These measures of Ministry of Economy provide tax relief in 4,781,614 workers from all over the country. In addition, there will be no changes in the monthly fee, and they will be able to access fixed rate credits from the 43% for working capital.

The increase in scales occurs in July precisely because it is the month in which monotributistas must recategorize, since the recategorization periods occur every six months.

afip-portada.jpg

This is a benefit for monotributistas that will allow them to recompose the purchasing power and get one pocket wage improvement which translates into greater consumption and economic activity. The objective of the measures is to encourage consumption by a key sector of the population.

How are the monotribute scales from July

- Category A they will go from $999,657.23 to $1,414,762.58

- Category B from $1,485,976.96 to $2,103,025.45

- Category C from $2,080,367.73 to $2,944,235.60

- Category D from $2,583,720.42 to $3,656,604.33;

- Category E from $3,042,435.05 to $4,305,799.15.

- Category F from $3,803,043.82 to $5,382,248.94

- Category G from $4,563,652.57 to $6,458,698.71

- Category H from $5,650,236.51 to $7,996,484.11.

- Category I $6,323,918.55 to $8,949,911.06

- Category J from $7,247,514.92 to $10,257,028.68

- Category K from $8,040,721.19 to $11,379,612.01.

Currently, 2,894,352 monotributistas belong to category A; 642,137 to B; 359,565 to C; 350,964 to D; 180,989 to E; 185,074 to F; 107,562 to G; 49,608 to H; 7,471 to I; 2,575 to the J; and 1,317 to the K.

electronic invoice afip.webp

When do you have to recategorize yourself in the Monotributo?

To assess whether a recategorization is appropriate the activity of the last 12 months must be taken into account with respect to billing or any of the other parameters used for typecasting such as the area affected, the rents accrued annually or the consumption of electrical energy.

If the parameters analyzed exceed or are inferior to those of the current category, it is necessary to carry out the recategorization. And the amount corresponding to the new category will be paid the month following the recategorization.

On the other hand, if less than 6 months have elapsed since the registration in the monotax, it is not appropriate to recategorize. While, those monotributistas who maintain the same category should not take any action.

Monotributo: how to do the recategorization in AFIP?

In order to be recategorized in the monotribute levels, it is necessary to analyze that there have not been changed the values of the following points in last 12 months:

- The Billing.

- The surface affected by the activity.

- The electrical energy consumed.

- The accrued rents.

According to him total values that each parameter throws, it will be necessary to recategorize it to the corresponding category according to the highest parameter. If it is appropriate to stay in the same category, no formalities should be done.

How to recategorize?

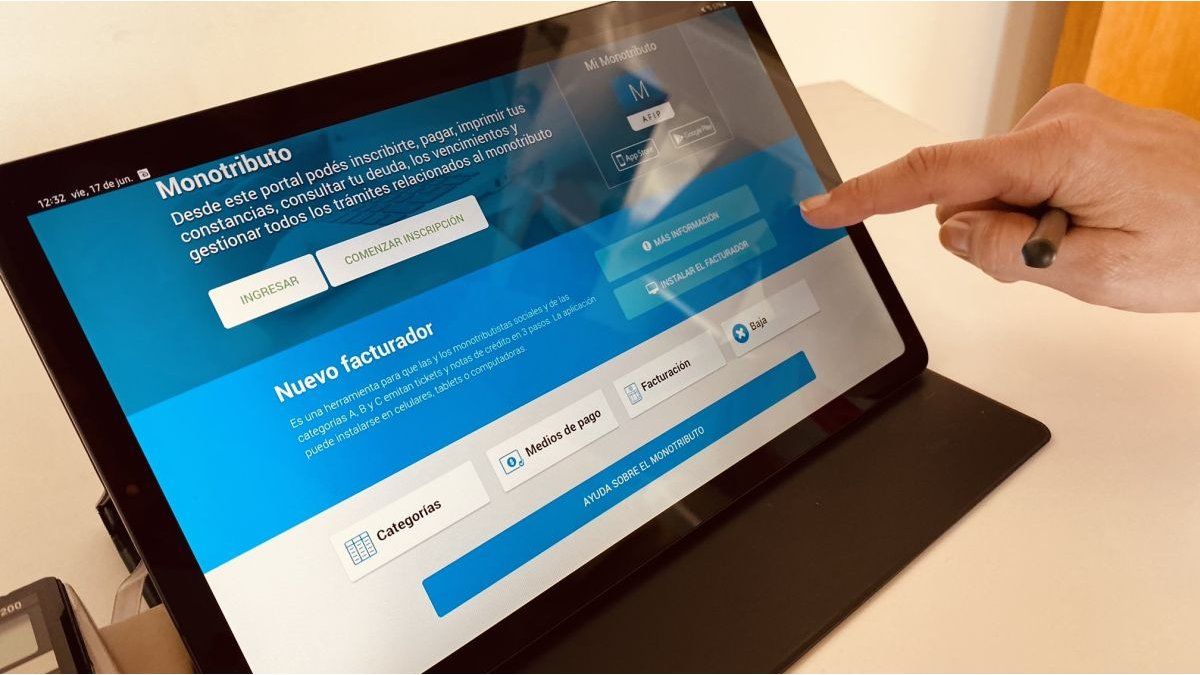

- Enter the website of the monotribute.

- Indicate CUIT, tax code and press “Accept”.

- Select the option “recategorize myself“

- Go to the section “Continue recategorization“.

- inform the new parameters.

- Indicate the option “print credential“.

- The system will issue the Form 184 (as proof of the recategorization carried out) and the new Payment credential.

Source: Ambito