Despite the benefit, thousands of small and medium-sized companies continued to be affected by the pandemic and accumulated more debt with the treasury.

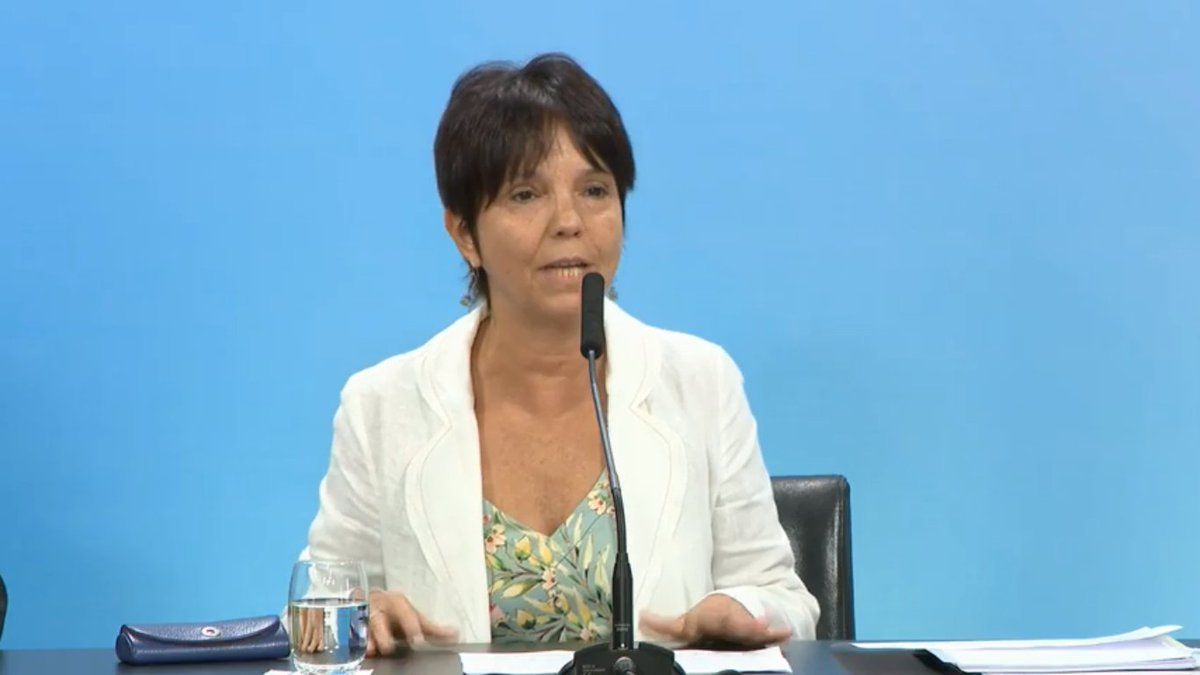

The organism that leads Mercedes Marcó del Pont has to put the new application into operation so that taxpayers and tax advisors can register and request benefits.

As pointed out by the tax attorney Sebastián Domínguez in a report on the new facilities, “the Senate was surprised by treating the half-sanction of the 2021 Moratorium on tables and in a few hours, the Moratorium became Law.” “The publication in the official gazette and the regulation by the AFIP now remain within 15 days,” the analyst explained.

The most attractive thing about the new measure is that “debts overdue as of August 31st are forgiven as long as they are less than $ 100,000 in total, for religious entities, associations, foundations, non-profit civil entities, entities that make up the System National Volunteer Firefighters, MSMEs and human persons and undivided estates that are considered small taxpayers, including monotributistas “.

On the other hand, it is allowed to rehabilitate previous payment plans and moratoriums that were expired due to non-compliance. While, In this new Moratorium 2021, overdue debts can be regularized until August 31, 2021.

“Existing payment plans may be reformulated, except those granted by virtue of Law 27,541 modified by Law 27,562 (Moratoria 2019 and 2020),” said the specialist.

Domínguez considered that “This is very positive since it will allow individuals and undivided estates to regularize income tax and personal property tax debts for fiscal periods 2019 and 2020, inclusive. “

“The other side is that whoever complied with the payment of the 2020 income and personal property tax in August 2021, may feel frustrated again. If he waited, he could pay in installments and with benefits,” the accountant warned.

On the other hand, punitive and compensatory interests will be condoned as follows:

- Micro and small companies, certain non-profit entities, and human persons and undivided estates, small taxpayers, for which it exceeds 10% of the capital owed; medium, which exceeds 35% and the rest 75%.

- In addition to a cancellation of fines and criminal actions, taxpayers may request payment plans of up to 120 installments in the case of small taxpayers and entities; medium-sized companies in 60 shares and large companies in 36 shares.

As the law empowers the AFIP to segment the fees based on the nature of the debts, Domínguez points out that “surely a smaller amount of fees will be allowed for social security contributions and withholdings and perceptions practiced and not paid.”

“On the other hand, in this new version of the Moratorium 2021 we continue with the differentiation, in our excessive criteria, between large companies and the rest of taxpayers and responsible parties. A small company can regularize the debt in 10 years and a large company only in 3 “, warned the specialist.

It also considered: “It seems appropriate to establish a different amount of quotas according to the type of taxpayer, but in our opinion, the project ends up establishing a kind of sanction for large companies for their condition, which would not be reasonable. ”

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.