The AFIP has updated the billing ceilings for each category of the monotribute since July. There will be no changes to the monthly fee.

The Minister of Economy, Sergio Massa, confirmed that the AFIP will increase the scales of the monotributo that generate tax relief in 4,781,614 workers throughout the country. There will be no changes to the monthly feeand they will also be able to access fixed rate loans 43% for working capital.

The content you want to access is exclusive to subscribers.

This is a benefit for monotributistas that will allow them to rebuild their purchasing power and obtain an improvement in pocket wages that translates into greater consumption and economic activity. The objective of the measures is to encourage consumption by a key sector of the population.

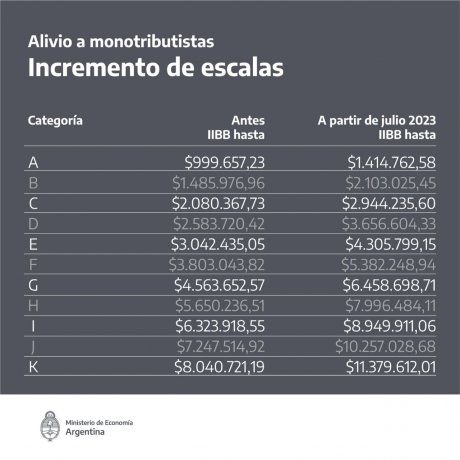

New scales of the monotribute from July 2023

As of the modifications that will come into effect in July, the monotribute categories they will be like this:

Relief to monotributistas

- Category A will go from $999,657.23 to $1,414,762.58

- in Category B from $1,485,976.96 to $2,103,025.45

- in Category C from $2,080,367.73 to $2,944,235.60

- in Category D from $2,583,720.42 to $3,656,604.33;

- in Category E from $3,042,435.05 to $4,305,799.15.

- In the case of Category F from $3,803,043.82 to $5,382,248.94

- in Category G from $4,563,652.57 to $6,458,698.71

- in Category H from $5,650,236.51 to $7,996,484.11.

- Along these lines, category I will rise from $6,323,918.55 to $8,949,911.06

- Category J from $7,247,514.92 to $10,257,028.68

- Category K from $8,040,721.19 to $11,379,612.01.

Currently, there are 4,781,614 monotributistas, of which 2,894,352 belong to category A; 642,137 to B; 359,565 to C; 350,964 to D; 180,989 to E; 185,074 to F; 107,562 to G; 49,608 to H; 7,471 to I; 2,575 to the J; and 1,317 to the K.

Source: Ambito