He Financial Conditions Index broke a streak of four falls in a row with a slight recovery, according to a report prepared by the Argentine Institute of Finance Executives (IAEF)together with the consulting firm Econviews.

The ICF went from -148.9 to -143.2 points. The improvement came essentially from local factors since the Argentine subindex improved more than 7 pointswhile international components worsened marginally.

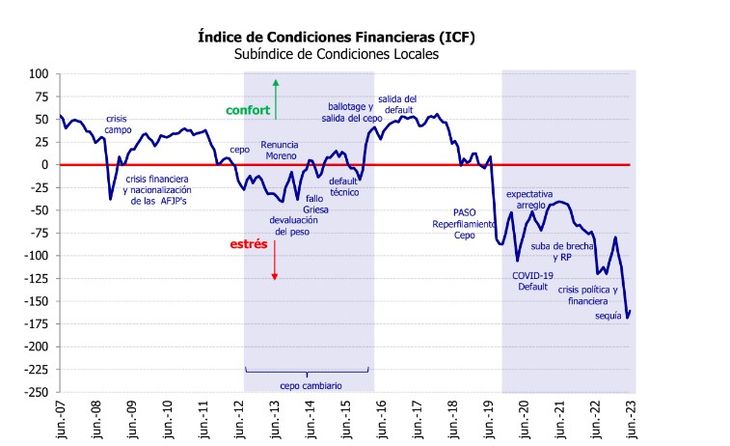

He local conditions subindex it stood at –160.3 points, an improvement of 7.6 points. The June data was the second worst since 2005 after May 2023. The local component of the ICF has been negative since August 2019 without interruption and has been in a stress zone for 47 consecutive months. Seven of the ten components improved in May while only three fell month-on-month.

What were the best performing variables in June

- Inflation

- expected devaluation

- Risk country

On the negative side, the 3 negative performances were the interest rate, the trust in banks and the risk of legislation, a variable that is easily distorted given the interventions made by the government to prevent the exchange rate gap from growing.

Screenshot 2023-07-10 131810.jpg

The international scene

The external conditions subindex dropped from 19.4 to 17.4, a very marginal reduction. This indicator has been in a comfort zone for 6 months. The good labor data that came out in early July may lead to a tightening of monetary policy, perhaps threatening that comfort going forward. Contrary to the Argentine index, the international had 7 components that fell and 3 that improved.

Among the latter are the volatility of American stocks, European risk and emerging risk, something that correlates with the drop in country risk, that is, they are two sides of the same coin. Among those that fell, none suffered a significant deterioration, but global liquidity and confidence among banks stand out. Another one that stumbled again is the financial index with respect to the S&P500, something that has been suffering since four North American banks went under.

Analysis of the situation of the Argentine economy

The Argentine economy it always grew steadily when financial conditions remained in a comfort zone for a long period of time. The last 4 years clearly demonstrate this. In 2020 with an international headwind for much of the year and negative local conditions for the entire year, GDP fell 9.9%. In 2021 the floor rebound reached 10.4%. In 2022 the economy grew 5.2% thanks to a drag of more than 4 points and some genuine growth. In 2023 we have a deterioration of the local index which correlates with the uncertainty typical of an election year and a drought that will hit the level of activity.

The strength of the US economy and in particular its labor market with unemployment of only 3.6% and an index of unfilled jobs suggests that the Federal Reserve will continue to tighten its monetary policy. This will put pressure not only on developed markets but on emerging markets including currencies.

This probably makes the financial conditions are stressed in the coming months.

Argentina has reduced its country risk in recent weeks, generating a positive carryover for July, but the electoral process is an important source of tension to which is added the stress due to the lack of reserves in the Central Bank and the ups and downs of the negotiation with the International Monetary Fund.

Screenshot 2023-07-10 132352.jpg

Source: Ambito