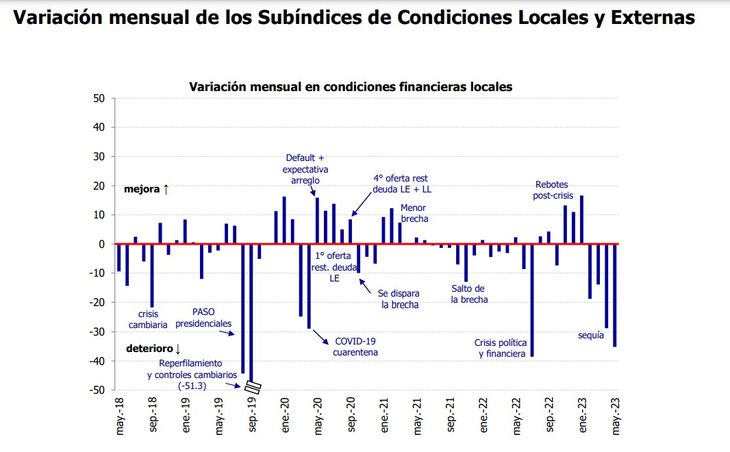

The financial conditions of the economy fell for the fourth consecutive month from -127.5 to -159.6, the worst level since April 2020, that is, the pandemic. The monthly loss is entirely attributable to local financial conditions. The good news is that since the index is a monthly average, the drag is positive and it is highly probable that we will see an improvement in June.

This is clear from the Financial Conditions Index (ICF) published monthly by the Argentine Institute of Finance Executives (IAEF) in conjunction with the consulting firm Econviews.

The local conditions subindex was located at -179 points, a drop of more than 35 points compared to -143.8 in April. This is the worst record of the local ICF since the series began in 2005. The local component of the ICF has been negative since August 2019 without interruption and has been in a stress zone for 46 consecutive months.

The three variables that worried the market

Eight of the ten components fell in May while only two improved month-on-month. The three variables that generated the most concern in the market are:

– The expected devaluation, measured by the one-year NDF.

– The rise in interest rates ordered by the Central Bank during May hit Badlar hard.

– The third component that generated the most losses for the local ICF was confidence in banks, which is measured through dollar deposits.

This drip stopped in the second half of the month, so it is one of the components that could recover in June. On the plus side they helped, albeit very marginally, the equity and bank liquidity components.

Screenshot 2023-06-12 121554.jpg

Positive Argentina externally

The external conditions subindex improved for the second consecutive month and went from 16.4 to 19.4 points and thus remained for the fifth consecutive month in positive territory, that is, a comfort zone. This implies that in the last five months the indicator was higher than its historical average.

Five of the ten variables that make it up improved their behavior in April while five of them fell. What added the most to the index were emerging currencies. We saw this in the region with the appreciation of the real, which a few weeks ago stood at less than 5 units per dollar, a favorable indicator for Argentina due to its exports of goods and tourism. The worst performance among the international variables was that of commodities. Clearly this plays against Argentina and we saw it with soybeans trading in Chicago below $500 per ton after a long time. In any case, the variations of the variables were in most cases almost testimonial, which explains why the sub-index moved very little last month.

The two positive long-term variables

In a very disappointing local environment there are at least two variables that are not in the stress zone. They are long-term liquidity and shares. Of the 8 that are stressed, there are five with significant stress. The expected depreciation is the worst of all, but on that list are also country risk, inflation, interest rates and the exchange rate gap. Between the two that are on the good side, it must be said that long-term liquidity is a by-product of low bank penetration in terms of credit to the private sector, so that although it contributes econometrically to the index, we refuse to take it as good news. The rise in the Merval in hard currency, on the other hand, is good news and in fact the “shares” component presents an interannual improvement.

Screenshot 2023-06-12 121533.jpg

Source: Ambito