The BCRA stated that this dynamic was explained by the change in the behavior of deposits in the wholesale segment, a segment in which the performance of deposits is important. Money Market Mutual Funds (paid demand deposits), which became more attractive in the second half of the month.

Despite the higher price increases, the placements of the fixed terms UVA, indexed to the Reference Stabilization Coefficient (CER).

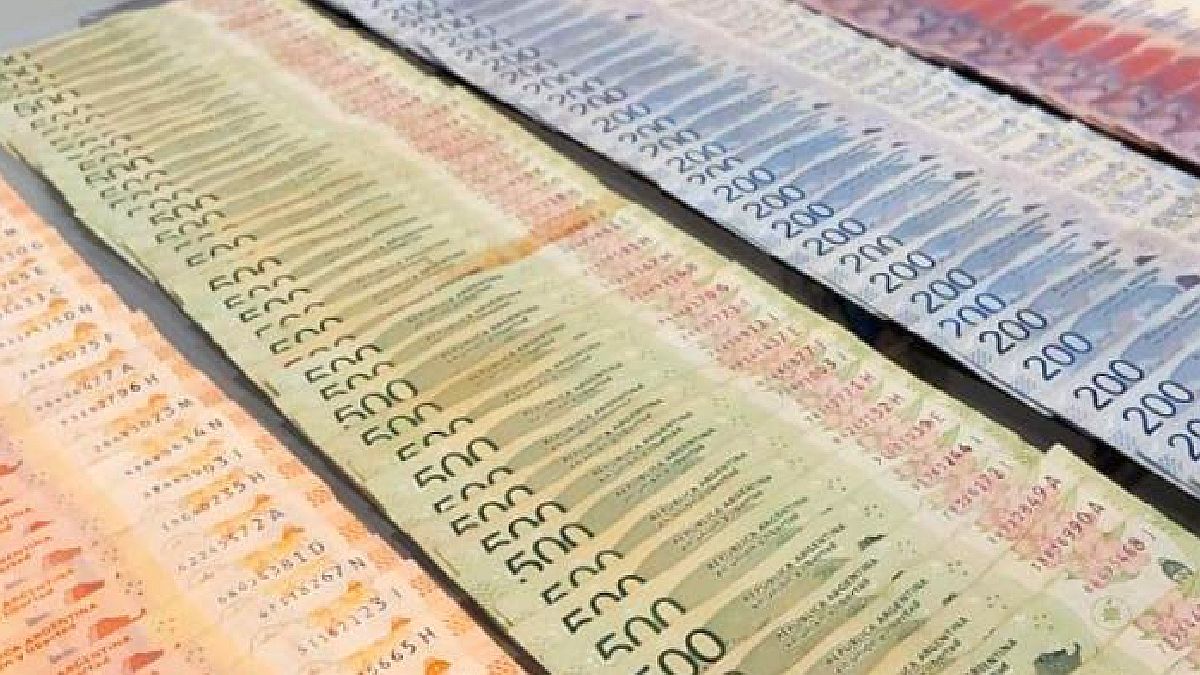

For their part, payment methods (Transactional private M2) grew 1.5% monthly in October, after two months of stability. At the level of its components, the largest contribution came from unpaid demand deposits, based on salary adjustments agreed jointly by various unions. Another factor that encouraged the demand for transactional money, according to the report, was the increased tourist movement by virtue of the long weekend.

With everything, private M3 broad monetary aggregate (means of payment + fixed terms) increased 1.6% per month at constant prices, the highest growth rate since August last year. In terms of GDP, it stood at 18.2%, 6 percentage points below the 2020 maximum.

Source From: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.