The former Minister of Economy (1991-1996; 2001), domingo horsemade a post on his personal blog, where he made a diagnosis of the economic scenario until the elections.

Titled: “It is possible to avoid falling into hyperinflation, but stagflation is becoming more evident and tends to worsen”the Cordovan economist stated that “it is probable that, until the STEP, including the month of June that is ending, the monthly inflation records will go back to around 7%, or even 6% per month.”

“It can be affirmed that the risk of an inflationary explosion seems attenuated, at least until PASO”, said Cavallo.

In addition, he pointed against the Secretary of Industry, Ignacio De Mendiguren: “He continues to publish figures on the level of economic activity that are not consistent with reality”he pointed.

“Public spending during the first five months of the year grew much more than what had been budgeted. In a context of adjustments of the official exchange rate to the rhythm of inflation (crawling peg passive) This expansion of public spending explains why monthly inflation has jumped from 6% to around 8% in recent months”, said the former minister.

This happens, the blog explained, because the Central Bank reduced the rate of devaluation of the peso in the official market since the beginning of June and “it will surely accentuate this trend until August 15.” He also pointed out that from Commerce it was decided to reduce from 3.2% per month to 0 the rate of adjustment of the prices agreed with leading companies in various areas.

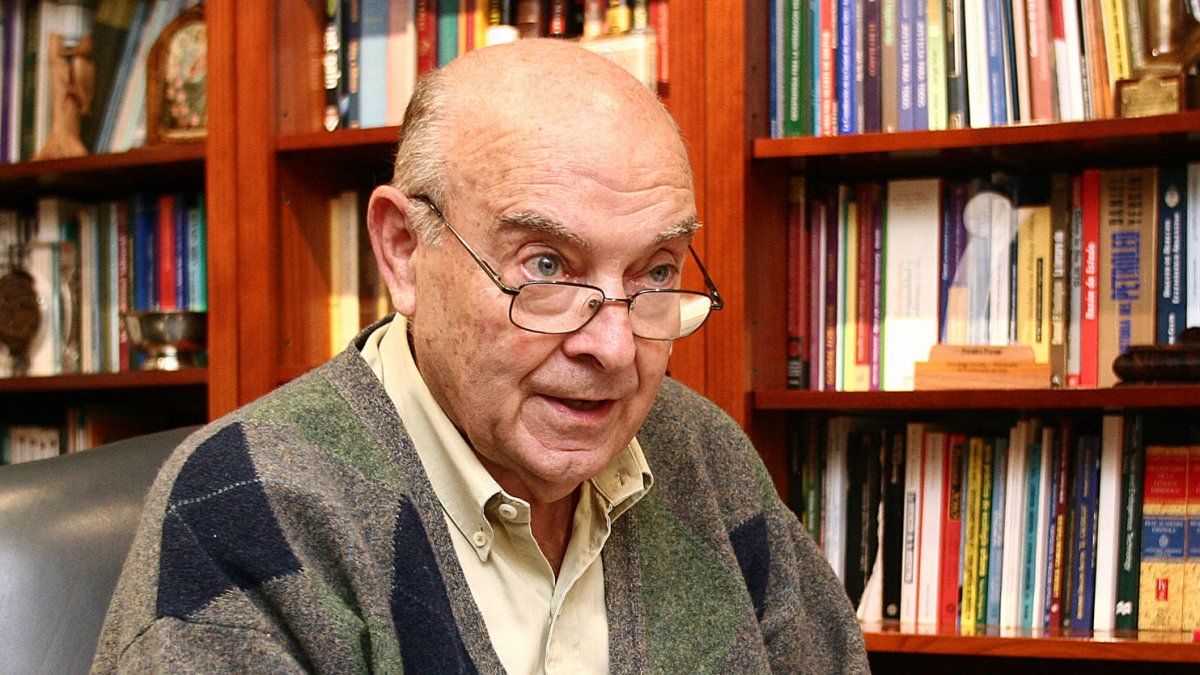

Domingo Cavallo Former Minister of Foreign Affairs of the Argentine Nation

Mariano Fuchila

According to Cavallo, what will inflation be like after the PASO?

For the former Minister of Economy, after the first electoral scenario, prices could rise again: “The immediate consequence of this policy will be the accentuation of relative price distortions, so it will be difficult to continue after the STEP. It cannot be ruled out that after August 15 the inflation rate will jump again to 8 or even 9% per month, especially if the agreement with the IMF imposes a greater adjustment in the official exchange rate.”.

In turn, Cavallo indicated that the expiration payment of US$2.7 billion to the IMF shows that Sergio Massa knows that the agency will make the planned disbursements “despite the fact that the originally negotiated fiscal and reserve accumulation goals were not met, nor will they be met.”

Regarding inflation for June, which will be known in the second half of this month, he stated that it could be around 7%, although “it would not be unusual for it to start with 6”.

“The government will surely celebrate it as a major achievementbut if this trend continues during July and the first two weeks of August, it will be as a consequence of an accentuation of the exchange lag and the freezing of prices ordered until August 15 by the Secretary of Commerce, practices that cannot be continued after I PASS them, under penalty of dangerously accentuating the relative price imbalances”, stated Cavallo.

And finally, he asserted that “inflationary inertia is impossible to break without a stabilization plan like the one described in my previous reports.”

dummy growth

Regarding the growth of the Monthly Index of Economic Activity published by the National Institute of Statistics and Censuses (Indec), the former Minister of Economy observed that “until April it gives -0.1%, comparing the month of April 2023 with the same month from the previous year, the drop is -4.2% In turn, the Orlando Ferreres update up to the month of May gives an accumulated drop of -0.7% and comparing the month of May 2023 with May 2022 the drop is -3%”.

“The INDEC manufacturing production index, which is the one highlighted by De Mendiguren, grew 2.4% until April (compared to the same months of 2022), but the FIEL update that reaches May already registers a drop of (-0.1%) for the first five months of 2023 compared to the same months of 2022 due to a drop of -3.4% from May 2023 to May 2022,” Cavallo stressed.

In turn, he added:All indicators of the level of real wages paid by the private sector available up to April register falls ranging from -1.7% (registered wage earners) to -12.9% (unregistered wage earners). Imports and exports register falls of -9.6% and -22.2% respectively for the first five months of 2023 compared to the same period of the previous year”.

“All these indicators show that the country is already in full stagflation, as it has been from 2011 onwards. The reality is far from being able to be described as in sustained growth”he concluded.

Source: Ambito