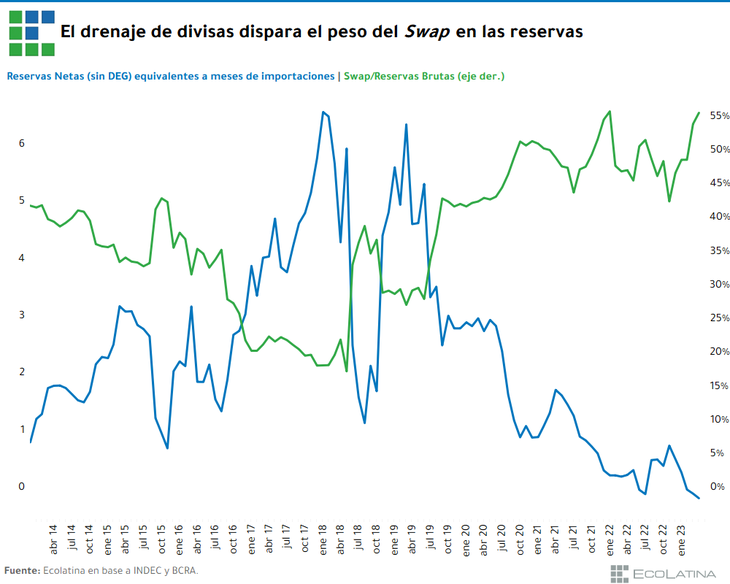

In this sense, the analysis detailed that “the use of the negotiated amount impacts both sides of the BCRA balance sheet: both the asset falls through lower reserves (import payments) and the liability through a lower Monetary Base (pesos are absorbed that importers sell in exchange for yuan), thus decreasing both gross and net reserves”.

Milestones-Swap3.png

The consultant explained that “The difficulty in carrying out a detailed monitoring of its use lies in the fact that there is no public data with the details of these operations as a result of the confidentiality of the agreements.”

Although he points out that “according to reports, the approvals of SIRAs whose imports are made in yuan have become more fluid since the negotiation of the new agreement.” The China swap has a term of 3 years and can be extended.

At present, various agreements and extensions have been entered into without interruption since 2009, with negotiations that modified the original contract.

The report recalled that “until before the current agreement, the amount that the Government could use of the almost US$19,000 million (130,000 million yuan) available was very limited: for example, the direct use of yuan was in 2020 and 2021 of only the 0.2% of the agreement”.

Swap with China: what are the risks

Regarding the risks that the agreement entails, the consultancy indicated that “the consequences of the different uses and applications of the swap are the relatively high and unknown interest rates that must be paid a posteriori.”

In this line, from Ecolatina they indicate that “as a counterpart, and although the information is not of a public nature, there are two associated risks”: rate risk and exchange risk.

- rate risk: Activation implies borrowing at a rate with a variable Shibor component, which implies being subject to sudden increases due to decisions of the BPC. In any case, the good news is that it has been going backwards and has already accumulated a 0.3 pp drop in 2023, standing in the area of 2.5% per year.

currency risk: like any debt in foreign currency, possible appreciations in the currency in which the debt is incurred implies a greater weight than the commitments assumed. In this sense, the CNH futures price for June 2024 -the reference currency of the Hong Kong market- today marked a value of 6.9 USD/CNH, which implies an appreciation of 2.6%.

This would mean that, on the loan of USD 10,000 M, an extra outflow of foreign currency of close to USD 300 M would be incurred, equivalent to two days of liquidation of the “soybean/agro dollar”. Finally, the crawling peg and eventual disruptive jumps in the exchange rate imply a greater weight in the country’s debtor position.

The implications of the swap

The report maintains that “taking into account that imports made by Argentina from China fell by 27% year-on-year during the first four months, the opportunity for the Asian country is presented as a win-win: it revitalizes bilateral trade, contributes to a more general in the diffusion of the yuan and gains influence in the region. In addition, measures of this style would allow alleviating the operations of companies of Asian origin that are operating in the local market”.

Meanwhile, “from Argentina’s point of view, the activation of the swap (as well as the potential arrival of the announced investments) allows the Government to obtain air in the complex situation of foreign currency shortage that it is going through: the activation allows the BCRA to grant yuan to importers that were not available before, “freeing up” foreign currency for other purposes,” the document provided.

In turn, the consultancy highlighted that “foreign purchases of Chinese origin account for 20% of our imports, so the use of the yuan would make it possible to alleviate restrictions on imports in a not insignificant volume and positively affect the activity”.

In addition, he stressed that “we must not lose sight of the fact that the diplomatic relationship constitutes a state policy that transcends the political sign of the governments, which have uninterruptedly supported the agreement and taken steps forward in deepening trade.”

Dashboard-china.png

Swap Timeline

– 1-(2009) – Precautionary and firepower: in the midst of the 2008/09 international crisis, during April 2009 the original agreement was signed, with a term of 3 years and for an amount of 70,000 million yuan – 10,000 million dollars.

The high level of reserves available (US$46.5 billion) made it possible to overcome the crisis without the need to make effective use of it and, therefore, record said agreement on the BCRA’s balance sheet.

In contrast, during 2014 gross reserves were US$20 billion below those then, and foreign currency inflows were lower as a result of the end of the commodity price boom and a foreign trade policy with an anti-export bias.

In this context, the renewal implied the effective incorporation of the swap into the BCRA coffers through different tranches. As a result, gross reserves grew by approximately US$11 billion, allowing the BCRA to show itself with “greater firepower” – in part, due to the opacity of the swap, which made it impossible to know exactly if it could be used to intervene in the MULC.

2- (2015) – Lifting of the stocks: during the management change that occurred in December 2015 and the liberalization of the exchange market, there was a modification in the agreement that allowed the conversion of 20,000 million yuan to dollars -around US$3,000 million and the possibility of using these currencies for intervention in the MULC. However, the dollars were not used on that occasion.

3- (2023) – Imports: the BCRA is in a delicate situation, reaching an accumulated loss of Net Reserves (without SDRs) -according to our methodology- that exceeds US$3.1 billion so far in 2023, reaching negative ground since the end of March. As a result of this drain, the relevance of the swap reached a record and now represents close to 60% of Gross Reserves.

Coupled with this, in the search to obtain financing sources, the Central Bank and Economy reached an agreement at the beginning of 2023 and in its recent visit to China for the use of 70,000 million yuan -close to 10,000 million dollars- , representing the entire original section 2009-

14, and renewed the agreement whose expiration operated between July and August.

The novelty is that these recent negotiations will make it possible to pay for imports in yuan and will work in practice as a trade credit.

Source: Ambito