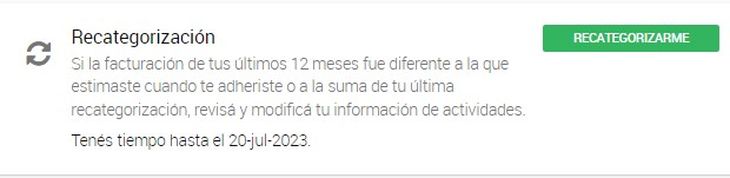

Until this Thursday, July 20, those who are registered in the regime of monotribute they should do the recategorization as a result of the billing levels being changed a 41.5%, as confirmed by the Federal Administration of Public Revenues.

To do the recategorization, you must enter the website of AFIP with Fiscal key.

The increase in scales occurs in July precisely because it is the month in which monotributistas must recategorize, since the recategorization periods occur every six months.

afip-portada.jpg

This is a benefit for monotributistas that will allow them to recompose the purchasing power and get one pocket wage improvement which translates into greater consumption and economic activity. The objective of the measures is to encourage consumption by a key sector of the population.

Monotribute 1.jpg

Step by step: how is the recategorization of the Monotax Step 1

Enter the AFIP portal at www.afip.gob.ar and there you look for the option monotributeor if you dare, or download the APP on your cell phone “My Monotribute”.

monotribute 2.png

Within monotribute you will find different options. You have to choose the last one that says “recategorization” You have time until July 20, 2359h.

Step 3

You will see your tax parameters, billing for the last year, electricity, rents and affected area. This screen is “Your information”.

Step 4

The most important step, you will find recategorization “our data” Here you will place the billing from 07/30/2022 to 06/30/2023. There you will enter the invoices that you issued and collected, during that period, those that you did not collect, do not add them.

Then you continue and they will ask you whether to carry out activity in any other province or not. If your answer is affirmative, enter the province, otherwise continue at the end of the process.

At the end, the confirmation of your data appears and it appears that:

- If your income GOES UP, you go up in Letters and pay a little more for the 20 of each month.

- If your income DECREASED, you lower the letter and you will pay less.

- If your income was the SAME, you stay in the letter where you are and pay according to the monthly payment increase in the table.

Monotribute 3.jpg

- You place the ANNUAL billing. As indicated in point 4 and Continue.

Experience advice: recategorize yourself on the dates that we indicate, do not let AFIP do it ex officio. You harm yourself since they take parameters as expenses or movements that do not correspond legally and insurance, you are expelled from the simplified Regime of the Monotribute to terror of the General Autonomous Regime.

Source: Ambito