing in the square. And it is that, although he acknowledges that there is “an objective situation of dollar shortages, pro-devaluation campaigns are mounted with the double objective of making exchange gains and politically weakening the Government.”

Dollar, rising: effects on the economy of the rise

One of the big problems with this behavior of certain sectors of the market is the relationship that exists between the rise in parallel dollar and the economy, above all, in terms of prices. The economist states that “we will have to see how the exchange rates will evolve in the coming days” and warns that, if the rise is consolidated, it will surely activate remarking reflexes, even if they are not justified by the costs”. Thus, he anticipates that you could begin to see a contraction of consumer demand.

And, on the other hand, this dynamic could have an impact on the evolution of inflation, which is already showing a worrying trend, with a figure for March of 7.7%which was higher than expected by most analysts in the City, and even by the Survey of Market Expectations (REM), published by the Central Bank (BCRA).

In order to stop the upward trend and control the incidence of these side effects on the economy, Aronskind considers that it is essential that the Government manages to seriously strengthen the reserves. “No, with patches,” he says, in clear reference to the different strategies that the current economic team has been implementing, such as the soybean dollar and other differentiated exchange rates.

The Government needs fresh dollars

It happens, as many voices of analysts point out, the effect of the differentiated exchange rates is felt later in issuance, with the consequences that this has, later in inflation, it is short term, since the BCRA has had to resort in repeatedly to these mechanisms to compensate for the little capacity to retain dollars that it has.

Thus, for Aronskind, “the BCRA has to take care of the dollars it supplies to the private sector, because unjustified import maneuvers have been detected”, which demanded dollars from the official exchange market and were not destined for production.

On the other hand, in terms of price containment, he believes that stronger measures than the current ones should be used against the abusive and monopolistic behavior of price makers, which threaten the citizens’ capacity to consume and do not comply with price agreements pre-agreed with the Government, even, in exchange for a greater possibility of access to official dollars to import.

Source: Ambito